Entain has stated that its full year 2023 results were in line with expectations, but warned that 2024 EBITDA will likely be impacted by almost £40m due to continued regulatory adjustments in the UK and the Netherlands.

The FTSE100 company’s EBITDA across the year improved by only one per cent in comparison to 2022, as the LSE gambling group continues to review its markets, brands and verticals, overseen by a newly appointed Capital Allocation Committee.

Entain’s UK NGR declines

Publishing its financial results, Entain declared a net gaming revenue – including its joint venture in BetMGM with MGM Resorts International – of £4.83bn, up 11 per cent when compared to 2022’s £4.35bn.

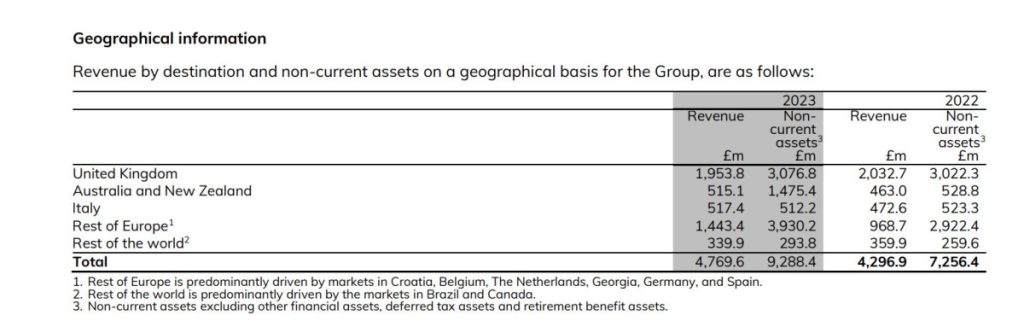

Excluding US operations, revenue came in at £4.77bn, an 11 per cent uptick year-over-year (2022: £4.3bn).

Regionally, UK & Ireland operations (35 per cent of total NGR) declined by three per cent YoY, International operations (44 per cent of total NGR) fell as well by two per cent, while Central and Eastern Europe operations (seven per cent of total NGR) improved by 11 per cent and USA operations (14 per cent of total NGR) rose by 36 per cent.

Online NGR rose by 12 per cent YoY – sports up by six per cent, gaming up by 17 per cent – with online active customers rising by 23 per cent. Excluding regulatory impacts, the vertical’s NGR grew by three per cent.

Retail NGR improved by nine per cent YoY following the acquisition of shops in Poland and New Zealand, as well as “the continued strengthen of the retail estate”.

BetMGM NGR grew by 36 per cent YoY to $1.96bn, earning a 14 per cent market share in the states where it operates, as well as a positive EBITDA for the second half of the year.

Group EBITDA increased by just one per cent YoY to £1bn (2022: £993m), but pre-TAB NZ accounting, EBITDA dropped by two per cent to £974m. Online EBITDA was in line with 2022 at £830m, while retail EBITDA is down one per cent to £277m.

Entain reported a loss after tax in 2023 of £878.7m, down in comparison to the profit after tax of £32.9m declared in 2022, “reflecting the DPA settlement and impairment charges primarily related to the Australia operations being impacted by point of consumption tax increases” – in which Entain has reserved £600m on account to conclude its legal settlement.

In November, the group’s Capital Allocation Committee also commenced a review of Entain’s markets, brands and verticals “to help focus the organisation, improve competitive positions in core markets and maximise shareholder value”.

CEO change

Entain also underwent a leadership change in December, with Jette Nygaard-Andersen stepping down as CEO. She has been replaced by Senior Independent Non-Executive Director Stella David on an interim basis until a permanent replacement has been found.

Commenting on the 2023 results, David said: “2023 presented a number of challenges for the group, both industry-wide and Entain-specific. I am extremely proud of how our people around the world came together to navigate the business through an eventful and at times difficult year.

“Against that backdrop, Entain was still able to deliver overall revenue growth of 14 per cent including our US joint venture achieving revenue at the top end of expectations.

“We have started the new financial year with a clear plan to accelerate our operational strategy, and are making pleasing progress across a range of initiatives to re-focus our market portfolio, prioritise organic growth, drive our share in the US, and expand our margins.

“We are entirely focused on operational excellence and outstanding execution and, as a result, are confident that we are on a pathway to delivering future growth. We remain confident that our continued focused execution will drive organic growth into 2025 and beyond.”

£40m EBITDA hit expected on UK & NED headwinds

In 2024, Entain noted that it is trading “in line with expectations” year to date. Brazil is showing “early signs of benefits from the improvements” initiated in 2023, while the BetMGM went live in Nevada and the single account single wallet will be introduced later this year in addition to further product improvements.

However, the group is expecting a hit on its EBITDA due to regulatory changes in the UK and the Netherlands.

In the UK, Entain stated that it was looking forward to the implementation of online slot stake limits and potential uniform safer gambling measures agreement across the market.

While the group expects these changes to be positive in the long run, “continued player disruption” in the short term could occur, but investments could take place in the market to grow market share.

For the Netherlands, Entain stated that proposed tighter deposit limits by the Dutch regulator Kansspelautoriteit from Q2 2024 have the potential to impact 2024 EBITDA.

As a result, the group expects “in aggregate, these dynamics could reduce FY24 EBITDA by approximately £40m”.

Entain added: “We continue to deliver on our refocused strategic priorities and are making clear strides in identifying and executing product and technology developments to improve customer acquisition and retention. Project Romer remains on track, to simplify our operations, improve efficiency and deliver £70m of net run rate cost savings by 2025.”

Barry Gibson, Chair of Entain, noted: “2023 was a period of necessary, but ultimately positive, transition for Entain. We have significantly strengthened the quality of our revenue base, enhanced our board, and delivered a resolution to a critical, historic, regulatory issue.

“We are making positive progress in our search for a new permanent CEO, and in the meantime, Stella is driving the business as it continues to take appropriate actions to deliver changes to drive a better long-term performance. We are also making good progress in adding to our board strength – Ricky Sandler and Amanda Brown joined the board in recent months and we expect to announce a further appointment shortly.

“As our transformation continues the newly formed capital allocation committee has commenced a review of Entain’s markets, brands and verticals. The objectives of the review are to help focus the organisation, improve competitive positions and maximise shareholder value.”