European consumers are continuing a trend of showing a greater affinity for mobile gaming, as new data reveals that the continents online gambling market grew by 11 per cent last year.

According to market data published by the European Gaming and Betting Association in partnership with H2 Gambling Capital, the market expansion saw gross gaming revenue rise from 2017’s €20m to €22.2m year-on-year.

The data is said to confirm a “a record-high online gambling share of the EU’s total gambling market,” with online activity accounting for a 23.2 per cent slice, up from the previous year’s 21.2 per cent.

The UK market accounted for the largest portion of the total EU online gambling market with 34.2 per cent, representing a market value of €7.3bn GGR.

Offline gambling, such as casinos, lotteries and bookmakers, finished with a total GGR of €73.5bn, accounting for 76.8 per cent of the overall EU market. The total EU gambling market value was €95.7 billion GGR.

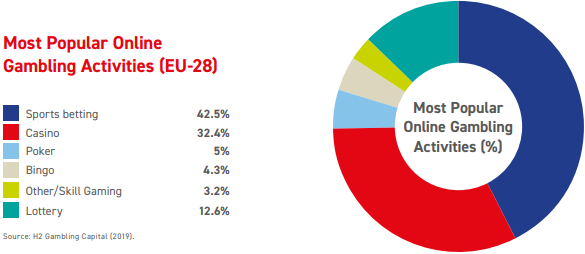

Sports betting was the most popular online gambling activity with 42.5 per cent of the total EU market share, worth €9.4bn GGR, followed by casino games at 32.4 per cent, or €7.2bn GGR, lottery at 12.6 per cent, €2.8 bn GGR, poker at 5 per cent, €1.1bn GGR, bingo at 4.3 per cent, €1bn GGR and other games with a 3.2 per cent market share €700,00 GGR.

Furthermore, 57 per cent of online bets were done so from a desktop computer with 43 per cent place from phones and tablets, showing a shift to mobile with an increase from 2017’s 39 per cent.

“Europe’s online gambling market continues to show a strong demand-driven growth and a switch to mobile devices,” stated Maarten Haijer, secretary general of the EGBA.

“But its increased popularity reinforces the need for more consistent and strong consumer protections and industry standards across all EU countries.

“The current situation of diverging and sometimes conflicting regulations in EU countries is detrimental to consumers, authorities and operators alike.”

Further findings from the data sees 320m online payments in deposits and withdrawals processed, €86m in sports sponsorships to European sports federations, leagues, clubs and event, 32,000 jobs created and sustained and a total of 16.5m customers.

The annual data collection includes that of the overall EU online gambling market and EGBA member companies – including information about their market value, payments, games, sports, customers, licensing and compliance.

EGBA represents bet365, Betsson Group, GVC Holdings, Kindred Group, MRG and ZEAL Network, who combined had a total of 121 online gambling licenses across 20 EU countries.