It’s very much a case of familiarity when dissecting the top performing games across the US legalised igaming ecosystem through November, but an Inspired performance across the new releases has stormed to the summit.

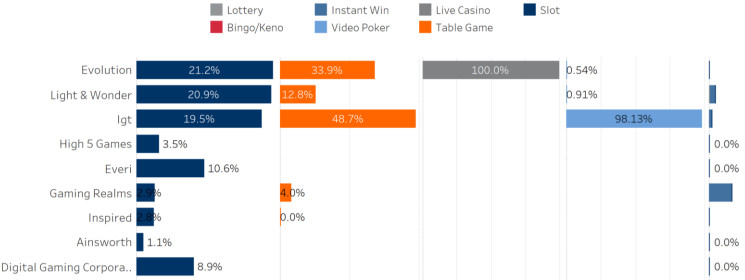

In the latest Eilers-Fantini performance report, the overall slots market is led by Evolution, Light & Wonder and International Game Technology that claim shares of 21.2 per cent, 20.9 per cent and 19.5 per cent, respectively.

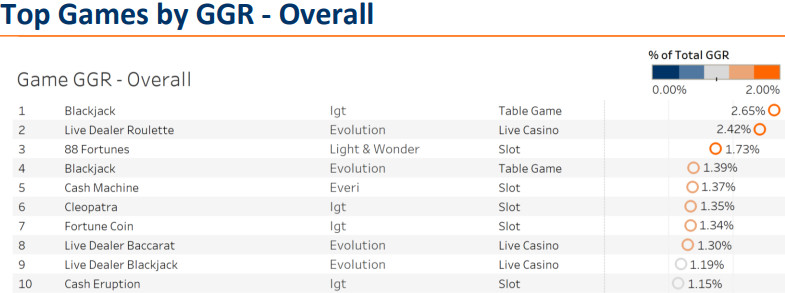

However, when looking on an individual titles basis it is the latter that comes out on top of the pile, with the Blackjack table game claiming 2.65 per cent of total GGR.

Rounding off the familiar top three is the Live Dealer Roulette (2.42 per cent) live casino game of Evolution, with the 88 Fortunes L&W slot claiming 1.73 per cent.

Of the top 25, 17 of those placed are online slots as AGS, Reel Play and Inspired join the aforementioned trifecta, with five live casino titles, two table games and one from video poker rounding things off.

This latest analysis examines data from Michigan, West Virginia, Pennsylvania, New Jersey and Connecticut across 30 online casino sites, tracking 39,638 games to represent 58.5 per cent of the market in terms of gross gaming revenue.

Rick Eckert, managing director of slot performance and analytics at Eilers & Krejcik Gaming, offered his insights on the latest monthly breakdown: “On a GGR basis the tried and true themes continue to remain at the top of the rankings, Slots like 88 Fortunes, Cash Machine, and Bonanza continue their dominance by a few means.

“These slots are abundantly apparent in the ‘featured’ and ‘top game’ sections placing them at the forefront for new and existing players, they are released by some of the largest suppliers that have agreements with all of the larger operators resulting in more exposure and revenue generated, and finally they are themes with proven game mechanics that players have gravitated to for the better part of a decade.”

Onto the newest kids on the block, and it’s the Big Egyptian Fortune slots from Inspired that has ascended the rankings for not only its own segment but also on an overall basis.

In fact, you have to slide down to Design Works Gaming’s Flash Pays Magician LuckyTap in tenth to break a slots monopoly that sees the Arizona-based group’s 10x Fortune sit in second.

Triple Jackpot Gems by Everi rounds off the top three, followed by Zillard King from Evolution’s Red Tiger Gaming, IGT’s Megajackpots Wolf Run, the L&W duo of Blazin Hot 7s Big Bonus and Lightning Gorilla and Gaming Realms’ themed Slingo Shark Week.

“Inspired and Everi alike have seen a recent surge in performance from new slots released in the US online gaming market,” Eckert continued by touching upon these new entrants.

“Themes like Inspired Big Wheel Bonus and Everi’s Triple Jackpot Gems which have surged into the top rankings in recent months.

“These themes have commonality in providing a more ‘classic’ style gameplay with Triple Jackpot Gems relaying on the mechanical reel gameplay and Big Wheel Bonus featuring the older fruit style reel symbols.

“This may not be a sign to come from top ranking games but for now these themes have filled a void that appears to have attracted players.”

On the ‘supplier mix by game category’ classification, Evolution continues to lead the way by occupying 25.7 per cent of the space, of which 86.6 per cent are online slots.

L&W follows with 21.7 per cent, with 90.6 per cent of this figure slots, which IGT’s portfolio is 83.8 per cent slots as the group’s titles claimed 16 per cent of the total space.

Slots remained the dominant segment when looking at the total games tracked with a total percentage of 90.2 (October: 90.1), ahead of table games’ 4.8 per cent (October: 4.9 per cent), with live casino remaining consistent at two per cent.

Video poker also remained consistent at 1.6 per cent while instant win rose fractionally once again to 0.9 per cent (October: 0.8 per cent). Each of lottery and virtual sports remained consistent month-on-month with 0.3 per cent and 0.1 per cent, while bingo/keno slipped to 0.1 per cent.

Mobile maintains its frontrunning status with the highest percentage of theo win generated at 65 per cent and leads across most segment, with desktop, via a theo win of 33 per cent, soaring ahead in virtual sports. Tablet continues to bring up the rear with two per cent.

As we quickly hurtle towards the end of the current year, Eckert close by taking a brief look ahead to what 2023 could bring.

“Over the next twelve months I would expect more suppliers to enter the US market but more importantly the suppliers that have entered in the market in 2022 will continue to build off of their success and expand their coverage to more operators,” he concluded.

The Eilers-Fantini report collects monthly game performance data directly from online operators to track how games perform in the region’s igaming ecosystem, with an ambition of growing the database similarly to that of its land-based game performance index.

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].