Everi has continued to make waves in the latest Eilers-Fantini monthly overview of the US igaming ecosystem, however, the Evolution, International Game Technology and Light & Wonder stranglehold is showing little sign of slipping any time soon.

Despite this dominance seeming to continue on an overall basis, when taking a look at fresh titles entering into the country’s online casino scene (below), Digital Gaming Corporation and White Hat Studios maintain recent form.

This latest analysis examines data from Michigan, West Virginia, Pennsylvania, New Jersey and Connecticut across 35 online casino sites, tracking 54,020 games to represent 64 per cent of the market.

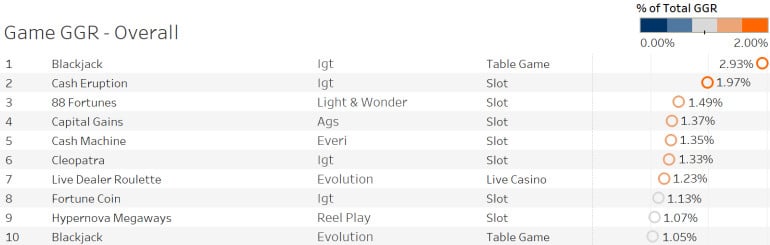

The familiarity witnessed across previous months when looking at the overall top grossing games has been broken up within the latest report, with Evolution’s Live Dealer Roulette top three stalwart down to seventh with 1.23 per cent (June: 1.58 per cent) of GGR through July.

IGT maintained top spot as its Blackjack title swelled its influence significantly to claim a 2.93 per cent (June: 1.86 per cent) slice of the online gaming space.

In addition, the company’s Cash Eruption slot rose from fourth to second courtesy of a percentage of 1.97 (June: 1.54 per cent), with L&W’s 88 Fortunes sitting in a familiar bronze placing at 1.49 per cent (June: 1.55 per cent).

Of the top 25 titles that are dominating the GGR charts, online slots maintain the lion’s share with 18 games. Live casino, all courtesy of Evolution, have five entrants, while table games comprise the remaining pair.

Remaining with the overall rankings, last month’s slots number one in DGC’s Gold Blitz has slipped down to second, with Inspired’s Stacked Fire 7s up from fourth to first and AGS’ Capital Gains, last month’s number five, rounding off July’s top three.

L&W’s aforementioned 88 Fortunes slipped from second through June to fourth in the latest rankings, while Bonanza by Evolution’s Red Tiger Gaming fell from third to sixth.

Eight unique suppliers are represented in the top 10 showing maintained variety in the segment, with IGT, ReelPlay and Greentube joining those mentioned above.

Despite sliding a place overall, DGC’s Gold Blitz retains its position atop of the new games rankings, with four previously unranked games occupying the remaining sports in the top five.

Fellow DGC titles Tippy Tavern claimed silver, ahead of White Hat Studios’ Ted Cash Lock, Design Works Gaming’s Flippin Rich Luckytap and Charming Ladys Boom by Greentube.

The new overall ranks are identical to the new slot ranks this month, with each of the top 25 representing titles that fall in the bracket of the latter list.

Rick Eckert, Managing director of Slot Performance and Analytics at Eilers & Krejcik Gaming, said of the latest publication: “We published the Eilers-Fantini Online Game Performance Report – July ’23.

“Highlighting the top new slots in online for the month, we observe previously unranked games DGC Tippy Tavern, White Hat Studios Ted Cash Lock, Greentube Charming Lady’s Boom, and Bragg Gaming Group/Bluberi’s Devils Lock.”

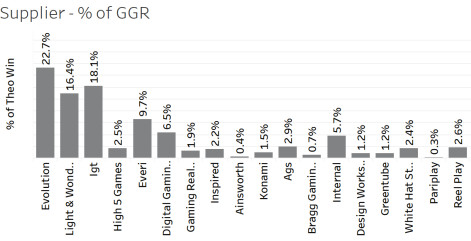

Looking specifically at the supplier mix, Evolution unsurprisingly continues to lead the way. Through July the group occupied 22.7 per cent (June: 22.5 per cent) of GGR, with 85.5 per cent (June: 85.2 per cent) of its gaming suite represented as online slots.

IGT was next in line once again regarding the supplier percentage of GGR with 18.1 per cent (June: 17 per cent), with 85.4 per cent of its portfolio being slots for the second consecutive month.

L&W remained third, with the group’s percentage of GGR standing at 16.4 per cent, down from 16.9 per cent month-on-month. 90.3 per cent (June: 90.4 per cent) of the group’s gaming suite are slots.

Slots remained the dominant segment when looking at the total games tracked with a total percentage of 91.3 (June: 90.9 per cent), ahead of table games’ 4.1 per cent (June: 4.3 per cent).

Live casino was next in line with 1.8 per cent (June: two per cent), ahead of video poker’s 1.2 per cent (2022: 1.3 per cent).

The 1.2 per cent gained by instant win and 0.2 per cent shared by lottery and bingo/keno each remained consistent MoM.

Mobile maintains its frontrunning status with the highest percentage of theo win generated at 70.2 per cent (June: 66.6 per cent) and leads across most segments, with desktop, via a theo win of 28.6 per cent (June: 31.6 per cent), soaring ahead in virtual sports. Tablet continues to bring up the rear with 1.2 per cent (June: 1.9 per cent).

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].