Evolution has highlighted the fact that “we are underserving the market at the moment” as evidence of the increasing demand that the group is witnessing for its services on a global basis.

This was highlighted in detail by CEO Martin Carlesund, who suggested that continued investment and optimised recruitment, as well as a focus on product innovation and financial strength, stand the company is good stead to achieve its ambitions through 2023 and beyond.

Speaking in a third quarter earnings breakdown, he also stressed that the gambling group is “focused on factors that are within our control”, despite external factors said to be playing a more significant role than ever before.

“The strengthening of the Euro against most currencies has affected our top line growth negatively during this year,” he said.

“Players deposit and play in many different currencies with our operators, the resulting GGR is converted to Euro which is the base for our invoicing.

“In the third quarter we estimate six to eight percentage points [of] negative headwind on revenue growth from currency effects when comparing revenues to the same quarter last year.”

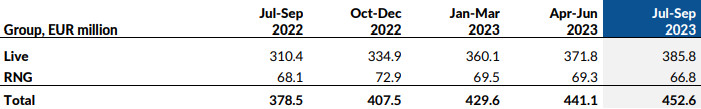

These comments came as the company reported third quarter revenue of €452.64m, up 19.6 per cent year-on-year from €378.53m, with the live casino taking the lion’s share of €385.8m (2022: €310.4m).

Despite noting that this “a measure of the phenomenal traction our games have”, Carlesund pointed out that it also means that Evolution is not expanding our studios at the right pace.

“We have faced delays, and in some cases not executed fully, in several of our planned studio projects for this year but even more importantly we need to increase the pace of recruitment both in existing studios as well as to support new studios,” it was commented.

“We are working hard to get back on track in our existing locations and we will continue to invest in our network of studios and add new locations.”

Following the grand opening of a small studio in Colombia as we entered the year’s fourth quarter, the firm is planning to follow this up with a fresh entity in Europe later in the year. In addition, three of four new studios will debut next year in Europe, North America and LatAm.

Revenue within the group’s RNG segment dropped 1.9 per cent to €66.8m (2022: €68.1m), with Carlesund quick to note the progress made, despite a step back in growth.

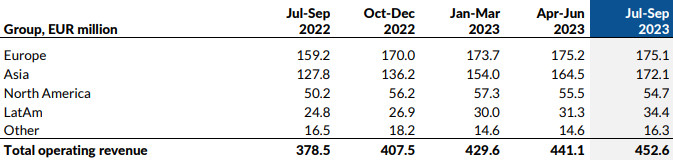

On a geographic basis, Europe leads the revenue chart with €175.1m (2022: €159.2m), finishing narrowly ahead of Asia’s €172.1m (2022: €127.8m).

Elsewhere, North America closed with €54.7m (2022: €50.2m), as Latin America reported €31.3m (2022: €19.4m). Evolution’s ‘other’ division highlighted revenue of €16.3m, down from €16.5m YoY.

“North America is a region that we expect to develop over many years as more US states regulate,” Carlesund continued.

“The online casino market is still in an early stage of development. We continue to see growth for our live product quarter to quarter in the existing states, while we in the past quarter take a step back in our RNG revenue compared to the second quarter.

“Together this results in a nine percent growth in North America compared to same period last year but a slightly lower revenue in the third quarter compared to the second quarter.

“Asia and Latin America both grow 35 and 39 percent respectively from last year and Europe shows a steady 10 percent increase. The growth compared to third quarter of last year is organic in all regions as the latest acquisitions were included in the group then.”

Furthermore, the third quarter also saw profit for the period reach €272.76m, up 23.3 per cent from the €221.29m reported one year earlier, while EBITDA increased 22.1 per cent to €318.59m (2022: €261m).

For the year-to-date, revenue, profit for the period and EBITDA increased 26.1 per cent, 27.1 per cent and 27.6 per cent to €1.32bn (2022: €1.04bn), €787.99m (2022: €619.85m) and €930.45m (2022: €728.91m), respectively.

Following this performance, an EBITDA margin of between 68 per cent and 71 per cent is maintained for the full-year, with this expected to hit the upper end of guidance.

“In summary, the underlying growth drivers remain unchanged,” he concluded. “We face a tougher macro climate today than one year ago and we are underserving the market at the moment, but we will continue to invest, optimise recruitment and, as always, push for growth through focus on product innovation.

“Our financial strength will continue to serve us well as we can continue to invest without interruption and grow.

“We remain committed to delivering new thrilling experiences to new and existing players and continue to strive to be just a little better every day. I look forward to the final months of the year and onwards into 2024.”