Despite acknowledging a second quarter that has delivered “a strong financial result”, Evolution CEO Martin Carlesund is seeking an accelerated performance through the remainder of the year and beyond.

In addition to noting that “I feel that we can do more to leverage our execution power to the fullest,” Carlesund also addressed a real-money gaming arm that is “not yet growing in line with our targets”.

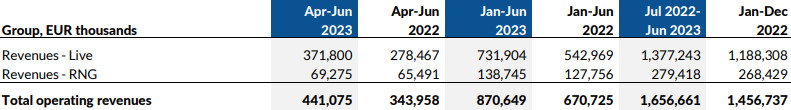

The comments come as the company reported that total revenue through the April to June time frame increased 28 per cent to €441.1m (2022: €344m).

This, the group said, “mainly derives” from online casino and increased commission from customers, as well as being partially aligned to a “continuous” roadmap of games launches.

Revenue from the group’s live casino business, representing 84 per cent of the total, increased 33.5 per cent to €371.8m, while RNG reached €69.3m. This is a drop of four per cent compared to Q2 2022 pro forma, but stable from Q1 and up 5.8 per cent year-on-year when contrasted to reported figures.

“We have made a lot of progress in our RNG operations during the period. At the end of the quarter, we are up to speed with our game release plan,” Carlesund said.

Adding: “We have earlier communicated that the development towards our goal of double-digit growth will take more time and while not yet growing in line with our targets for RNG, it is worth pointing out that it is a highly profitable business and accretive to group margins.

“With our operational improvements in place I see that we have many opportunities to execute on going forward.”

On a geographic basis, Europe leads the revenue chart with €175.2m (2022: €151.9m), finishing narrowly ahead of Asia’s €164.5m (2022: €110.9m).

Elsewhere, North America closed with €55.5m (2022: €46.1m), as Latin America reported €31.3m (2022: €19.4m). Evolution’s ‘other’ division highlighted revenue of €14.6m, down from €15.7m YoY.

“We continue to see long-term growth opportunities in all regions,” Carlesund noted, with an added influx of titles set to head to the US in a bid to increase its live share of the country’s online casino ecosystem.

“In LatAm we continue to see player numbers increase from the region and we have started to expand our studio network there with small studios in Argentina and Columbia,” he continued.

“Europe and Asia are today the largest regions for us, both were early in taking on live casino and players are familiar with the product. There is much potential in both regions.

“In Europe demand for new tables exceeds our current delivery capacity, something we will work to address during the quarters to come.”

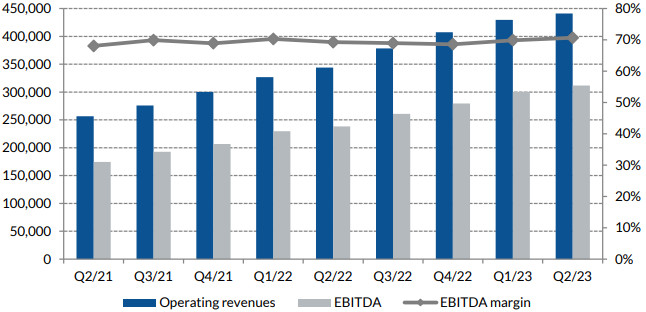

Furthermore, the first quarter also saw profit for the period reach €264m, up 31.5 per cent from the €200.87m reported one year earlier, while EBITDA increased 30.8 per cent to €311.69m (2022: €238.21m).

For the year-to-date, revenue, profit for the period and EBITDA increased 29.8 per cent, 29.3 per cent and 30.8 per cent to €870.64m (2022: €670.72m), €515.23m (2022: €398.56m) and €611.85m (2022: €467.89m), respectively.

“We have a very strong financial position and our cash flow generation continues to support our dividend policy (of distributing a minimum dividend of 50 per cent of net profit over time) and investments in people and innovation now and going forward,” Carlesund concluded.

“As an all-equity financed, profitable company, we are focused on growth and therefore we will continue to invest and push for growth even though we currently face a tougher macro-economic climate than last year. During the second quarter we have continued to expand and invest in our existing studios, and also plan for new locations.

“New titles and constantly improving the playing experience in our existing games is an important cornerstone in our ambition to deliver growth.

“Securing long-term quality in combination with the fact that we always want to do more and better, this is our mind-set and the reason why we can expand our gap to competition also in challenging times.

“We will continue to invest for growth, to try new solutions – sometimes fail – but always strive to be better, every single day.”