A series of increases means that the United States stands on the cusp of an “unprecedented” end to the year, as the American Gaming Association also vows to stand firm in the ongoing fight against illegal operators.

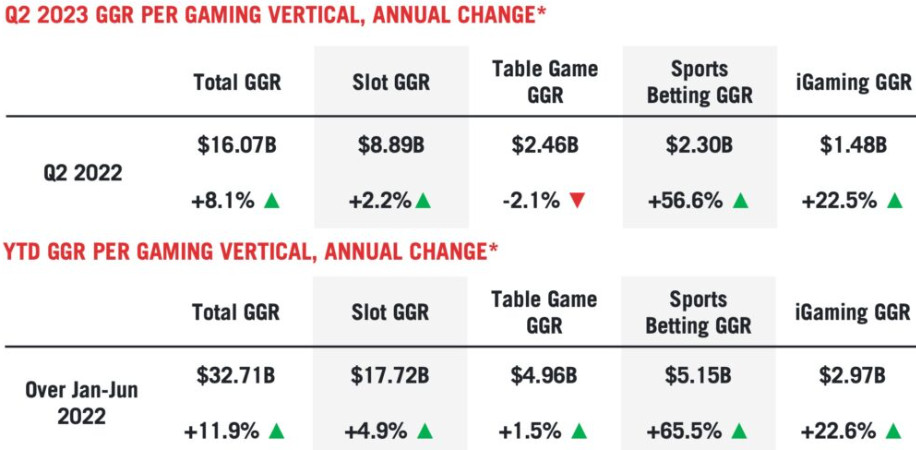

Maintaining a spree of quarterly revenue growth, the industry association’s Commercial Gaming Revenue Tracker highlighted Q2 revenue growth of 8.1 per cent to $16.07bn, driven by online increases that was set against a relatively flat land-based performance.

A tenth consecutive quarter of growth sees the April to June time frame become the second-highest in industry history, topped only by the current year’s first three month period.

The $32.71bn in commercial gaming revenue generated in the first six months of 2023 tracks 11.9 per cent ahead of the same period one year earlier.

This has also resulted in an estimated $7.28bn in direct gaming tax revenue for state and local governments through the first six months of the year, 12.9 per cent ahead YoY.

“While commercial gaming is on track for an unprecedented third consecutive year of record revenue, the lasting impact we’re making on our communities through this record growth is even more impressive,” said AGA President and CEO Bill Miller.

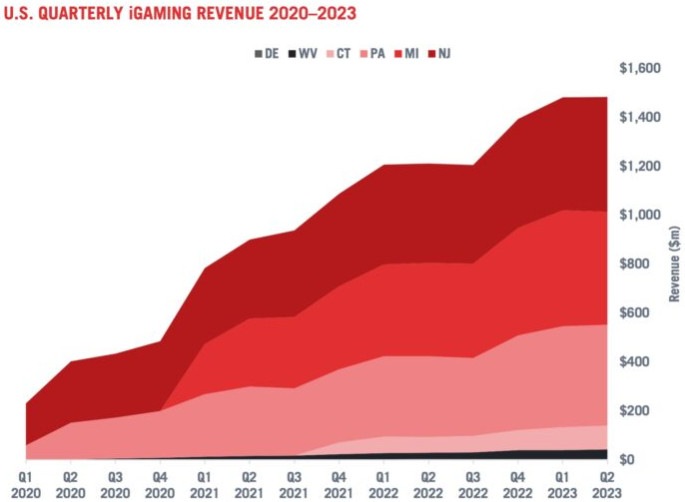

Online casino is reported as maintaining “robust growth”, with revenue of $1.48bn representing a 22.5 per cent YoY uptick to secure an industry record for any second quarter. This is driven by a series of records being set in Connecticut, New Jersey, Pennsylvania and West Virginia.

The AGA reported that igaming “is on track for another record year”, with revenue of $2.97bn through the year-to-date standing 22.6 per cent ahead of 2022.

Combined online and land-based sports betting revenue totaled $2.3bn in Q2 2023, an industry record and a 56.6 per cent year-over-year increase. This is partly aligned to the introduction of mobile sports betting in Kansas, Maryland, Massachusetts and Ohio.

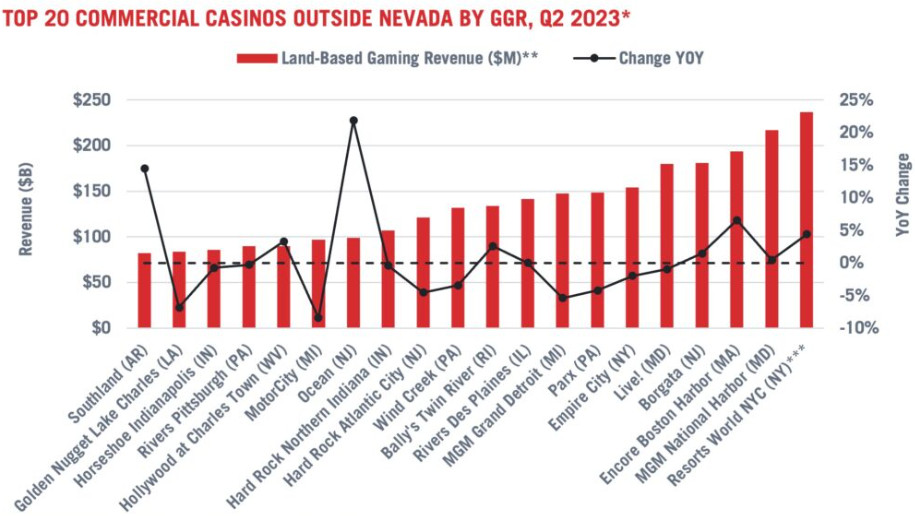

Land-based entities continued to make up more than three quarters of total commercial revenue, with slots, table games and sports betting less than one percentage ahead YoY at $12.38bn. Resorts World NYC continues to be the industry lead of non-Nevada casinos.

“These results are a clear indication that our post-pandemic recovery wasn’t a fluke: the gaming sector continues to thrive, and when we do well, our communities do well,” continued Miller.

“To sustain this momentum, the AGA will continue enlisting more allies in our fight against the illegal market, bolstering responsible gaming, and building a business environment that allows our innovative industry to bring world-class entertainment to adults across America.”