Evolution continues to hold a dominant position within the US online casino space, despite another market share slide through October, as AGS made an impact in the online rankings courtesy of a previously unranked title.

Coming hot on the heels of the industry’s annual descent on the entertainment capital of the world, the impact of previously unranked games, in particular within the new game rankings, is once again felt despite dropping from 12 to seven.

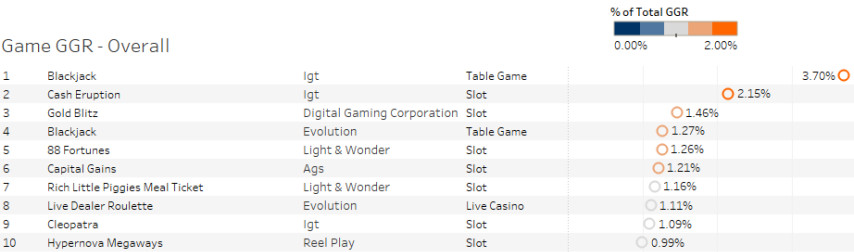

Our attention is first occupied by the overall top games by gross gaming revenue, where International Game Technology retains its place at the summit as the Blackjack table secures a percentage of 3.7.

Sister title Cash Eruption lead frogs one place month-on-month to become the leading slot title with overall GGR of 2.15 per cent, as Digital Gaming Corporation’s Gold Blitz drops from silver to bronze with 1.46 per cent.

Of the top 25 titles that are dominating the GGR charts, online slots maintain the lion’s share with 17 games. Live casino, all courtesy of Evolution, has five entrants, while table games comprise the remaining three. Video poker remains out of the top 25.

Continuing with the overall rankings, Evolution’s Live Dealer Speed Baccarat drops to second place after storming to the summit at its first attempt, with the aforementioned Blackjack offering surging from third to make it a double triumph.

However, rounding off the top three is AGS’ Mega Diamond, which will become a prominent feature throughout the latest monthly breakdown. In its first feature, the slot title edged out Capital Gains, also an AGS game, as well as DGC’s Fire and Roses Joker and Gold Blitz. The latter falling from second to sixth.

In the slots breakdown, Mega Diamond sits ahead of Capital Gains, as Fire and Roses Joker and Gold Blitz once again trail. Light & Wonder’s 88 Fortunes, a consistent top performer, round off the top five.

A total of seven unique suppliers are represented in the top 10, which is once again hailed as “showing continued variety in the segment”. These are Light & Wonder, DGC, AGS, Evolution, IGT, ReelPlay and Greentube. The top 25 also features the likes of Everi, Anaxi and Inspired.

In the new game rankings, the aforementioned Mega Diamond leads the way, with last month’s one and two, namely Fire and Roses Joker and L&W’s Rich Little Piggies Meal Ticket, down one place each.

A total of seven new releases make the top 25, with the leader joined by DGC’s Trojan Kingdom (6th), Anaxi’s Buffalo (9th), White Hat Studios’ Fire Coins (13th) and Wolf Legends Megaways Jackpot Royale (14th), Fantasma Games’ Payday Express (23rd) and Evolution’s Blobsters Clusterbuster (24th).

The new overall ranks are identical to the new slot ranks for another consecutive month, with each of the top 25 representing titles that fall in the bracket of the latter list.

Previously, the potential of the chasing pack has been touched upon in detail by Rick Eckert, Managing Director of Slot Performance and Analytics at Eilers & Krejcik Gaming, with Anaxi, Aristocrat’s real-money gaming division, one citing as causing much optimism.

Following the latest breakdown, he commented: “The increased presence of igaming suppliers and omni-channel content is more evident every passing year and noted below from our coverage.

“Mega Diamond from AGS enters the OGPD ranking number one in the new slot ranks. This theme has been tracked in our retail database since July ’22 and was ranked 25th last month in the core video reel high denom segment where it is currently performing best at the $1 base denomination.

“Anaxi/Aristocrat much anticipated release of Buffalo makes its debut in the OGPD ranking number nine in the new slot ranks. This title is the top grossing game in retail but indexing lags other popular titles from the supplier we are expecting to populate online.

“Blueberi’s Devils Lock powered by Bragg Gaming Group moves up the ranks again this month now at number sixteen in the new slot ranks. This game features perceived persistence and cash on reels that are overly prominent in retail but still trending up online.

“Later this month, we will take a deeper dive into online game attributes through our quarterly data insights report.”

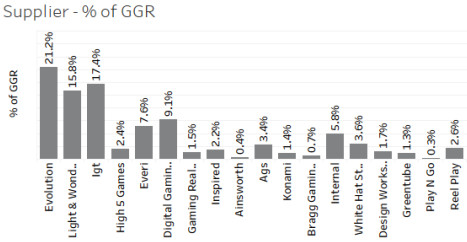

Looking specifically at the supplier mix, Evolution unsurprisingly continues to lead the way, although another decline in share, as touched upon earlier, was evidenced.

Through September the group occupied 21.2 per cent (September: 2s.4 per cent) of GGR, with 85.7 per cent (September: 83.5 per cent) of its gaming suite represented as online slots.

IGT was next in line, however a slight recovery to 17.4 per cent (September: 16.7 per cent) halted a significant slide felt one month earlier. 85.9 per cent (September: 85.2 per cent) of its portfolio were tracked as slots.

L&W remained third, although the group’s percentage of GGR also rose slightly to 15.8 per cent, up from 15.1 per cent month-on-month. 90.1 per cent (September: 87.9 per cent) of the group’s gaming suite are slots.

Slots remained the dominant segment when looking at the total games tracked with a total percentage of 91.2 (September: 90.1 per cent), ahead of table games’ falling 3.8 per cent (September: 4.9 per cent).

Live casino was next in line with 1.9 per cent, ahead of instant win’s 1.6 per cent, video poker’s 1.1 per cent and the 0.2 per cent shared by lottery and bingo/keno. Each remained consistent month-on-month.

Mobile retains its frontrunning status with the highest percentage of theo win generated at 69.9 per cent (September: 70.8 per cent) and leads across most segments, with desktop, via a theo win of 29 per cent (September: 28.5 per cent), soaring ahead in video poker, virtual sports and lottery. Tablet continues to bring up the rear with 1.2 per cent (September: 0.8 per cent).

This latest analysis examined data from Michigan, West Virginia, Pennsylvania, New Jersey and Connecticut across 32 online casino sites, tracking 50,885 games to represent around 64 per cent of the market.

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].