Newly-ranked games from the likes of High 5 Games and White Hat Studios stormed towards the top of the new game ranks in Eilers-Fantini’s March report.

On the other hand, the top games by gross gaming revenue stayed somewhat the same as February, as did the supplier charts with Games Global closely rivalling the ever-present big three suppliers – Evolution, IGT and Light & Wonder.

Meanwhile, the research firm’s recently-launched Canadian report continues to grow, revealing a neck-and-neck finish between Pragmatic Play and IGT for the supplier top spot.

US performance

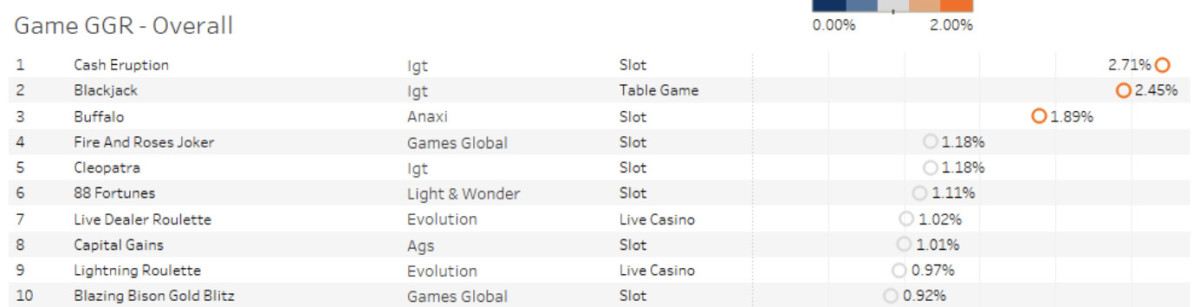

We kick off March’s Eilers-Fantini breakdown with the usual top games by GGR chart, which saw almost every game in last month’s top 10 games make up the top 10 once again, albeit in different positions.

IGT’s Blackjack and Cash Eruption switched places at the very top of the chart for March, with Cash Eruption taking top place with a 2.71 per cent share of GGR and Blackjack following up in second with 2.45 per cent.

Anaxi’s online version of its popular Buffalo title continued to prove itself as a top-performer after securing consecutive third place finishes, coming in with 1.89 per cent of GGR share.

This was followed by the only game to break into the top 10, with Games Global’s Fire and Roses Joker taking fourth position with 1.18 per cent of GGR. IGT’s Cleopatra title rose from February’s seventh place finish to round out the top five in March.

Within the top 25 games by GGR, slots represented the strongest-performing format with 16 titles, with five live casino, three table games and one video poker title making up the rest.

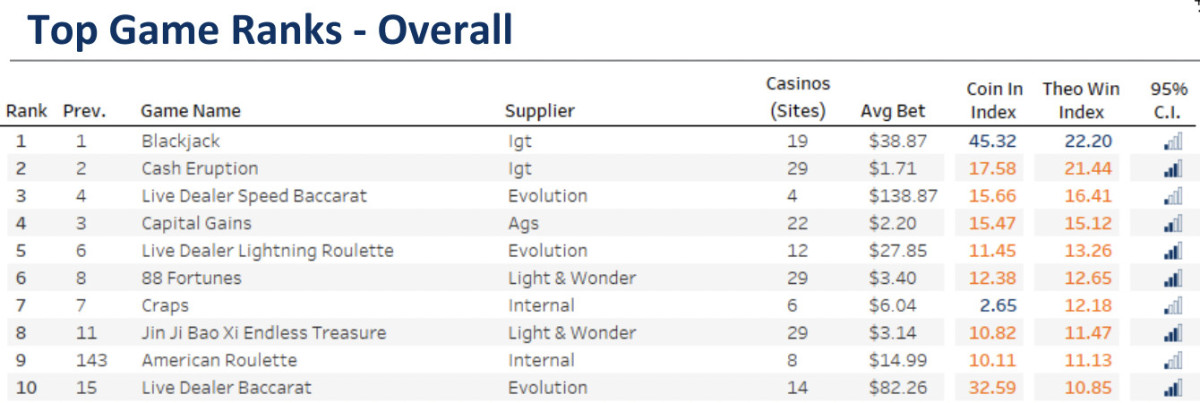

Looking at the table for top-performing games overall, IGT’s Blackjack continues to cement its position in first place, while Cash Eruption secured second once again.

Some slight movement was seen in the remainder of the top five, as Evolution’s Live Dealer Speed Baccarat leapfrogged over AGS’ Capital Gains slot to take its third place, with the latter settling for fourth place.

Finishing off the top five was Live Dealer Lightning Roulette from Evolution, which climbed one place from sixth to fifth due to Games Global’s Blazing Bison Gold Blitz falling considerably from last month’s fifth place down to eighteenth place.

This title had also taken a considerable hit in the games by GGR charts as it was the only title not to make the top 10 for consecutive months, falling from fourth to tenth place with a GGR percentage drop from 1.36 per cent to 0.92 per cent.

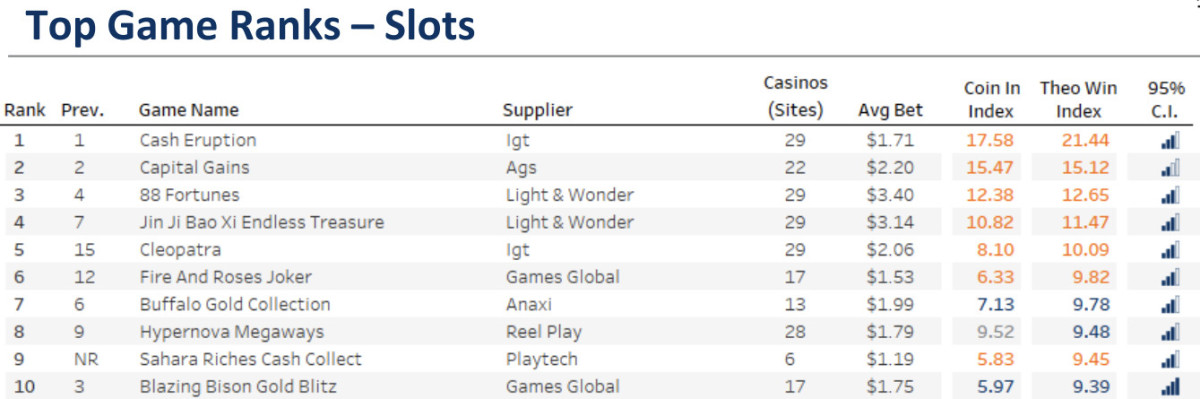

In the slots-focused charts, IGT’s Cash Eruption and AGS’ Capital Gains slots remained in first and second place respectively, while 88 Fortunes from Light & Wonder rose from fourth place to third, thanks to another drop off from Blazing Bison Gold Blitz, which fell from third to tenth.

Making up the rest of the top five slots was Jin Ji Bao Xi Endless Treasure from Light & Wonder, climbing from seventh to fourth, and IGT’s Cleopatra which climbed ten places from 15 to five.

Studio representation dropped slightly across March, as while 12 suppliers made up February’s top 25 slots chart, March saw only 11 suppliers represented with High 5 Games, Playtech, Reel Play, Greentube and White Hat Studios all appearing.

Looking into the new game rankings, the top two titles stayed solidified in their places as Anaxi’s Buffalo Gold Collection and AGS’ Platinum 8x8x8x game in first and second place, respectively.

A new ranking from IGT took the bronze medal for new titles in Wheel of Fortune Gold Spin Triple Red Hot 7s, pushing last month’s third place finisher Games Global’s Fishin Pots of Gold Gold Blitz down to fourth.

This was then followed by another new ranking as High 5 Games rounded out the top five with its latest East-Asian slot release, 88 Drums, which finished just ahead of another new ranking, White Hat Studios’ branded Peaky Blinders Jackpot Royale.

For yet another consecutive month, slots were the dominant vertical in the new games charts, with all of the top 25 games being slot titles.

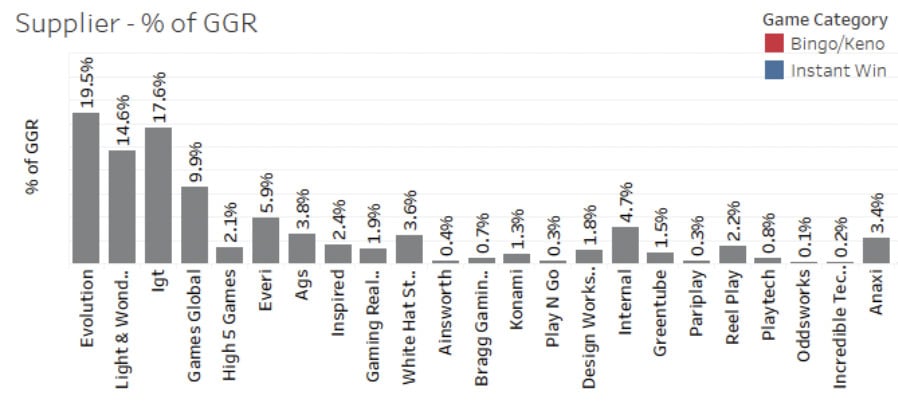

As per usual, Evolution sat on top of the supplier charts with 19.5 per cent of GGR, with IGT and Light & Wonder taking their usual sports in second and third with 17.6 and 14.6 per cent, respectively.

While it remained in fourth place, Games Global gained some footing on the big three suppliers, rising from February’s 9.7 per cent of GGR to 9.9 per cent.

Meanwhile, Evolution’s tracked portfolio is 85.6 per cent slots, with IGT’s 86 per cent and Light & Wonder’s 90.5 per cent slots.

Once again, slots remained the dominant segment when looking at the total games tracked, with a total percentage of 91.6, ahead of table games which stands at 3.5 per cent.

Instant win games were up next with 1.9 per cent, ahead of live casino’s 1.7 per cent, video poker’s 0.9 per cent and the 0.2 per cent from both lottery and bingo/keno.

Mobile recorded 69.8 per cent for the highest percentage of theoretical win generated, beating desktop’s 29.2 per cent and tablet’s one per cent.

This latest analysis examined data from Michigan, West Virginia, Pennsylvania, New Jersey and Connecticut across 30 online casino sites, tracking 51,818 games to represent around 64 per cent of the US market.

Canada statistics

Eilers-Fantini’s Canadian analysis continues to grow as the report now covers statistics from 10 online casino sites, tracking 10,080 games across five provinces.

Looking at the Canadian top games by GGR charts, IGT’s Cash Eruption title took first place with 1.62 per cent of GGR, followed by two Pragmatic Play slots in Sweet Bonanza and Sugar Rush which came in second and third place respectively with 1.51 and 1.13 per cent.

IGT’s Cleopatra title claimed fourth place with 1.05 per cent GGR while last month’s first place finisher, Live Dealer Roulette from Evolution dropped down to fifth place with 0.91 per cent.

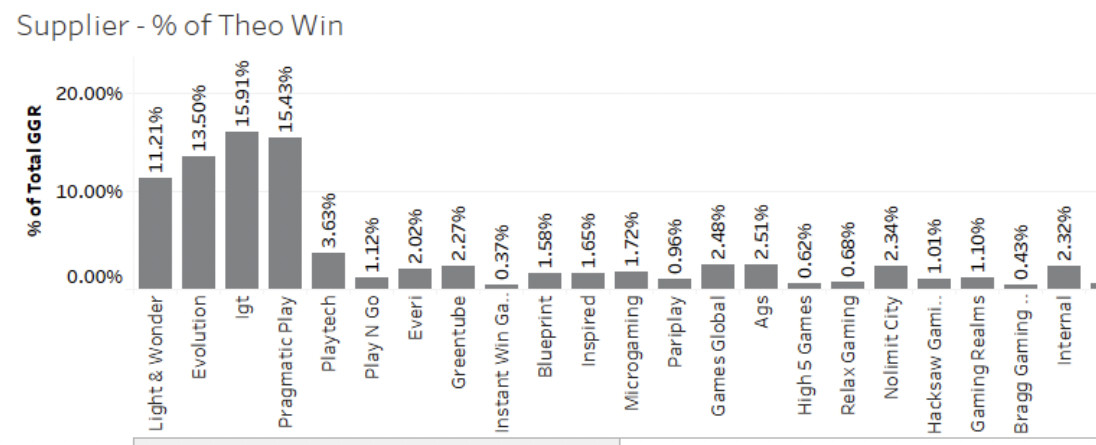

A closely fought battle between IGT and Pragmatic Play saw IGT come out victorious in the percentage of theoretical win charts for Canadian suppliers, besting Pragmatic Play’s 15.43 per cent with 15.91 per cent.

Used to settling for second and third place in the US charts, Evolution and Light & Wonder sat in third and fourth place, achieving 13.5 and 11.21 per cent respectively.

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].