White Hat Studios and Digital Gaming Corporation have maintained their US online casino momentum through a further month, reports Eilers-Fantini in a latest monthly overview.

Coming after Rick Eckert, Managing director of Slot Performance and Analytics at Eilers & Krejcik Gaming, singled out the pair, alongside Everi, as being best placed to challenge the status quo, the new top game ranks (analysed below) continue to be fruitful.

In addition, Eckert also cited Anaxi, Aristocrat’s real-money gaming arm, as a potential one to watch in potentially overhauling the dominance of Evolution, International Game Technology and Light & Wonder.

He said of the latest publication: “We published the Eilers-Fantini Online Game Performance Report – June ’23. Tracking GGR over the past 12 months Light & Wonder, Everi, and Digital Gaming Corporation show growth trends while Evolution and IGT are being impacted by more internal development in the table game segment and increased competition with slots.”

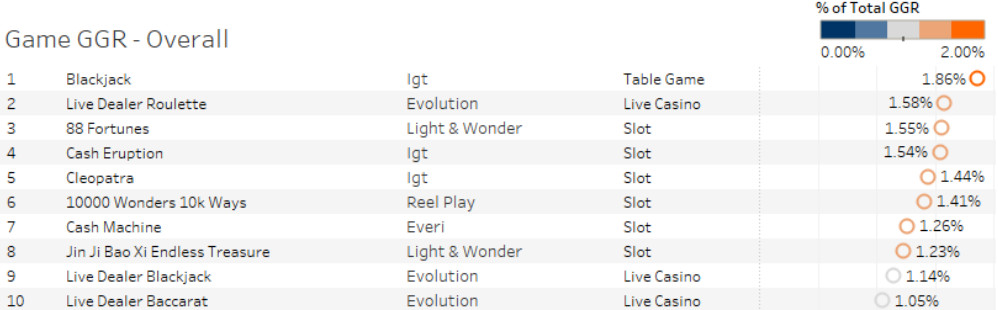

Despite the rivalries within the US’s digital gaming domain becoming increasingly fierce, the familiarity witnessed across previous months when looking at the overall top grossing games is maintained through June.

The dominance of IGT’s Blackjack (1.86 per cent), L&W’s 88 Fortunes (1.55 per cent), up one spot, and Evolution’s Live Dealer Roulette (1.54 per cent) are proving a tough nut to crack, as the big three retain their places, despite falling percentages as competition ramps up.

Of the top 25 titles that are dominating the GGR charts, online slots maintain the lion’s share with 19 games. Live casino, all courtesy of Evolution, have four entrants, while table games comprise the remaining pair.

Sticking with the overall rankings, but adopting a slots focus, DGC’s previously unranked Gold Blitz surged to the top spot as L&W’s 88 Fortunes was displaced once again and closed the month in second. Bonanza by Evolution’s Red Tiger Gaming closed out the top three.

Eight unique suppliers are represented in the top 10, which, Eilers-Fantini noted, shows a continued variety in the segment. Joining L&W, DGC, Evolution, IGT and Everi are AGS, Inspired and Reel Play.

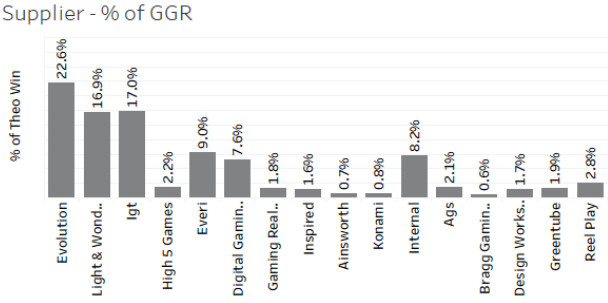

On an overall basis, familiarity was witnessed once again. Evolution leads the way overall with a total GGR of 22.4 per cent (16.1 per cent on a slots basis), which is up from the previous month’s 15.7 per cent.

IGT was next in line with an overall percentage of 16.9 (April: 17.4 per cent), of which 15.4 per cent was slots, while L&W rounded off the top three once more with 16.7 per cent (April: 16.2 per cent) and a slots score of 19.9 per cent.

On the new games front, which saw the overall and slots ranks display identical rankings, DGC boasted six entrants, including four of the top five.

Gold Blitz knocked sister title Squelin Riches off top spot, with Amazon Kingdom and Bison Moon coming in fourth and fifth.

The only previously unranked game comes from White Hat Studios, with the Jackpot Royale version of the popular Goonies theme splitting the DGC quartet.

On the ‘supplier mix by game category’ classification, it is Evolution that maintains its place at the summit via a slight rise month-on-month. Through June the group occupied 22.6 per cent (May: 22.3 per cent) of the space, of which 85.2 per cent (May: 85.8 per cent) are online slots.

IGT was next in line regarding the supplier percentage of GGR with 17 per cent (May: 17.6 per cent), of which 85.4 per cent (May: 85.3 per cent) were slots. L&W was up of 90.4 per cent (May: 90.1 per cent) of which slots claimed 16.9 per cent (May 16.3 per cent) of the total ecosystem.

Slots remained the dominant segment when looking at the total games tracked with a total percentage of 90.9, ahead of table games’ 4.3 per cent.

Live casino was next in line with two per cent, ahead of video poker’s 1.3 per cent, the 1.2 per cent gained by instant win and 0.2 per cent shared by lottery and bingo/keno. Each of these remained consistent MoM.

Mobile maintains its frontrunning status with the highest percentage of theo win generated at 66.6 per cent (May: 65.7 per cent) and leads across most segments, with desktop, via a theo win of 31.6 per cent (May: 31.9 per cent), soaring ahead in video poker and virtual sports. Tablet continues to bring up the rear with 1.9 per cent (May: 2.4 per cent).

This latest analysis examines data from Michigan, West Virginia, Pennsylvania, New Jersey and Connecticut across 30 online casino sites, tracking 44,615 games to represent 59 per cent of the market.

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].