Digital Gaming Corporation is continuing to ride the crest of the US’ igaming wave, as the chasing pack makes further headway into the dominant position adopted by Evolution, IGT and Light & Wonder across recent months, according to the latest Eilers-Fantini monthly report.

Following Rick Eckert, Managing Director of Slot Performance and Analytics at Eilers & Krejcik Gaming, speaking of expectations for this superiority to continue, an anticipated drop in market share for the former pair has been witnessed once again.

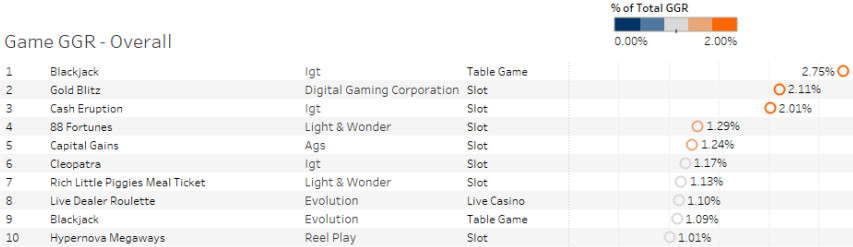

The familiarity witnessed across previous months when looking at the overall top grossing games was cast aside through September, as Evolution’s Live Dealer Roulette slipped from second to eighth with overall GGR of 1.1 per cent.

IGT’s Blackjack table game retained first place with dominant GGR of 2.75 per cent, with the top ranked slot of DGC’s Gold Blitz, which has had control over the new ranking across recent months, taking silver with 2.11 per cent.

Cash Eruption rounds off the top three, with the IGT title possessing a 2.01 per cent control of GGR after dropping one position month-on-month.

Of the top 25 titles that are dominating the GGR charts, online slots maintain the lion’s share with 17 games. Live casino, all courtesy of Evolution, has five entrants, while table games comprise the remaining three. Video poker drops out of the top 25.

Remaining with the overall rankings, Evolution’s Live Dealer Speed Baccarat secures top spot at its first attempt, with Gold Blitz down one position to finish ahead of the third placed Blackjack of IGT.

In the slots breakdown, DGC’s Fire and Roses Joker, which is also making its first appearance, blazes a path to second to sit behind sister title Gold Blitz. AGS’ Capital Gains climbs one place to claim bronze.

A total of seven unique suppliers are represented in the top 10, which is hailed as “showing continued variety in the segment”. These are Light & Wonder, DGC, AGS, Evolution, IGT, ReelPlay and Greentube.

In the new game rankings, the aforementioned Fire and Roses Joker sits atop another podium, with a pair of fresh L&W releases in Rich Little Piggies Meal Ticket and Coin Combo Perfect Peacock closing in the second and third positions.

White Hat Studios’ The Goonies Jackpot Royale, up from 21st place, and Greentube’s Charming Lady’s Boom round out the top five.

The new overall top games rankings table is dominated by DGC with seven entrants, which comes narrowly ahead of L&W’s six. Almost half of the top 25 are previously unranked games, with new releases counting 12 entrants.

The new overall ranks are identical to the new slot ranks for another consecutive month, with each of the top 25 representing titles that fall in the bracket of the latter list.

Reflecting on the group’s performance on social media, Neill Whyte, Chief Commercial Officer of DGC’s B2B division, said: “For us, competition keeps us on our toes. It creates an environment that makes us produce better content and experiences for our customers and their players. It requires us to build closer relationships with our customers to find the edge to make us stand out over others.

“We don’t always get it right, and more often than not, we beat ourselves up trying to understand ‘the why’. What does the data say, what do the lobby reviews tell us, what is the feedback from the customer, etc., but overall, we tend to focus on games and the content.”

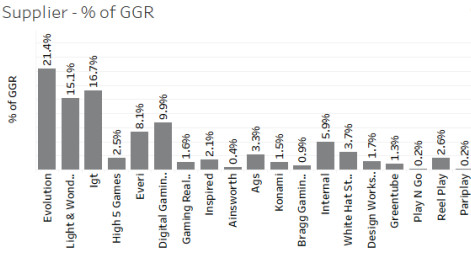

Looking specifically at the supplier mix, Evolution unsurprisingly continues to lead the way, although another decline in share was evidenced.

Through September the group occupied 21.4 per cent (August: 22.4 per cent) of GGR, with 83.5 per cent (August: 84.8 per cent) of its gaming suite represented as online slots.

IGT was next in line once again a drop was also witnessed here after recording 16.7 per cent (August: 19.1 per cent) of GGR, with 83.5 per cent (August: 85.2 per cent) of its portfolio being slots.

L&W remained third, although the group’s percentage of GGR rose slightly to 15.1 per cent, up from 15 per cent month-on-month. 87.9 per cent (August: 90.6 per cent) of the group’s gaming suite are slots.

Slots remained the dominant segment when looking at the total games tracked with a total percentage of 90.1 (August: 90.9 per cent), ahead of table games’ 4.9 per cent (August: 4.4 per cent).

Live casino was next in line with 1.9 per cent (August: two per cent), ahead of instant win’s 1.6 per cent (August: 1.1 per cent), video poker’s 1.1 per cent (August: 1.2 per cent) and the 0.2 per cent shared by lottery and bingo/keno as each remain consistent month-on-month.

Mobile retains its frontrunning status with the highest percentage of theo win generated at 70.8 per cent (August: 69.9 per cent) and leads across most segments, with desktop, via a theo win of 28.5 per cent (August: 28.9 per cent), soaring ahead in virtual sports and lottery. Tablet continues to bring up the rear with 0.8 per cent (August: 1.2 per cent).

This latest analysis examined data from Michigan, West Virginia, Pennsylvania, New Jersey and Connecticut across 34 online casino sites, tracking 50,105 games to represent around 64 per cent of the market.

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].