The S&P 500 Index ended its three-week winning streak as macro fears and US President Donald Trump’s 100% tariffs on China rattled markets last week. Gaming stocks, most of which tend to have a beta in excess of one and are thereby more volatile, had a dismal week. The Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, fell 5.8%, more than twice the 2.4% drawdown in the S&P 500 Index.

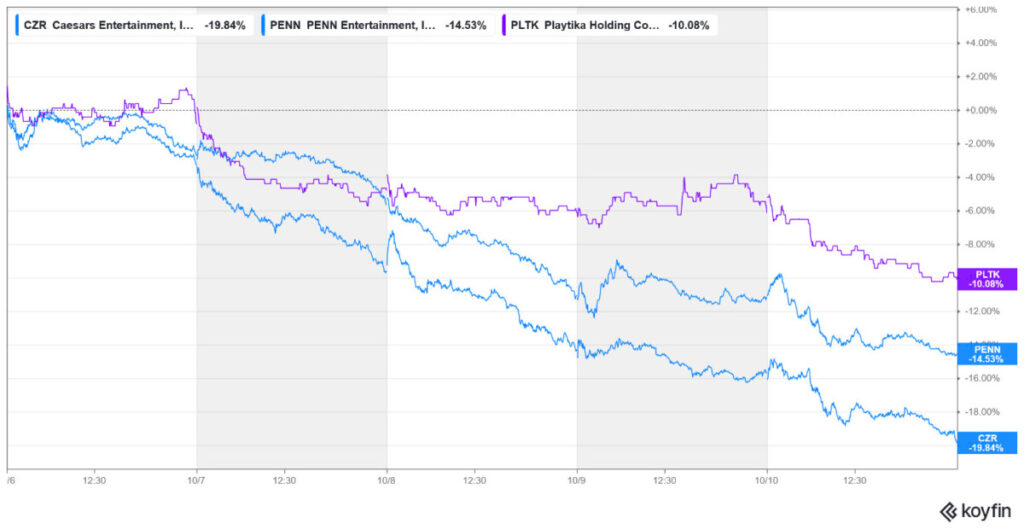

There were not many gaming stocks that closed in the green last week, but The Star Entertainment Group managed to buck the trend with double-digit gains. Caesars Entertainment, Penn Entertainment, and Playtika Holdings saw double-digit losses last week and were among the worst-performing stocks in our coverage of gaming stocks.

Largest Gaming Stock Gainers

Star Entertainment (ASX: SGR): +10%

Star Entertainment was the biggest gainer in our coverage of gaming stocks as it rose 10% in what was otherwise a dismal week for gaming and gambling stocks.

There wasn’t any company-specific news last week, and the gains appear to be in response to some of the other positive developments in the previous two weeks. For instance, on September 30, Star announced that it had received a loan covenant waiver under its syndicated facility agreement.

The waiver is subject to the exchange of signed documentation, and the announcement came a month after the release of Star’s preliminary 2025 financial report, which mentioned ongoing discussions with lenders regarding the waivers.

Moreover, in a regulatory filing on September 25, Star Entertainment said that Queensland Attorney General and Minister for Justice and Integrity have confirmed that the Crisafulli Government deferred the suspension of The Star Gold Coast’s casino license until 30 September 2026, as authorities pointed to the “steady progress” that the company made on remedial measures.

Meanwhile, Star Entertainment has been quite volatile this year, amid back-and-forth on its plan to sell its 50% stake in the Queen’s Wharf Brisbane casino to Hong Kong-based partners Chow Tai Fook Enterprises and Far East Consortium. While the talks initially collapsed, the companies reached a binding agreement in August, which would help bring much-needed cash to the debt-laden company.

Zeal Network Se (DAX: TIMA.D.DX)

Zeal Network closed almost flat last week and managed to dodge the meltdown in US markets.

Notably, Zeal Network, the largest online lottery company in Germany, has been working on strategic partnerships to expand its reach.

In July, it partnered with Greentube, the digital gaming subsidiary of Novomatic, to integrate select Greentube online games into its portfolio for its German B2C brands, LOTTO24 and Tipp24.

The same month, its investment arm ZEAL Ventures announced a co-investment in Random State, a Swedish iLottery and iBingo specialist.

Largest Gaming Stock Losers

Caesars Entertainment (NYSE: CZR) -19.8%

Caesars Entertainment stock was the biggest loser in our coverage of gaming stocks and shed almost a fifth of its market capitalization last week. Concerns over the US economy and tariff fears led to the sell-off in gaming stocks, while worries that prediction platforms like Kalshi might take market share from online betting operators have also dampened sentiments.

Earlier this month, Robinhood’s CEO, Vlad Tenev, shared via a social media post that the platform’s prediction markets had surpassed 4 billion event contracts traded all-time, with a significant portion of that volume occurring in the most recent quarter. Kalshi has also been reporting record volumes, prompting analysts to lower their target prices on sports betting companies. For instance, last week, Stifel Nicholas lowered CZR’s target price from $45 to $43. Ceaser’s high debt burden is not helping matters and making markets apprehensive about the company.

“These companies need to come out with a strategy for investors — whether it’s launching prediction markets or stepping up marketing,” said Jordan Bender, an equity research analyst at Citizens, about sports betting companies. He warned, “Until that happens, the prediction markets present a risk.”

Penn Entertainment (NYSE: PENN) -14.5%

Penn Entertainment was among the other major losers last week, falling 14.5%. Pretty much the same factors were at play as economic uncertainty and threat from prediction rivals took a toll on PENN stock. Notably, activist investor AG Vora, which secured two seats on Penn’s board earlier this year, believes that the company’s online sports betting business “failed” despite spending $4 billion on the venture over five years. It particularly listed the Barstool Sports acquisition, where Penn eventually sold back the venture to Dave Portnoy for a mere $1 after having paid over $550 million originally.

Penn also has a partnership with ESPN Bet for sports betting, which AG Vora criticized in the past.

Playtika Holdings (NYSE: PLTK) -10.1%

Playtika Holdings lost just over 10% last week and extended its YTD losses to 51%. The stock hit a new 52-week low last week, as it continued its dismal 2025 run.

Playtika’s recent financial performance has been disappointing, and its Q2 earnings failed to impress, with both revenues and net profit falling short of consensus estimates. The company also lowered its 2025 revenue guidance by $10 million and now expects the metric to come in between $2.70 billion and $2.75 billion, even as it reaffirmed the adjusted EBITDA guidance of between $715 million and $740 million.

Other Major Gaming Industry Developments

Last week, there were some key announcements on strategic partnerships. Here are some of the key ones.

- In a major move, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, announced an investment of up to $2 billion in prediction market platform Polymarket. The major news comes just weeks after the platform received regulatory clearance to relaunch in the United States.

- Glitnor Group partnered with Kambi for a new sportsbook rollout. As part of the deal, Glitnor will replace its current B2B sportsbook provider with Kambi’s sportsbook technology and services, including its robust betting engine, AI-powered trading capabilities.

- The Orlando Magic and Hard Rock Bet also announced a new partnership last week under which Hard Rock Bet becomes the team’s official sportsbook.

Elsewhere, provisional figures released by the Macao SAR Government last week showed that over 1.14 million visitors entered Macau during this year’s eight-day National Day Golden Week holiday. That amounts to 143,000 average daily visitors, which is a record high.

On the regulatory front, the UK Gambling Commission confirmed that new rules for online deposit limits will be phased in from the end of October 2025 as part of enhanced responsible gambling measures. In another major regulatory development, Brazil’s Chamber of Deputies withdrew the previous proposal that would have imposed retroactive taxation on the online betting industry.