A user on Polymarket who has made over $1 million wagering on Google search markets has been accused of working at the company. The individual has changed their username on the platform in an apparent attempt to evade online accusations.

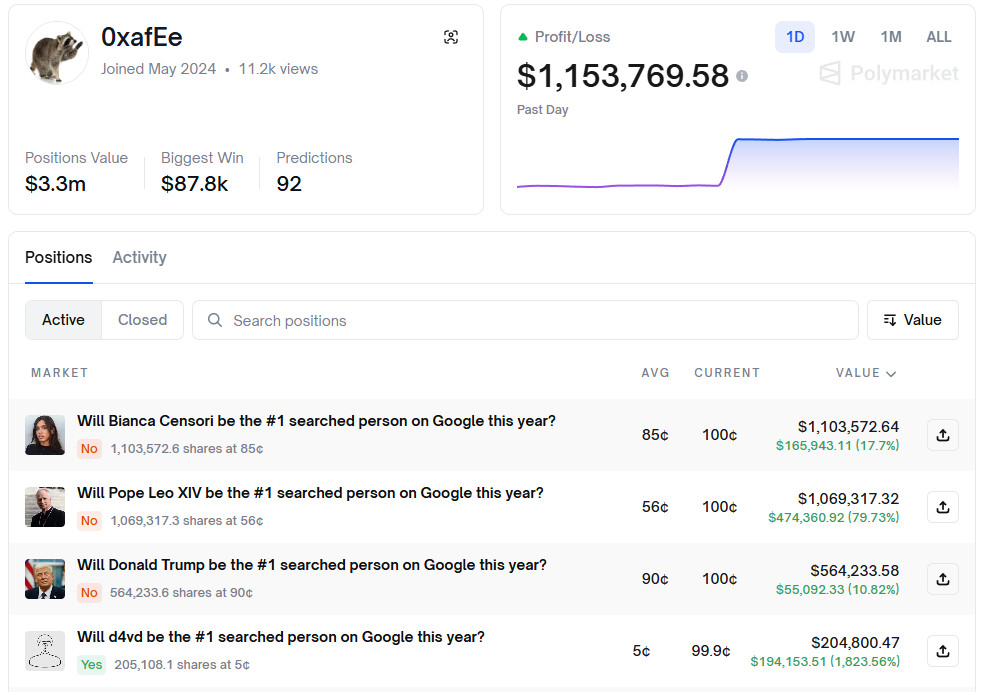

The wagers were flagged in a thread on X, noting the Polymarket account AlphaRacoon generated profits of over $1 million in a single day of trading. The account has since been renamed to 0xafEe.

Polymarket openly displays information related to wagers placed by users. The account 0xafEe has open trades worth $3.3 million. The majority of the markets the user is profiting from relate to the most searched people of the year.

Google revealed the list of the most searched people this week, with singer d4vd at number one. The account wagered on d4vd when the singer was available at 5 cents, leading to a profit of almost $200,000.

Additional “No” wagers on several individuals to be the most searched yielded further profit, with a trade on Pope Leo XIV generating the largest win, at almost half a million dollars.

The top searched people of this year were:

- d4vd

- Kendrick Lamar

- Jimmy Kimmel

- Tyler Robinson

- Pope Leo XIV

- Shedeur Sanders

- Bianca Censori

- Zohran Mamdaniight

- Greta Thunberg

- Sanae Takaichi

In addition to profiting from the search terms, the account also made $150,000 by wagering on when Gemini 3.0 would be released. Although the activity has been flagged as suspicious, there is no evidence to suggest that the person operating the account is affiliated with Google or any of its companies. There are also no specific rules on the markets stating that Google employees are prohibited from participating.

Polymarket CEO Endorses Insider Trading

Prediction markets generally have loose rules on who can participate. Polymarket founder and CEO Shayne Coplan stated last week that insider trading on the company’s markets is not actively prohibited. Instead, he said it is “cool” that people have financial incentives to divulge information to the platform.

He stated, “I think what’s cool about Polymarket is that it creates this financial incentive for people to go and divulge the information to the market and the market to change, and all of a sudden it’s trading at 95 cents.”

Against-the-house betting companies would ban users they believed had inside knowledge, as when users win, the house loses. However, prediction markets do not lose out when users win. Instead, they will generate more profit by taking a commission from the trades.

Should Insider Trading be Banned?

Coinbase CEO Brian Armstrong also stated this week that it is unclear whether insider trading on prediction markets is beneficial or detrimental. In an interview with the New York Times, he said if the goal is to try to get a signal about what is going to happen in the world, then you want insider trading.

He said the matter is up for debate, adding, “If you want to protect the integrity of the markets, maybe you don’t want insider trading.”

Armstrong deliberately influenced prediction markets at Kalshi and Polymarket on what he would say during the company’s Q3 earnings call last month. At the end of the call, he reeled off the remaining words in the markets that he had not said naturally in the call.

The market was relatively small, with a total of $83,000 traded on the two platforms. During the interview this week, he stated that this was not insider trading, as he did not trade on the market.

CFTC Reluctant to Regulate Markets

In the interview, he stated that he had spoken with one of the candidates to lead the Commodity Futures Trading Commission (CFTC) about whether the organization should ban insider trading. The CFTC regulates prediction markets, but has been reluctant to place many restrictions on licensed platforms.

The new nominee to lead the regulator, Michael Selig, also hinted he would continue the hands-off approach, leaving it up to courts to decide on whether sports markets are legal.

For now, company insiders may continue to profit on markets where they have inside knowledge. There have also been accusations that military insiders have profited by successfully predicting when airstrikes would take place.

Polymarket’s war markets have attracted criticism, with opponents arguing they gamify conflict. As the company re-enters the US market, it is likely to face further scrutiny over the acceptability of certain markets and who is allowed to participate.