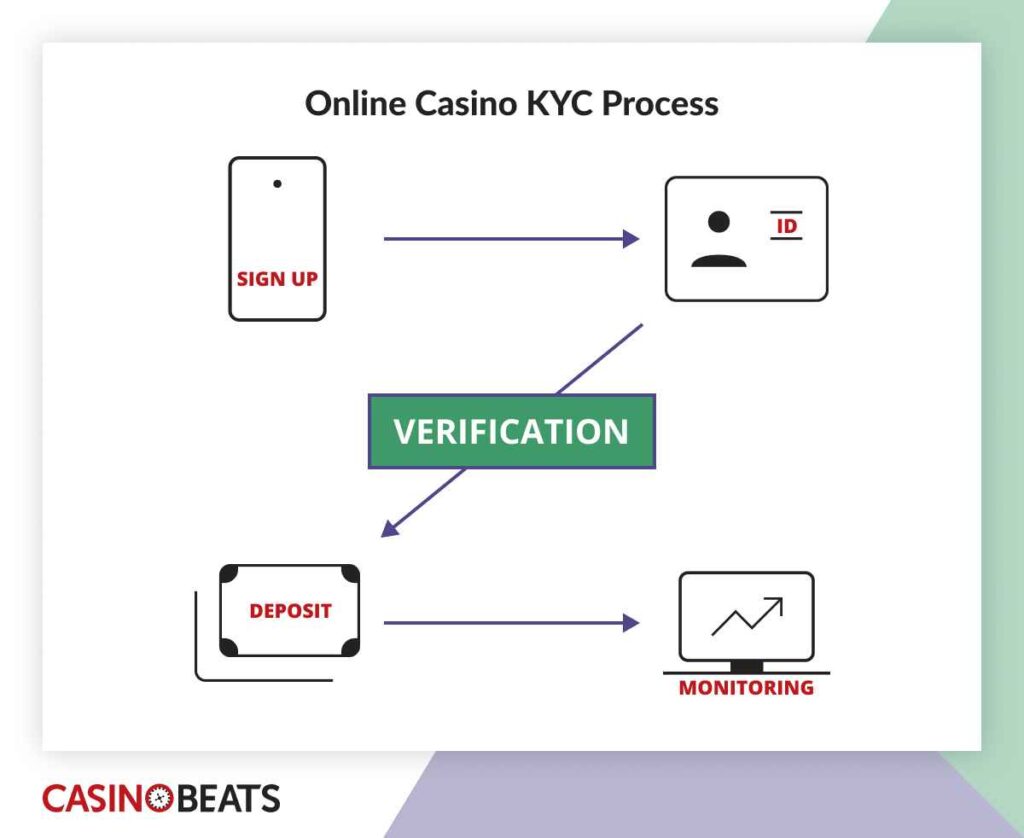

KYC (Know Your Customer) is the online casino verification process that checks and confirms your identity and account as required by online casinos. This guide explains the KYC casino process, the documents you’ll need, when checks are triggered, and practical tips to keep withdrawals smooth and secure.

Key Beats

- KYC stands for ‘Know Your Customer’. Casino KYC is a legal requirement for online casinos to confirm the player’s identity, age, address, and payment method.

- New players must submit a legal photo ID, proof of address, proof of payment, a selfie, and declare the source of funds.

- It’s best to complete KYC casino process early in the registration process with clear, up-to-date documents to avoid delays in withdrawing funds.

What Is KYC in Online Casinos?

KYC in online casinos is a regulated casino verification process designed to ensure safe and compliant gambling. KYC gaming confirms your identity, location, and control over the funds used on your account.

Casinos collect basic personal details at sign-up and verify them using a government-issued photo ID, along with recent proof of address like a utility bill or bank statement. Players are also typically required to confirm ownership of their payment methods and complete a selfie or short video check to match their face to the submitted ID.

Beyond identity checks, KYC casino supports broader risk management and financial crime prevention. Licensed casinos screen players against sanctions lists and Politically Exposed Persons (PEPs), monitor transactions for unusual activity, and may request source-of-funds evidence if spending patterns or risk levels increase.

While the process may take a few minutes, online gambling KYC protects both players and operators, serving as a clear indicator of a reputable casino and is also essential for smooth, delay-free withdrawals.

Why Do Casinos Require KYC Verification

Online casinos require KYC checks to ensure safe and fair play for all users. KYC casinos verify your identity, location, and payment methods as part of the casino verification process, protecting both the player and the operator from fraud, money laundering, and underage gambling. For anyone engaging in online gambling KYC, this is a standard step that ensures compliance with local regulations.

How to Complete KYC in Online Casinos

Completing the KYC casino process is essential for safe and smooth online gambling. Following the casino verification process ensures your identity, payment methods, and account are secure, while helping casinos comply with casino KYC requirements.

- Prepare your documents

Gather a government-issued ID such as a passport, national ID, or driver’s license, and a recent proof of address like a utility bill or bank statement. Having everything ready speeds up verification.

- Log in to your account

Access the casino verification or KYC section in your account. This is usually clearly marked in the account or profile settings.

- Upload your documents

Submit your ID and proof of address through the casino’s secure portal. Make sure the documents are clear, legible, and up-to-date to avoid delays.

- Complete additional checks (if required)

Some casinos ask for a selfie or short video to match your ID. For higher deposits or in certain jurisdictions, you may be required to provide proof of source of funds, such as payslips or bank statements.

- Wait for verification

Verification typically takes from a few minutes up to 24 hours. You’ll receive confirmation via email or directly in your account once it’s approved.

Always use valid documents that match your account information. Upload through the official casino portal and double-check that all details are correct. Following these tips ensures the casino KYC process is smooth and efficient.

Required KYC Gaming Documents for Online Casinos

Many reputable online casinos use a secure upload portal and accept clear photos or PDFs. Below, we have identified five KYC casino documents that operators may request from you. Aim for color images, good lighting, and all four corners visible. Most apps will guide you through the process.

- Proof of identity (POI): Valid, in-date passport, national ID card, or photo driving license. If using an ID card/license, upload both sides. Details must be legible (name, DOB, expiry/Machine-Readable Zone (MRZ)).

- Proof of address (POA): Recent document (usually dated within 90 days) showing your full name, residential address, and date. Standard options include: utility bill, bank/credit card statement, council/local-authority, or government letter. Original PDFs from online banking are ideal.

- Payment method ownership: Evidence that you own the card/account used.

- Cards require a photo showing the last four digits and your name (cover the rest).

- Bank/e-wallet usually needs a screenshot with your name and account/email visible.

- Crypto might require a wallet/app screenshot proving control of the address (some operators also request a transaction hash).

- Selfie/Biometric liveness: Real-time selfie or short video to match your face to the POI and confirm liveness (remove hats/glasses; use good light).

- Source of funds and enhanced due diligence (EDD): Payslips, recent bank statements, tax returns, proof of sale/winnings, or business accounts. Ensure documents show your name, dates, and relevant entries.

Expert Tip: When it comes to casino withdrawal verification, your account name/address must exactly match your documents to avoid delays.

When Should You Complete Online Gambling KYC Requirements

The smoothest path is to complete the casino KYC requirements immediately after sign up, but before you make your first deposit. That way, your first withdrawal won’t be held up for last-minute checks. Triggers vary by regulator and operator, but KYC in online casinos is typically required or re-requested when:

- Account creation / first use: In some markets, identity and age must be verified before depositing or playing.

- First withdrawal: You may experience blocked payouts until the casino withdrawal verification process is complete.

- Thresholds are reached: Large or cumulative deposits/withdrawals can trigger additional checks or Enhanced Due Diligence (EDD).

- Payment method changes: Adding a new card, bank account, e-wallet, or crypto address usually requires ownership proof.

- Risk flags: Mismatched personal details, unusual device/IP locations, VPN use, rapid transaction patterns, or possible sanctions/PEP hits.

- Document expiry or periodic reviews: You may be asked to resubmit when your ID expires or during scheduled AML reviews.

- Safer-gambling interventions: Affordability or source-of-funds evidence can be requested if your activity changes.

💡 Best practice for KYC casino verification: verify early, keep in-date documents ready, and ensure your account name/address matches your ID precisely to avoid unnecessary delays.

Why KYC Casino Verification Is Important

KYC casino verification may seem like extra paperwork, but it is essential for safe and fair online gambling. It protects players, prevents fraud, and ensures that licensed casinos can operate smoothly. Verified accounts also make deposits and withdrawals faster and more reliable, while keeping your money and personal information secure.

Legal compliance & licensing

Licensed operators must meet anti-money-laundering (AML) and counter-terrorist-financing (CTF) obligations. KYC is the core control that regulators expect to see in place.

Age & identity protection

Verifying date of birth and identity prevents underage gambling and impersonation.

Fraud prevention

KYC deters stolen cards, chargebacks, bonus abuse, multiple-accounting, and account takeovers. It also helps casinos link payment methods to real people, reducing financial crime.

Safer gambling

Verified profiles support affordability reviews and targeted interventions where spending or behavior changes indicate risk.

Faster, safer withdrawals

Once your identity and payment ownership are confirmed, payouts move with fewer manual checks and a lower chance of holds or reversals.

Dispute resolution & audit trail

Clear, verified records help resolve payment disputes with banks and payment providers and satisfy regulatory audits.

Market access

Strong KYC enables operators to offer more payment options and operate in more regulated markets, providing players with stable services and more explicit protections.

Pay Attention to No KYC Casinos

No KYC casinos can be tempting for fast registration, privacy, and crypto support. But skipping standard KYC casino verification has trade-offs: licensing and player protections may be weaker, and withdrawals can be limited or require document checks for larger amounts.

Before depositing, always review the casino’s license, payout rules, and withdrawal conditions. This helps you make an informed choice while understanding why casino verification is important at regulated sites.

Conclusion

Know Your Customer (KYC) checks are a standard, regulated safeguard at reputable online casinos. Casino KYC requirements confirm your identity and age, verify your address, and prove you control the payment methods you use. In higher-risk or higher-value scenarios, you may also be asked for source-of-funds evidence.

Modern operators streamline Know Your Customer laws with secure upload portals, biometric ‘liveness’ checks, and automated risk screening, to speed approvals and protect players from fraud and account takeovers. For the fastest results, verify early, use in-date documents, ensure your account details match your ID exactly, and submit clear, complete images or original PDFs.

Online Casino KYC Acronym Glossary

KYC: Know Your Customer, identity, address, and payment checks

AML: Anti-money laundering

CTF: Counter-terrorist financing

EDD: Enhanced due diligence, extra checks for higher risk or large amounts

SoF: Source of funds, where the money used to gamble came from

SoW: Source of wealth, how overall wealth was accumulated

POI: Proof of identity, Passport, national ID, or photo driving license

POA: Proof of address, recent utility bill, bank statement, or government letter

PEP: Politically exposed person; higher risk due to public role

MRZ: Machine-readable zone on passports and many ID cards

GDPR: General Data Protection Regulation, EU and UK data rules

UKGC: United Kingdom Gambling Commission, UK regulator

MGA: Malta Gaming Authority, EU regulator

SSN: Social Security Number, used in US identity checks

VPN: Virtual private network, can trigger location risk flags

FAQs

A government-issued ID and proof of address are typically required. Some casinos may also ask for a selfie or source-of-funds proof.

Pick a provider that is secure, compliant, and fast, ensuring smooth casino verification and data protection.

Often, casino KYC verification takes only minutes if the images are clear. Manual or EDD (Enhanced Due Diligence) reviews can take longer.

Your account may be restricted, and pending withdrawals may be paused. You’ll be asked for better or alternative documents; unresolved cases can be closed.

At licensed casinos, your documents for casino KYC and casino verification are protected under GDPR. Uploads are encrypted, access is restricted, and files are stored only as long as required for verification.

Not usually. The UK verifies before play, and the USA varies by state. The EU and Malta are risk-based, while some offshore rules are lighter.

Yes, but no KYC casinos often have weaker licensing and may request documents for large withdrawals.