The New York Stock Exchange-listed crypto exchange giant Coinbase says it will launch prediction market services.

The US-based firm said last week that it was expanding its operations to move beyond its traditional core: namely, providing platforms for customers to trade cryptoassets.

Max Branzburg, Coinbase’s Vice President of Product, told CNBC last week that the firm’s new prediction market offerings would launch “in the next few months.”

Coinbase: Prediction Market Plans

Branzburg suggested that customers in the United States would be the first to access the markets, with a “gradual international rollout based on jurisdictional approvals” slated to follow.

The executive added that Coinbase also plans to launch tokenized real-world assets (RWAs) services, as well as stock trading, derivatives, and early-stage token sales.

The RWA refers to physical assets such as real estate properties, commodities, and machinery whose ownership is tokenized on blockchain networks. This allows owners to sell tradable fractions of their assets.

Branzburg said Coinbase was “building an exchange for everything.” He explained: “[We will have everything you want to trade, in a one-stop shop, on-chain. […] We’re bringing all assets onchain: stocks, prediction markets, and more. We’re building the foundations for a faster, more accessible, more global economy.”

Blockchain-Powered Betting

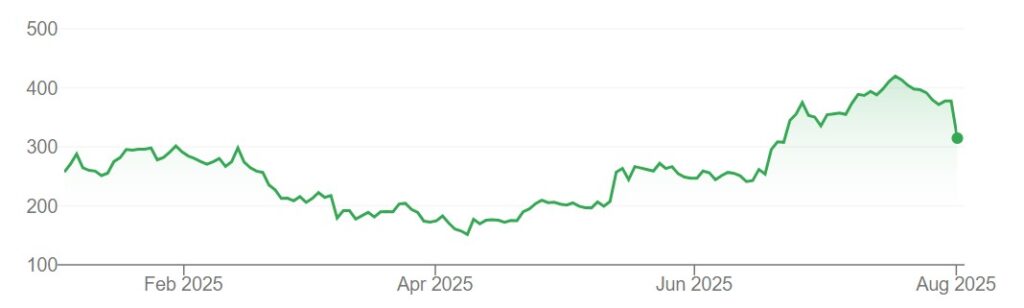

The firm has also recently announced that it added 2,509 Bitcoin (worth some $290 million) to its holdings in the second quarter of the current financial year.

This will put Coinbase in the top 10 list of public companies that hold Bitcoin, overtaking Tesla in the process.

The predictions market move could put Coinbase into direct competition with predictions market heavyweights like Kalshi and Polymarket.

Observers say Kalshi and Polymarket have become competitors to more established gambling operators since the start of the decade.

Crypto- and blockchain-powered prediction markets have experienced enormous popularity in several regions over the past few years.

Operators like Polymarket have garnered news headlines by offering USD Coin (USDC)-denominated shares that represent the likelihood of future outcomes occurring.

USDC is a United States dollar-pegged stablecoin, whose value is largely backed by its issuer’s fiat assets.

Customers have effectively used Polymarket to place bets on the outcomes of general elections, various awards, and sports matches.

However, crypto-powered prediction markets have run afoul of gambling regulatory bodies and government agencies in both the US and elsewhere.

Gaming regulators in France and Switzerland blocked access to Polymarket last year. And agencies in Poland, Singapore, and Belgium have made similar moves this year.

But Coinbase is no stranger to navigating through rough regulatory waters. And with pro-crypto industry reforms likely to roll out in many countries this year, the exchange will likely feel confident of success.

Coinbase Rivals Making Similar Moves

Coinbase’s move to expand beyond traditional offerings will come as no surprise to many crypto observers.

Fellow US-based crypto giants Gemini and Kraken have made similar announcements in recent weeks.

Early last month, Kraken announced its partnership with Backed Finance to launch tokenized equities on the BNB blockchain protocol.

The move will allow customers to trade blue-chip stocks both within and outside market opening hours.