Virtual Gaming Worlds (VGW) founder Laurance Escalante is set to take complete control of the company after shareholders voted overwhelmingly in favor of his offer to buy the 30% of shares he doesn’t already own, which would value the company at A$3.2 billion ($2.1 billion).

The decision will allow Escalante to take the company private, a strategy he’s argued would help navigate VGW through various risks, including regulatory headwinds in the US.

At the shareholder meeting on August 1, 85.04% of attending shareholders (91.31% of all minority shareholders) voted in favor of the founder’s offer of A$5.05 per share.

The transaction now awaits court approval, which is expected on August 5. If granted, the scheme will become effective August 6, with an implementation date of August 20.

If all goes to plan, Escalante will complete the acquisition via Ocean BidCo Limited, a special purpose vehicle incorporated in Guernsey. Minority shareholders have the option to receive cash, shares in Ocean BidCo, or a combination of both.

The End of a Turbulent Relationship

Escalante’s full takeover would mark the end of a long and strained relationship with minority investors.

Tensions have escalated in recent months, including a profanity-laced tirade at investors, where Escalante told them to sell their shares if they did not trust his leadership.

The outburst followed mounting shareholders concerns over undervaluation, governance transparency, and VGW’s response to US regulatory pressures.

Recently, shareholders also raised questions about the founder’s involvement in social gaming platform Kickr Games. They claim Kikr directly competes with VGW’s brands, causing a conflict of interest.

Despite these tensions, Escalante’s offer of A$5.05 per share falls within estimates of independent advisory solutions provider Kroll Australia. Kroll valued the company in the range of A$4.53 – 5.63 per share.

The offer is also much higher than Escalante’s initial bid in November 2024. An Independent Board Committee hired by VGW’s board, rejected the A$3.50 – $4 per share offer.

Escalante Claims Going Private Will Help Growth

Escalante argues that by going private, VGW could operate with greater flexibility and fewer distractions from shareholder obligations.

Through Ocean BidCo’s registration in Guernsey, a tax haven, VGW will no longer need to file Australian financial reports. The tax advantages and more favorable regulatory environment could help VGW in achieving cost efficiency.

Still, Escalante has confirmed he will maintain an Australian tax-paying entity and remain domiciled in the country.

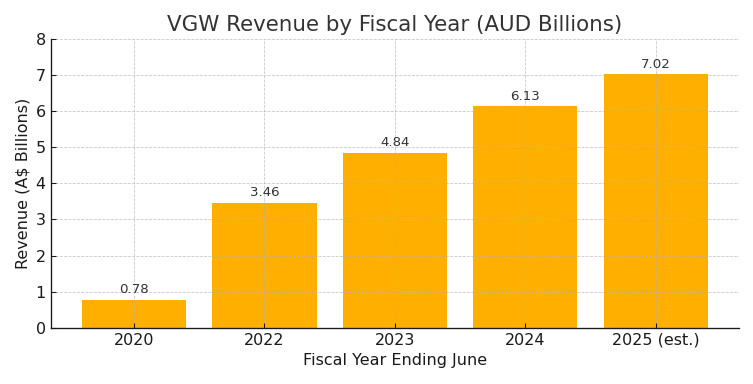

VGW has posted strong results in recent years. In FY2024 (ending June 2024), it reported A$6.1 billion in revenue, up 27% YoY. The net profit was A$491.6 million, a 33% YoY. In the previous fiscal year, VGW reported a 40% increase from 2022.

Meanwhile, the company forecasts profits in FY2025 of A$555–570 million, an increase from last year, despite anticipated declines due to exits from multiple US states.

Note that the 2025 estimate is based on an assumption that VGW would mirror H1 results in H2.

Could Being Private Help With Mounting US Troubles?

While growing substantially in recent years, VGW is under fire across the US, one of its primary markets.

The dual-currency sweepstakes model is facing mounting legislative and regulatory pressures. Recently, the company announced exits in Mississippi and New Jersey, growing the list of ineligible states to 11.

Out of those, seven have been in the past year. VGW left Connecticut in the fall of 2024 and Delaware in the spring of 2025. Legislative changes in New York and Nevada, and a regulatory crackdown in Louisiana, have forced the company to withdraw from those staes in the past few months.

VGW’s brands Chumba Casino, LuckyLand Slots, and Global Poker also do not operate in Idaho, Michigan, Montana, or Washington state. Meanwhile, regulatory crackdowns could also threaten the company in Maryland and West Virginia. Furthermore, legal actions are in effect against VGW in Alabama.

While being private might allow VGW to respond to these threats without needing to disclose sensitive information to shareholders, the company faces a tough road ahead in the US. VGW’s heavy dependence on the market will likely remain its most significant risk.