Flutter Entertainment (NYSE: FLUT) released its Q2 earnings after the close of markets yesterday. Here are the key takeaways from the earnings report and management discussion during the earnings call.

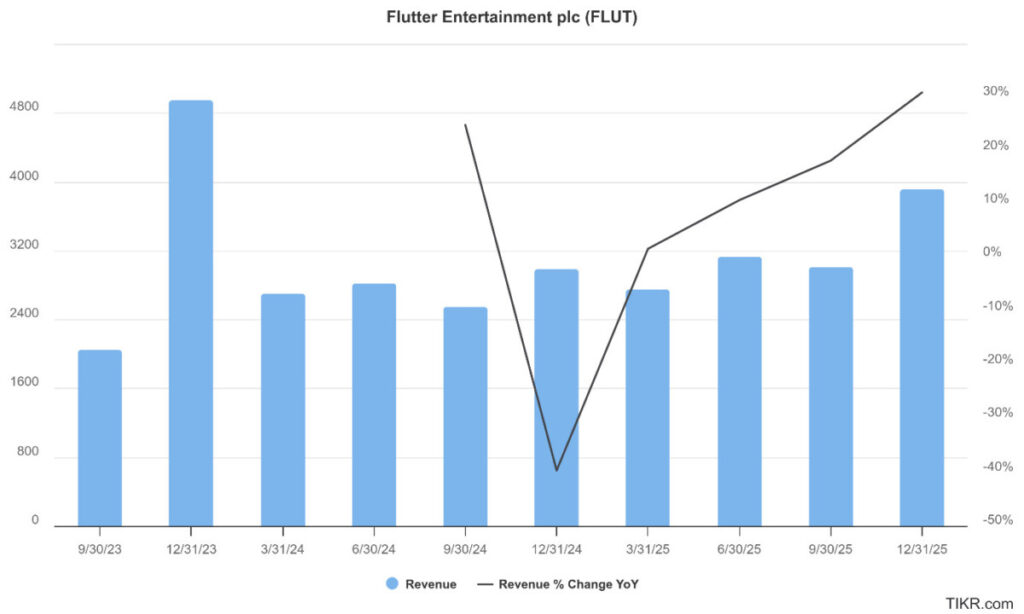

Flutter reported revenues of $4.19 billion in the June quarter, up 16% year-over-year and slightly ahead of the $4.13 billion that analysts were expecting. The company’s adjusted EBITDA rose 25% over the period to $919 million.

Flutter Entertainment Posted Better-Than-Expected Q2 Earnings

However, its GAAP EPS plummeted 59% to $0.59 due to a non-cash charge related to Fox option valuation. Flutter has until December 3, 2030, to exercise that option that arose from its acquisition of The Stars Group in 2020. Flutter’s adjusted EPS, meanwhile, rose 45% year-over-year to $2.95 and came in ahead of consensus estimates.

Despite higher operating cash flows in the quarter, Flutter’s free cash flow fell by 11% led by higher groupwide technology investment and capital expenditure from the Snai acquisition. The company repurchased shares worth $300 million in Q2 and expects to return $1 billion to shareholders through buybacks in 2025.

Flutter also raised its annual guidance and expects its revenues and adjusted EBITDA to rise by 23% and 40% respectively, at the midpoint. Previously, it had guided for revenues to rise by 22% while projecting a 35% year-over-year rise in adjusted EBITDA. Notably, the company raised its guidance, despite $40 million negative impact from tax changes in Illinois, Louisiana, and New Jersey. The company attributed the higher guidance to market access savings post the deal with Boyd, positive impact from US sports results, and the delayed launch in Missouri.

Flutter Entertainment’s Q2 Earnings Breakdown

Here is a breakdown of Flutter’s Q2 earnings and some of the key takeaways from the earnings call.

- Flutter’s US revenues rose 17% in Q2, with sportsbook revenues rising 11% and iGaming revenues rising by 42%. The segment’s adjusted EBITDA came in at $400 million, $100 million higher than consensus estimates on strong operating leverage and favorable sports results.

- The company’s international revenues rose 15% led by strong iGaming growth in key markets, and incremental revenues from the NSX and Snai acquisitions.

- Average monthly players rose 11% year-over-year to 15.97 million.

- FanDuel had its highest gross revenue margin of 16.3% in June

- Flutter also provided color on its agreement with Boyd Gaming to acquire the latter’s 5% stake in FanDuel for a cash consideration of $1.75 billion. Flutter financed that acquisition with debt, which would lead to a short-term increase in its leverage metrics, but the company expects leverage metrics to eventually fall towards its medium-term leverage ratio target of 2 to 2.5x. Moreover, Flutter expects annual cost savings of $65 million from the renegotiated market access agreement with Boyd.

- Notably, DraftKings (NYSE: DKNG), one of Flutter’s peers, said during its Q2 earnings call that the company is actively considering expansion into prediction markets. Responding to an analyst’s question over Flutter’s stance on prediction markets, which is fast gaining traction in the US, CEO Jeremy Jackson said that it is a “fast-moving space,” while adding that the company is “evaluating the various regulatory developments and assessing the potential opportunities this may present for FanDuel.” He stressed that Flutter’s two-decade experience in running Betfair Exchange would be helpful as and when it decides to consider an entry into prediction markets.

So far, leading brokerages haven’t reacted to Flutter’s Q2 report, but the Street sentiment has been quite positive over the last month after the company announced the FanDuel transaction at attractive terms. After that announcement, several brokerages, including Bank of America, Stifel, Truist, Barclays, Oppenheimer, and Needham, had raised Flutter’s target price.

Flutter stock was added to the CRSP index and several Russell indices in Q2, which also helped support the stock’s price action. FLUT is up 18.4% for the year based on yesterday’s closing prices, and is outperforming the broad-based S&P 500 Index.