Gaming stocks had a lackluster week, and the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ) closed in the red, underperforming the broader S&P 500 Index. Tepid earnings reports primarily led to underperformance among some gaming companies.

Skillz and Playtech Plc were among the major gainers last week. Meanwhile, Light and Wonder and Accel Entertainment saw double-digit declines.

Top Gaming Stock Gainers

Skillz (NYSE: SKLZ): +13.6%

Skillz is among the most volatile gaming stocks and often finds its way into the week’s biggest gainers or losers. After losing 21.4% in the week ending August 1, which made it the worst performer among our coverage of gaming companies, the stock gained 13.6% last week.

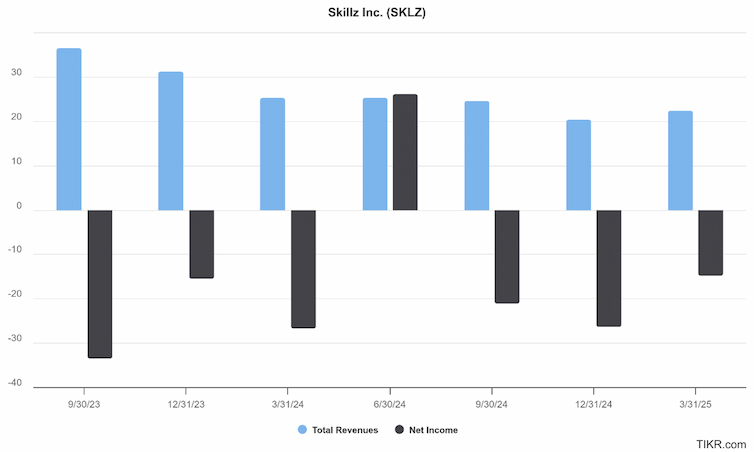

Skillz’s rise was primarily due to its above-expected Q2 earnings release, which sent the stock up by 14.6% on Friday.

Revenue rose 8.2% year-over-year to $27.37 million, beating the analysts’ consensus estimates. SKLZ posted an adjusted EBITDA loss of $10.4 million and a net loss of $8.9 million.

The company’s paying active users grew 20% to 146,000. That marks a welcome break as the user numbers have been falling over the previous few quarters.

Skillz sees a silver lining in its financial performance this year and said that the Q2 earnings “build on the first quarter’s progress towards our goal of delivering consistent top-line growth and positive adjusted EBITDA.”

Still, given the stock’s volatile nature and its small market cap of around $120 million, making it a micro-cap company, investors should exercise caution.

Playtech (LON: PTEC): +7.4%

With a gain of 7.4%, Playtech extended the momentum from the previous week’s rally, which followed the release of its interim results and trading update.

Playtech expects adjusted EBITDA for the first half of the year to be at least €90 million. Although it would be significantly below the £243.0 million (€279 million) posted in the corresponding period last year, it still exceeds analysts’ expectations.

The company received encouraging commentary in the trading update. Highlights included strong performance in its B2B (business-to-business) segment and a better-than-expected contribution from its associate firms.

The results reinforced the narrative of resilience among European gaming technology providers, even in the face of slower consumer spending in certain regions.

Electronic Arts (NYSE: EA): +6.7%

Electronic Arts continued its strong performance from the preceding week, amid optimism over the upcoming “Battlefield 6” game. Arete Research upgraded EA stock from a neutral to buy and assigned a $192 target price amid optimism over the forthcoming title.

The company had also posted better-than-expected earnings for the June quarter, which were released on July 29.

Genius Sports (NYSE: GENI): +6.1%

Genius Sports built on the prior week’s 9.7% gain following the announcement of a strategic partnership with PMG, which represents brands like Nike and TurboTax. It also secured exclusive betting data rights for select competitions in European football leagues.

Last week’s rise was primarily driven by positive sentiment following Genius’s release of its Q2 earnings.

While the company missed earnings estimates and posted a wider-than-expected loss, revenue rose 24% year-over-year to $118.7 million, which exceeded Wall Street estimates. Moreover, its adjusted EBITDA grew 64% to a record high of $34.2 million.

Genius Sports also raised its 2025 guidance, expecting revenues and adjusted EBITDA to rise by 26% and 57%, respectively, this year. During the Q1 earnings call, the company forecasted group revenues to increase by 21% and EBITDA by 46%.

After Genius Sports’ Q2 earnings, several brokerages, including Macquarie, B. Riley, Benchmark, and Goldman Sachs, raised their target prices. Guggenheim has raised its price target to a Street-high of $16.

Top Gaming Stock Losers

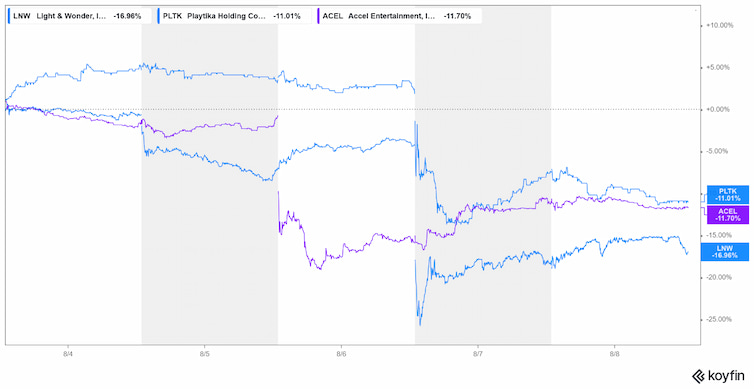

Light & Wonder (NYSE: LNW): -16.7%

Light & Wonder was the biggest loser in our coverage of gaming stocks and fell 16.7% last week, turning negative for the year. The company reported mixed earnings for the second quarter, as it beat bottom-line expectations but fell short of revenue estimates.

LNW’s Monthly Active Users fell 4% to 5.2 million, which dampened sentiments. Furthermore, Player Conversion Rate (percentage of paying users) declined to 9.8%, down from 10.5% in Q2 2024.

LNW also confirmed that it would delist from Nasdaq and consolidate its public listing on the Australian Securities Exchange (ASX). The process is expected to be completed by the end of November.

After the earnings report, JPMorgan downgraded LNW stock by one notch to neutral while slashing the target price from $108 to $95 as the brokerage is wary of Light & Wonder’s ability to grow its earnings organically.

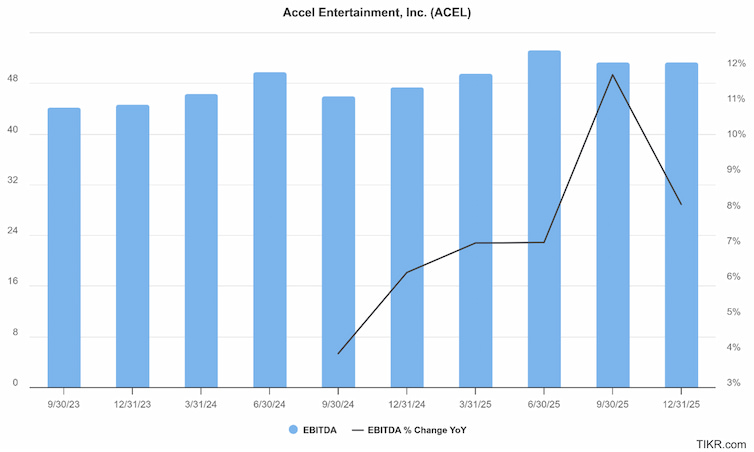

Accel Entertainment (NYSE: ACEL): -11.7%

Accel shares sank after Q2 results on August 7, falling 15% on Wednesday and 11.7% for the week.

Revenue and adjusted EBITDA rose 8.6% and 7.1% year-over-year to fresh records. However, net income plummeted by over 50% to just $7.3 million. The company stated that the steep decline in profits was partially due to losses resulting from the change in the fair value of the contingent earn-out shares.

Markets, however, did not take too kindly to the profit drop, and after last week’s crash, ACEL is now up just about 3% for the year. It is nearing bear market territory after falling almost 17% from its recent highs.

Playtika Holdings (NYSE: PLTK): -11%

Playtika Holdings lost just over 11% last week as its Q2 earnings failed to impress, with both revenues and net profit falling short of consensus estimates.

The company also lowered its 2025 revenue guidance by $10 million. It now expects the metric to come in between $2.70 billion and $2.75 billion. Still, it reaffirmed the adjusted EBITDA guidance of between $715 million and $740 million.

Other Notable Gaming Earnings

Apart from the companies mentioned above, several other gaming companies also released their quarterly earnings last week. Here’s a brief snapshot:

- Penn Entertainment reported a strong set of numbers for the second quarter, with both revenues and profits surpassing estimates. The company’s interactive segment achieved record quarterly gaming revenue. Management expressed optimism that the segment will achieve profitability in the final quarter of this year, a trend it expects to sustain in 2026 and beyond.

- DraftKings posted better-than-expected numbers in Q2. During the earnings call, the company said that it is actively considering expansion into prediction markets. In a related development, the Commodity Futures Trading Commission (CFTC) has cleared the way for Railbird and QCEX to offer prediction markets by not enforcing specific swap reporting and recordkeeping rules. That could pave the way for other companies to join the fast-growing market.

- Flutter reported revenues of $4.19 billion in the June quarter, up 16% year-over-year. The results were slightly ahead of the $4.13 billion that analysts were expecting. The company’s adjusted EBITDA rose 25% over the period to $919 million. Flutter talked about evaluating “potential opportunities” in the prediction markets.