The S&P 500 Index and Dow Jones Index rose to a record high on Friday after Fed Chairman Jerome Powell’s dovish comments at the annual Jackson Hole Symposium lifted sentiments.

The Roundhill Sports Betting & iGaming ETF (NYSE: BETZ) continued its year-to-date outperformance versus the S&P 500 Index and gained 2.4% last week, well ahead of the latter’s 0.27% rise. Douyu International and Codero were among the major gainers last week. Meanwhile, Star Entertainment and Robinhood underperformed.

Top Gaming Stock Gainers

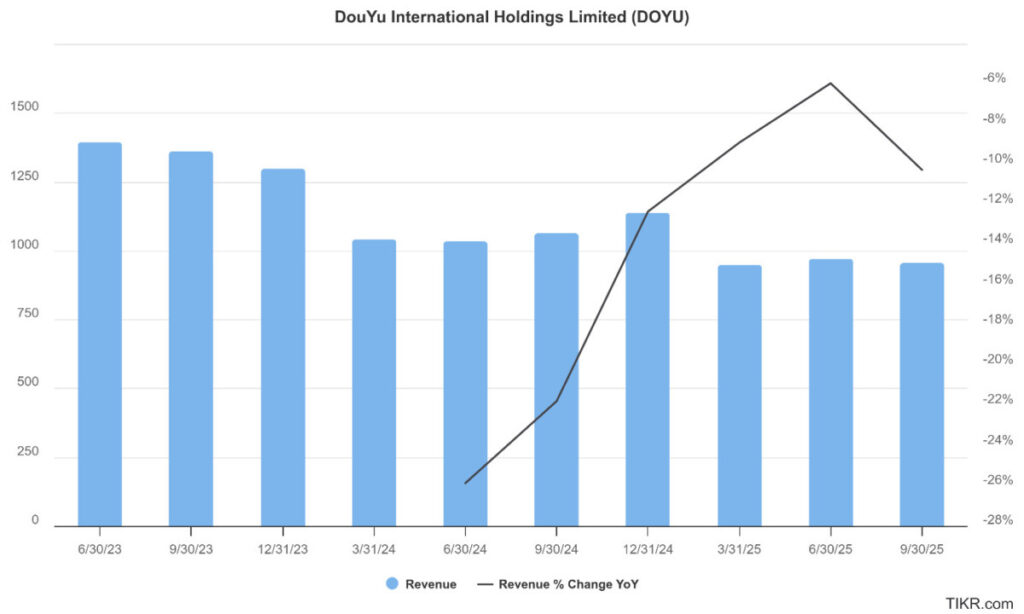

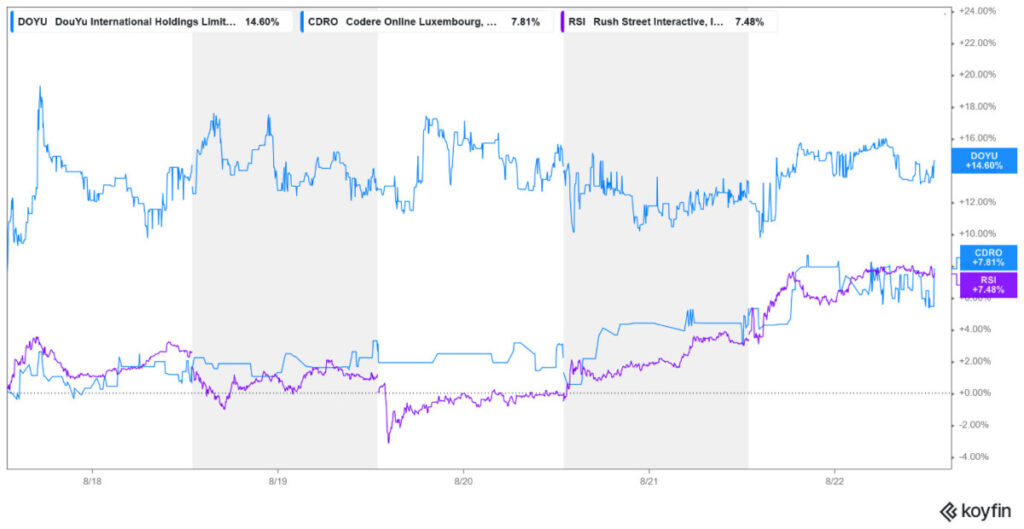

Douyu International Holdings (NYSE: DOYU): +14.6%

Douyu International Holdings was the largest gainer in our coverage of gaming stocks, with the stock adding 14.6% last week.

Despite recent gains, the stock is down over 26% for the year and approximately 53% lower than its 52-week high due to concerns over the company’s financial health.

Meanwhile, last week’s rally was driven by positive market reaction to its Q2 2025 earnings. The company’s net revenues rose 2.1% year-over-year to $147.1 million, which was ahead of estimates. Importantly, it generated a net profit of $5.3 million in the quarter, which is a marked improvement from the $6.9 million loss in the corresponding quarter last year.

The analyst community is not sold on the stock’s outlook, though, and its mean target price of $7 is 15.5% lower than last week’s closing price.

Codere Online (NYSE: CDRO): +7.8%

With gains of 7.8%, Codere Online was the second-largest gainer last week. There wasn’t any major news related to the company, which is a major online gaming operator in Latin America and Spain. However, on July 31, it released its Q2 2025 earnings, which were ahead of Street estimates. The management also maintained its annual revenue guidance of €220-230 million and adjusted EBITDA forecast of €10-15 million despite the headwinds, including adverse currency movements.

Rush Street Interactive (NYSE: RSI): +7.5%

Rush Street was among the other major gainers last week and rose 7.5% to extend its year-to-date gains to an impressive 53%. Last week’s rise occurred amid the broader market rally, and the stock gained over 4% on Friday due to hopes of a rate cut.

Previously, on July 31, the company posted better-than-expected Q2 numbers and also raised its annual guidance. The new guidance projects revenue of $1.05 billion to $1.10 billion and adjusted EBITDA of $133 million to $147 million. The previous guidance called for revenues to be between $1.01 billion and $1.08 billion, and adjusted EBITDA between $115 million and $135 million.

After RSI’s Q2 earnings, several analysts raised their target price. However, amid the recent rally, the stock has outpaced its mean target price of $17.89.

Top Gaming Stock Losers

Star Entertainment (ASX: SGR): -4.5%

Star Entertainment Group was the worst-performing stock in our coverage of gaming stocks, shedding 4.5% last week. The stock has been quite volatile in recent weeks, gaining 19.5% in the preceding week. However, in the week before, it lost 20%.

The recent volatility has been driven by the company’s plan to sell its 50% stake in its Queen’s Wharf Brisbane casino to Hong Kong-based partners Chow Tai Fook Enterprises and Far East Consortium.

While the talks previously collapsed, they have since revived. The deal, if it were to go through, would be nothing short of a lifeline for Star Entertainment, helping the debt-laden company improve its financial position.

Last week’s fall appears likely due to uncertainty over the deal’s future.

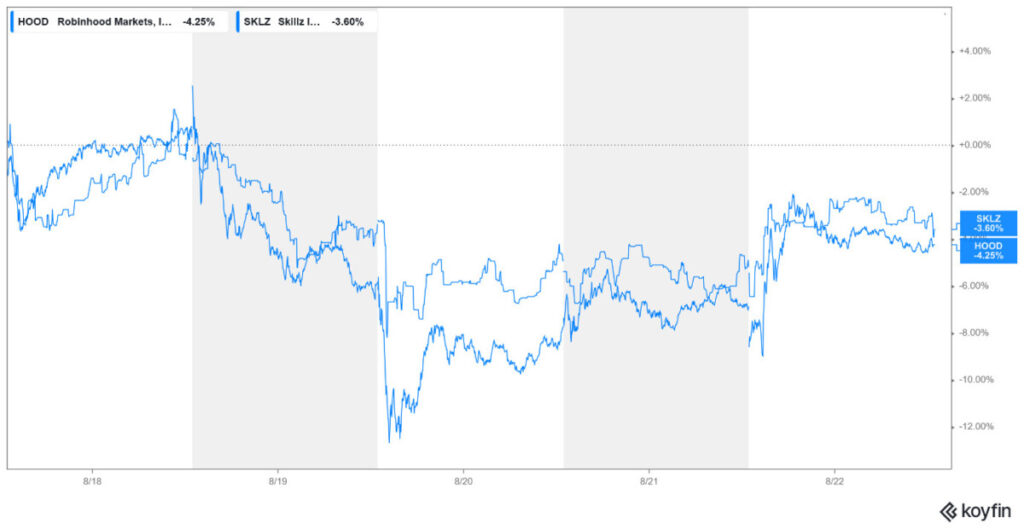

Robinhood (NYSE: HOOD): -4.2%

Robinhood stock fell 4.2% last week as the rally in fintech stocks lost steam. Last week, Robinhood expanded into pro and college football prediction markets.

JB Mackenzie, VP & GM of Futures and International at Robinhood, stated: “Football is far and away the most popular sport in America.”

“Adding pro and college football to our prediction markets hub is a no-brainer for us, as we aim to make Robinhood a one-stop shop for all your investing and trading needs.”

A day after that announcement, FanDuel, which is the online gambling division of Flutter Entertainment, announced a partnership with CME Group under which it would allow bets on stocks and commodities.

The move, however, has attracted regulatory scrutiny, with the Nevada Gaming Commission questioning it.

Skillz (NYSE: SKLZ): -3.6%

Skillz was among the other major losers, falling 3.6% last week. Last week’s decline was preceded by 17% and 13.6% gains in the previous two weeks, respectively, and the fall looks more like a profit-taking exercise as there wasn’t any major company-specific news last week.

SKLZ stock, which is a lot more volatile than its peers and often finds its way into the week’s biggest gainers or losers, is now up almost 71% for the year.

Skillz was part of the 2021 meme stock mania and has participated in the recent meme stock frenzy.

While Skillz faces significant headwinds, its Q2 earnings, released on August 7, showed some improvement in financial performance. The company’s active paying users grew 20% to 146,000. That marks a welcome break as the user numbers have been falling over the previous few quarters. It, however, still posted a net loss of $8.9 million in the quarter.

Other Major Gaming Industry Developments

In another major industry development, DraftKings notified customers that it will no longer accept credit cards for sportsbook or online casino deposits, effective August 25.

Elsewhere, lawmakers in India cleared the “Promotion and Regulation of Online Gaming Bill, 2025,” which aims to impose a blanket ban on all “real money games,” regardless of whether they are based on skill or chance.

While some states in India have banned online gaming, including fantasy sports, there was no official federal law governing this matter until now. The Bill has evoked mixed reactions, and while some have hailed the move, saying it would help curb gaming addiction among the youth, others have criticized the provisions, expressing fear over job losses, revenue loss for the government, and likely expansion of the illegal market.