The S&P 500 Index ended its three-week winning streak and closed in the red last week despite the gains on Friday following the release of inflation data. Meanwhile, the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, closed in the green, outperforming the market after a three-week gap.

Super Group and Electronic Arts were among the major gainers last week. Meanwhile, Star Entertainment Group and Golden Entertainment underperformed.

Largest Gaming Stock Gainers

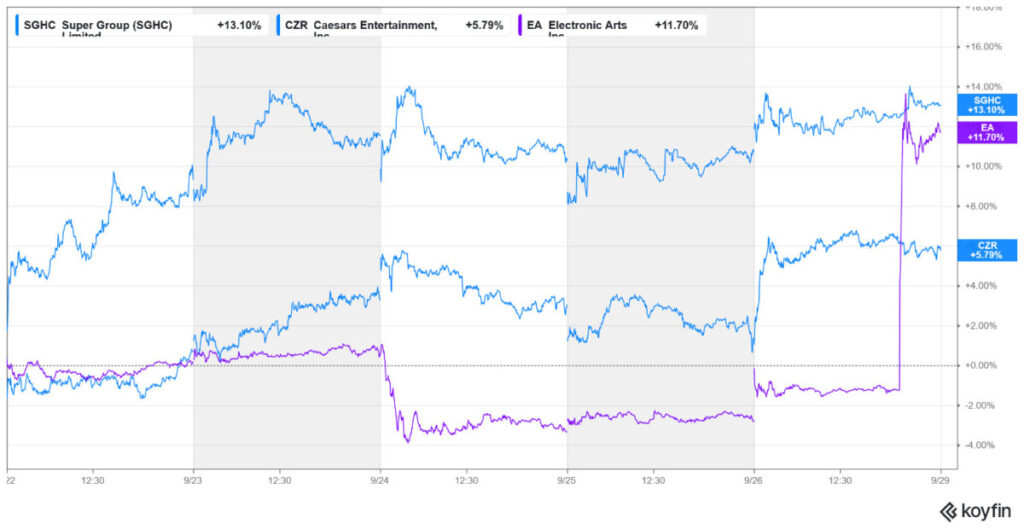

Super Group (NYSE: SGHC) +13.1%

With gains of 13.1%, Super Group was the best-performing stock among our coverage of gaming stocks. The stock has more than doubled this year as markets have given a thumbs-up to the company’s strategic actions and financial performance.

Notably, Super Group, the parent company of Betway sportsbook, which announced an exit from the US market last year, has thrived in Europe. The company reported record revenues and adjusted EBITDA in Q2 2025, led by a 28% rise in its ex-US Online Casino revenue.

Earlier this month, it raised its 2025 guidance and now expects to post revenues between $2.125 billion to $2.200 billion. It also raised the adjusted EBITDA guidance to between $550 million to $560 million versus the previous projection of $470 million to $480 million, citing better-than-expected performance so far in the third quarter.

Several analysts have raised SGHC’s target price this month, and last week, JMP Securities raised its estimate from $15 to $16. Although there was no specific announcement last week, SGHC continued its uptrend amid optimism over its outlook and the eventual exit from the loss-making US market, which the company expects to complete in early Q4.

Electronic Arts (NYSE: EA) +11.7%

Electronic Arts was among the other major gainers last week, rising 11.7%. While the stock was in the red for the week until Thursday, it jumped nearly 15% on Friday on reports that it is in advanced talks to go private at a $50 billion valuation. Saudi Arabia’s Public Investment Fund, private equity firm Silver Lake, and Jared Kushner’s Affinity Partners are reportedly considering a bid for the gaming giant.

Notably, EA’s rival, Activision Blizzard, was previously acquired by Microsoft, despite the deal initially facing regulatory hurdles.

Caesars Entertainment (NYSE: CZR) +5.8%

Caesars Entertainment was among the other major gainers last week. The stock has been quite volatile in recent days, as it was removed from the S&P 500 Index to make way for Robinhood, but was subsequently added to the S&P 1000 and the Russell Small Cap Comp Value Index.

The stock has looked weak this year, and despite last week’s gains, which were largely driven by the broader market rally on Friday, it remains down over 19% for the year.

Largest Gaming Stock Losers

Star Entertainment (ASX: SGR): -8%

Star Entertainment was the biggest loser in our coverage last week, shedding 8% of its market capitalization. It was the second consecutive week that the stock made it to the list of biggest losers, as it continues its dismal 2025 run, during which it has lost over 51%. The stock was removed from the S&P/ASX 300 Index effective last Monday, which only intensified the sell-off.

The stock has been quite volatile over the last month, amid back-and-forth on its plan to sell its 50% stake in the Queen’s Wharf Brisbane casino to Hong Kong-based partners Chow Tai Fook Enterprises and Far East Consortium. While the talks initially collapsed, the companies reached a binding agreement last month, which would help bring much-needed cash to the company, which has a stretched balance sheet and is discussing waivers on loan covenants with its lenders.

Meanwhile, the stock fell last week despite some positive regulatory developments. In a regulatory filing on September 25, Star Entertainment said that Queensland Attorney General and Minister for Justice and Integrity have confirmed that the Crisafulli Government deferred the suspension of The Star Gold Coast’s casino license until 30 September 2026, as authorities pointed to the “steady progress” that the company made on remedial measures.

For the last four years, Star has faced regulatory headwinds as authorities launched probes against the company over possible breaches of laws related to anti-money laundering and counter-terrorism financing.

Golden Entertainment (NYSE: GDEN): -5.6%

Golden Entertainment fell 5.6% last week. It went ex-dividend on September 25, and it is typical for a stock to drop by an amount roughly equal to the dividend on its ex-dividend date, as new buyers are no longer entitled to the upcoming payment.

The stock has lost over 26% this year as its financial performance has disappointed markets. While Golden Entertainment boasts a healthy dividend yield of 4%, it is struggling with growth, and its revenues have been in a downward trend. In Q2 2025, although it reported better-than-expected earnings, its revenues fell short of estimates.

Century Casinos (NYSE: CNTY): -4.8%

Century Casinos‘ stock continued to whipsaw and fell 4.8% last week. The stock, which was among the major gainers in the preceding week, was the biggest loser in the week before.

CNTY has been quite volatile this year, and while it has risen from the 52-week low of $1.30 it hit amid the April sell-off, it is still down over 20% for the year. CNTY is a loss-making microcap company with a market capitalization below $100 million, characterized by low trading volume and a beta of over 2x, which makes it susceptible to significant price swings and is therefore a high-risk investment.

Other Major Gaming Industry Developments

In other gaming industry developments, PrizePicks has gained approval from the Commodity Futures Trading Commission (CFTC), which could enable the company to enter prediction markets. Previously, UK-based lottery operator Allwyn acquired a controlling stake in PrizePicks.

Separately, Boyd Gaming disclosed a cybersecurity breach. However, the company does not expect the breach to have a material impact on its financial health, given its “comprehensive cybersecurity insurance policy,” which would help cover most of the financial impact.