A leading politician has hit out at the South Korean National Pension Service (NPS)’s investment in so-called “sin stocks,” with a portfolio that includes gambling-related shares.

The South Korean media outlet Health Chosun reported that the NPS has increased its holdings in stocks related to alcohol, tobacco, and gambling and casinos “by 16% over the past three years.”

The total NPS “sin stocks” portfolio has surpassed the 6 trillion won ($4.28 billion) mark this year, stoking the ire of some observers.

The pension fund is the world’s third-largest pension fund globally, behind only Japan’s Government Pension Investment Fund and Norway’s Government Pension Fund in terms of size.

Its assets are worth more than $900 billion, and it is the nation’s largest single investor.

The offices of the Democratic Party lawmaker Nam In-soon, a member of the National Assembly’s Health and Welfare Committee, released NPS-compiled data on September 26 showing that the fund’s investment in companies related to alcohol, tobacco, and gambling totaled 6.4134 trillion won ($4.4 billion) in February this year.

Three years ago, that figure stood at 5.5282 trillion won ($3.9 billion).

National Pension Service: Gambling Stock Controversy

The data shows that 20% (1.2963 trillion won, or $920 million) of the “sin stocks portfolio” is comprised of domestic shares, the newspaper Maeil Kyungjae reported.

These include the likes of Kangwon Land. The NPS has bought around $150 million worth of stock in the firm, which operates the High1 casino and resort in Gangwon Province.

High1 is the only casino in South Korea that is allowed to admit domestic patrons.

The fund has also bought 46.2 billion won ($32,784,560) worth of stock in GKL (Grand Korea Leisure). GKL operates the Seven Luck brand, which runs casinos catering to foreign passport holders in Seoul’s Yongsan and Gangnam districts, as well as in Busan.

More Responsible Investment Needed, Says MP

The NPS has also invested hundreds of millions of dollars in KT&G Corporation, the country’s leading tobacco company. KT&G regularly reports annual sales exceeding $4 billion.

Additionally, the pension fund has backed companies such as Hite Jinro, one of the country’s largest alcohol producers.

Its overseas stock portfolio includes shares in the tobacco giants Philip Morris International, the Altria Group, and British American Tobacco.

The NPS also owns shares in the UK-based alcoholic beverages firm Diageo and the Dutch beer-making giant Heineken.

Nam complained: “Citizens spend trillions of won in national health insurance premiums and hospital bills every year because of diseases caused by alcohol, gambling, and tobacco. The NPS must reduce its regressive investment ratio […] in sin stocks.”

She called for more “responsible investment” and said the fund needed to adopt a “socially responsible” model.

The NPS has faced criticism for its investment policies in the past. In 2023, the fund purchased approximately $20 million worth of shares in the US-based cryptocurrency exchange Coinbase.

The timing of the purchase was unfortunate, as Seoul continued to impose restrictions on domestic crypto exchange platforms.

At the time, the fund responded to criticism by stating that third-party portfolio managers had decided to buy COIN stock on its behalf.

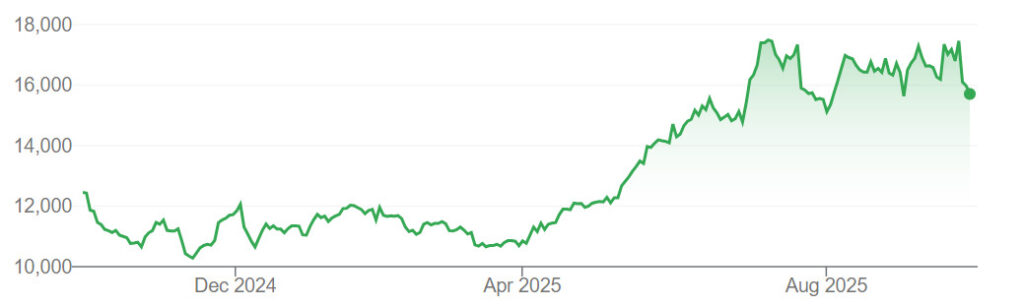

South Korean casino-related stocks are currently booming on the Korea Exchange as footfall and revenues rise.

Casinos across the country are braced for higher visitor numbers after the government announced a temporary waiver for Chinese tourist visa fees.

Shares in a range of East Asian casino firms continue to rise, with Macao also continuing to post positive growth figures this month.