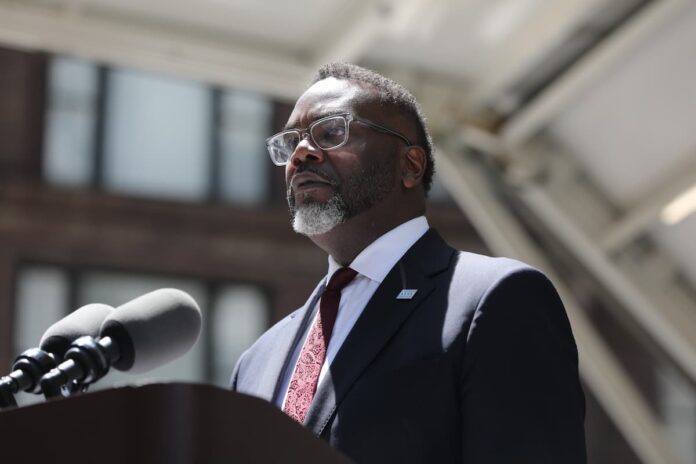

Chicago Mayor Brandon Johnson‘s newly released 2026 budget plan includes a 10.25% city tax on adjusted gross sports-betting revenue within the city. The proposal, introduced amid a projected budget shortfall of $1.15 billion, would bring the effective tax rate for top operators like FanDuel and DraftKings to over 50% once the state levy is factored in.

Local Sports-Betting Tax Proposal

The proposed tax, outlined in the city’s 2026 Budget Overview, would apply to all wagers placed within city limits—online and at retail sportsbooks. Johnson’s proposed measure could generate approximately $26 million, a slight drop in the $16.6 billion budget.

The tax comes as no surprise, as the city council had already discussed it as an option months ago. Still, it’s significantly higher than the September proposal by the city’s Financial Future Task Force. That option floated a different mechanism – a flat 25- or 50-cent surcharge per bet.

The task force estimated this mechanism would have raised between $8.5 million (for a 25-cent surcharge) and $17 million (for a 50-cent surcharge). The numbers are based on the assumption that 20% of online sports betting wagers are placed within Chicago.

The mayor’s office opted instead for a percentage-based approach that scales with operator revenue.

Illinois Could Become More Expensive for Operators

If approved, Chicago’s tax would be in addition to the Illinois state rate of 20–40% on gross gaming revenue.

Additionally, when combined with the state’s new per-wager excise tax—25 cents for the first 20 million bets and 50 cents thereafter—the total effective burden on some operators could exceed 50%. That would take Illinois to the top as the most expensive US market for operators. Currently, New York, New Hampshire, and Rhode Island impose a 51% tax.

All sportsbooks in Illinois have already passed surcharges or minimum bets in response to the state tax. FanDuel led the charge with a 50-cent surcharge, with DraftKings following suit a few days later.

Fanatics, Caesars, and bet365 have all levied a 25-cent surcharge. Meanwhile, ESPN Bet, BetRivers, Hard Rock Bet, BetMGM, and Circa have imposed a minimum bet requirement. That ranges from $1 to $10. If Chicago passes the 10.25% tax, operators will likely respond once again.

Industry groups argue that such a high combined rate could depress betting volume or prompt customers to shift to unregulated offshore sites. Still, Johnson’s administration defended the measure as part of a “fair-share” approach to closing the city’s deficit without raising property taxes.

The proposals now move to the Chicago City Council, which will need to approve the 2026 budget later this year. If enacted, the sports-betting tax would take effect January 1, just six months after the state’s higher rates began.

Video-Gaming Terminals Also in Contention

While the mayor is eyeing sports betting as a new revenue source, some city council members are exploring other forms of gambling.

In September, a proposal from Alderman Anthony Beale to lift Chicago’s ban on video-gaming terminals (VGTs) advanced through the License Committee on an 8-6 vote. Beale claims legal VGTs in bars and restaurants could generate $60 million to $100 million annually for the city.

Mayor Johnson, however, opposes the plan. His office cites a city analysis showing VGTs would bring $10 million annually at best. His biggest concern with the plan is that it could even cost the city money. That’s because it could cannibalize revenue from the upcoming Bally’s Casino slot machines. Illinois taxes casino slots nearly four times higher than VGTs.

Bally’s itself cautioned that a VGT rollout could cost Chicago $74 million a year in lost tax receipts. It could also result in over 1,000 fewer casino jobs. The Johnson administration argues that Chicago currently lacks a regulatory framework to monitor thousands of new gaming machines. It also claims that the costs of enforcement could offset any new income.

The mayor’s stance positions Chicago at a crossroads — deciding whether new gambling revenue is worth the potential cost to its casino ambitions.