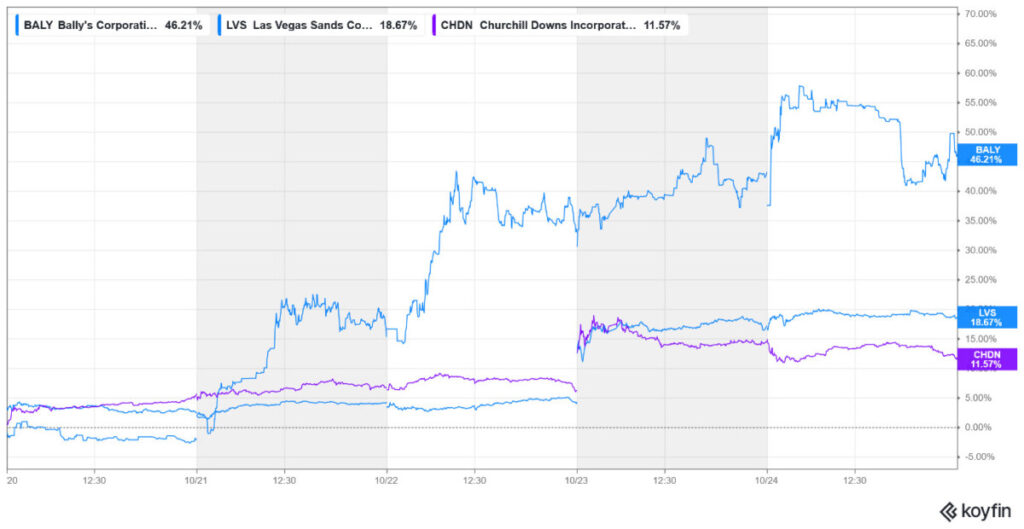

Gaming stocks had a mixed week, and the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, closed in the red even as the broader markets rose to record highs after a tepid inflation report raised hopes of a Fed rate cut.

Bally’s Corporation and Las Vegas Sands were among the major gainers last week. Meanwhile, Playtech and Evolution underperformed.

Largest Gaming Stock Gainers

Bally’s Corporation (NYSE: BALY) +46.2%

With a gain of over 46% last week, Bally’s Corporation was the biggest gainer in our coverage of gaming stocks. Truist analyst Barry Jonas raised the stock’s target price from $11 to $13 last week, which helped support the rally.

However, there have been other encouraging developments related to the debt-laden company in recent weeks. Last month, Bally’s announced an increase in its revolving credit facility, which would help strengthen its balance sheet. It also said that existing and new lenders in its revolving credit facility have consented to the proposed sale and leaseback of its Twin River Lincoln Casino Resort to Gaming and Leisure Properties (NYSE: GLPI). The transaction, which is yet to be approved by the company’s term-loan lenders, would put cash worth $735 million before transaction expenses and taxes into Bally’s coffers.

Earlier this month, Bally’s Corporation and Intralot S.A. announced the completion of Intralot’s acquisition of Bally’s International Interactive Business for a total consideration of €2.7 billion (approximately $2.9 billion).

Thanks to the recent rally, Bally’s stock has turned positive for the year even as its return still trails most of its peers.

Las Vegas Sands (NYSE: LVS) +18.67%

Las Vegas Sands was among the other major gainers last week and rose 18.7%. Last week’s gains came after the company reported a stellar set of numbers for the September quarter, beating the top line and bottom line.

LVS’s net revenues increased 24% year-over-year to $3.33 billion, surpassing the $3.06 billion that analysts had expected.

The company’s adjusted EPS rose to 78 cents, well ahead of the 61 cents that analysts were modeling. During the quarter, Las Vegas Sands spent nearly $500 million on share repurchases and extended its share-repurchase authorization to $2 billion through 2027. The company also increased its quarterly dividend by 20% to 30 cents, effective next year.

Several brokerages, including Goldman Sachs, Stifel, Macquarie, Barclays, and JPMorgan Chase, raised the stock’s target price following the earnings report.

Churchill Downs (NYSE: CHDN) +11.57%

Churchill Downs also saw double-digit gains last week and made it to the list of major gainers after reporting impressive earnings for Q3 2025. However, despite last week’s gains, the stock is still down over 24% for the year.

The company’s Q3 revenues rose 9% to a record high of $683 million, surpassing the consensus estimate of $672 million. The adjusted EPS came in at $1.09, well ahead of the $0.97 that analysts had forecast.

The Live and Historical Racing segment was the key driver of the growth. The segment’s revenue increased 21% year-over-year to $305.7 million, led by a continued expansion in its historical horse racing (HHR) machine venues.

Largest Gaming Stock Losers

Playtech Plc (LSE: PTC) -15.18%

Playtech Plc was the biggest loser in our coverage of gaming stocks, losing 15.2% to turn negative for the year. The fall was led by Evolution AB’s announcement that it had amended an existing lawsuit to include Playtech as a defendant.

Evolution alleged that Playtech’s subsidiary, Playtech Software Limited, had commissioned and paid for a 2021 report from Black Cube containing “highly inflammatory and knowingly false claims” about Evolution’s business practices, particularly concerning its operations in prohibited and sanctioned markets.

“Although Playtech has finally been identified after years of trying to keep its involvement in this smear campaign a secret, Black Cube continues to evade the Court’s discovery orders by withholding relevant information. We will continue to hold Black Cube, Playtech, and all the other players in this defamatory scheme responsible for their misconduct,” said Evolution in its release.

Evolution AB (STO: EVO) -7.34%

Evolution also made it to the list of biggest gaming losers last week as it shed over 7.3% of its market cap. Last week’s decline was primarily attributable to the Q3 earnings miss, where the company’s adjusted EBITDA fell 5.3% year-over-year to €336.9 million and trailed estimates. The company’s net revenues also fell 2.4% to €507.1 million in the quarter.

Evolution, however, saw improvement in performance in Europe and Latin America. Performance in Asia, meanwhile, continues to underwhelm, with management terming it “very far from satisfactory.”

“We continue to fight the cyber criminality that has affected our business there for too long, and during the quarter we didn’t progress as much as we would have wanted,” added the company about its Asia business, which happens to be its biggest market.

After Evolution’s earnings, J.P. Morgan reiterated its sell rating on the stock while lowering the target price from SEK 675 to SEK 600. Kepler Capital also lowered its target price from SEK 1,000 to SEK 955 while maintaining its buy rating.

Super Group (NYSE: SGHC) -7.01%

Super Group, which has otherwise had a stellar year and is up over 90%, fell 7% last week and was among the biggest losers in our coverage of gaming stocks. Last week’s drawdown looks likely due to profit booking after the rally in the previous months. Investors will next be watching the company’s Q3 earnings, which are scheduled for November 3.

Notably, in September, Super Group raised its 2025 guidance and expects to post revenues between $2.125 billion and $2.2 billion. It also raised the adjusted EBITDA guidance to between $550 million and $560 million versus the previous projection of $470 million and $480 million, citing better-than-expected performance in the third quarter.

Other Major Gaming Industry Developments

The gaming industry was rocked by rigging allegations last week. Coach Chauncey Billups (Portland Trail Blazers), player Terry Rozier (Miami Heat), and former player Damon Jones were arrested after being charged with participating in a conspiracy to rig high-stakes games.

Elsewhere, the UK Gambling Commission announced a £10 million fine for online operator Platinum Gaming Limited and a £240,000 fine for Petfre (Gibraltar) Limited for various social responsibility and anti-money laundering failings.

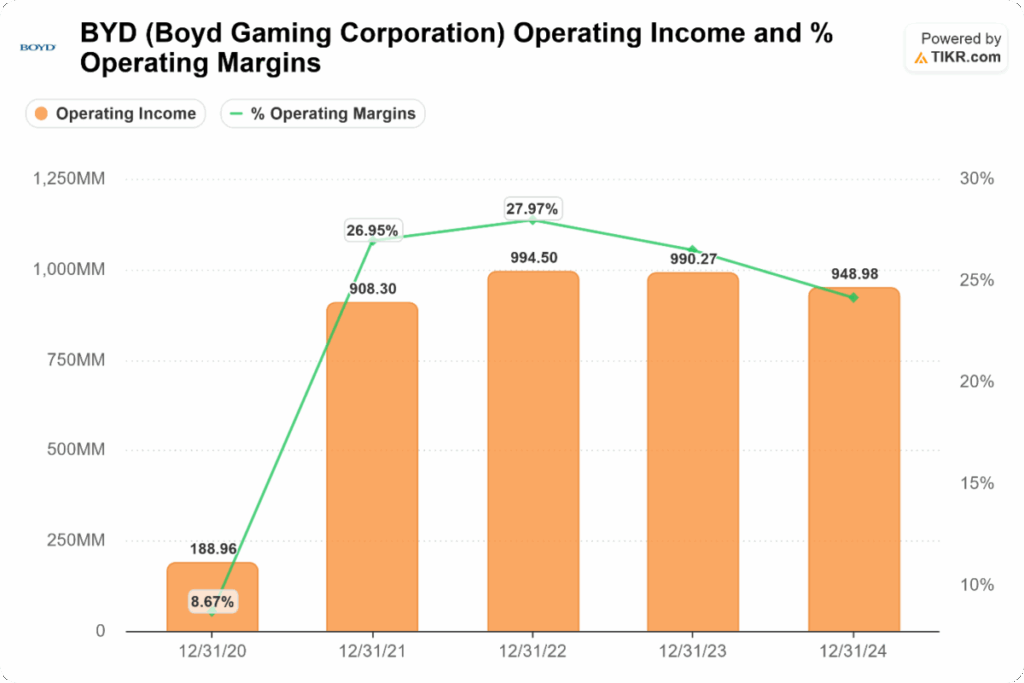

Among other major earnings, Boyd Gaming stock fell after reporting its Q3 earnings. The company’s adjusted EBITDAR (earnings before interest, taxes, depreciation, amortization, and rent) was $321.8 million, a slight decrease year-over-year, which the company attributed to lower market-access fees following the FanDuel stake sale to Flutter Entertainment.

BOYD received nearly $1.4 billion by selling a 5% stake in FanDuel to Flutter Entertainment, which it has predominantly used to deleverage its balance sheet. As a result of its deleveraging efforts, Boyd’s leverage ratio fell from 2.8x to a more reasonable 1.5x.