Coinbase CEO Brian Armstrong deliberately manipulated Kalshi and Polymarket prediction markets during his earnings call on Friday. As the NBA betting scandal grips the nation, should Armstrong face repercussions for spot-fixing? His actions have exposed the vulnerability of prediction markets.

Armstrong ended the earnings call by saying, “I was a little distracted because I was tracking the prediction market about what Coinbase will say on their next earnings call.”

He then deliberately manipulated the market, stating, “I just want to add here the words Bitcoin, Ethereum, blockchain, staking, and Web3 — to make sure we get those in before the end of the call.”

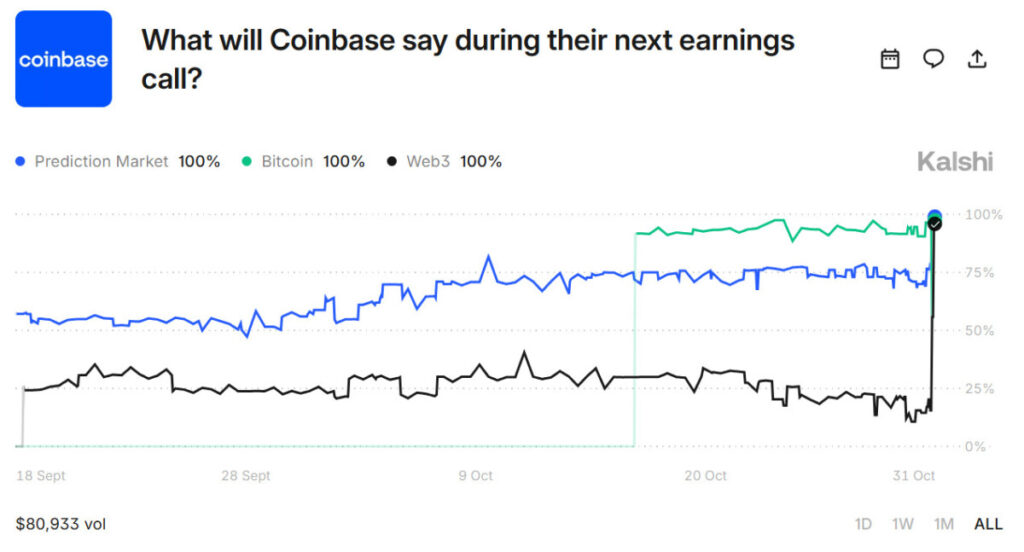

In total, a relatively small amount was traded on Kalshi’s market at $80,933, and just over $3,000 at Polymarket. But it could still have generated a significant windfall for users who backed the terms.

In particular, the Kalshi market had Web3 at an 11% chance shortly before the end of the earnings call. This means users could have multiplied their money by more than nine times.

If an NBA player had done a similar stunt, a federal investigation would no doubt have been opened. Terry Rozier has been indicted for exiting a game early in order to manipulate his prop markets.

It has raised numerous questions about the vulnerability of “mention markets” available on platforms such as Kalshi and Polymarket.

In the wake of the NBA scandal, there have been renewed calls for a ban on micro bets, which are very specific events in a match that depend on one individual’s performance.

Ohio’s Gov. Mike DeWine says the state has an agreement with the MLB and sportsbooks to ban the bets. As Armstrong has proven, mention markets are just as susceptible to manipulation.

While the majority of pushback for prediction markets has been focused on sports, an expansion of mention markets could also lead to further legal scrutiny.

Armstrong Laughs Off Criticism

Jeff Dorman, chief investment officer at digital asset firm Arca, criticized Armstrong’s stunt on X, stating, “I’m tired of dumping on Clownbase, but you need your head examined if you think it’s cute or clever or savvy that the CEO of the biggest company in this industry openly manipulated a market.”

Coinbase has invested in both Polymarket and Kalshi, and Armstrong used the same call to promote the firm’s new “Everything Exchange,” which may eventually support prediction markets.

The CEO laughed off any backlash from his actions, taking to X to write, “lol this was fun – happened spontaneously when someone on our team dropped a link in the chat.”

A Coinbase spokesperson said Armstrong’s remarks were “made in a lighthearted, offhand way, referencing online discussion around the earnings call.”

The company’s internal controls prohibit employees from participating in prediction markets or any related activity involving the company, the person added.

In this way, it is not entirely comparable to the scandal in the NBA, as the main complaint from federal investigators is that Rozier and others passed on information for betting purposes. There is no indication that Armstrong informed anyone he was going to say the words, and he claims it was a spontaneous decision.

While Coinbase has company rules regarding engagement in prediction markets, most companies have likely not considered this issue. If mention markets continue to expand, this could be problematic.