Gaming stocks, which had been outperforming broader markets in 2025, ended October on a sour note, with the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ) falling 5% last week, while the broad-based S&P 500 Index gained 0.7%. It was the fourth consecutive week that BETZ underperformed the S&P 500 Index, and its year-to-date returns now trail those of the market.

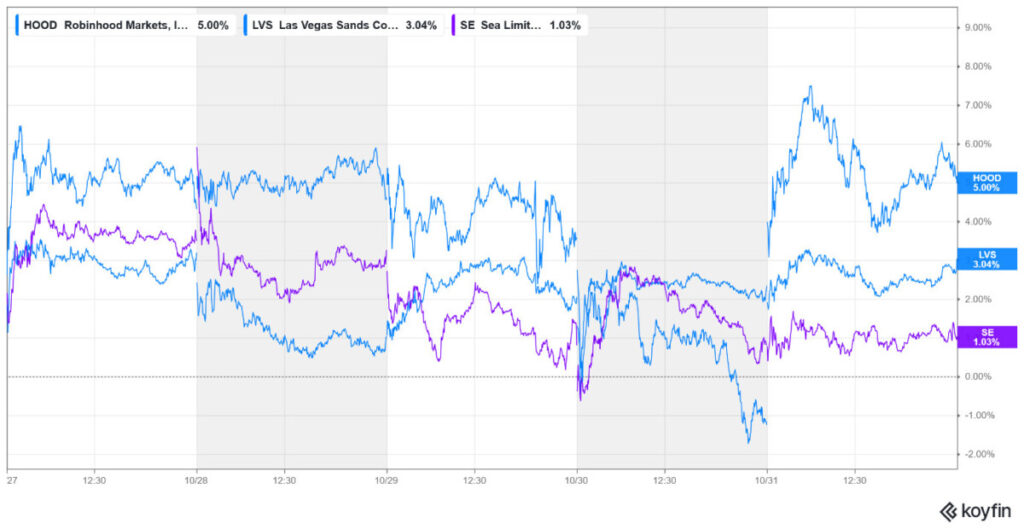

In what was yet another dismal week for gaming stocks, Robinhood and Las Vegas Sands managed to close in the green. Meanwhile, Century Casinos, Skillz, and Rush Street Interactive underperformed, experiencing double-digit declines.

Largest Gaming Stock Gainers

Robinhood (NYSE: HOOD) +5%

Robinhood stock gained 5% last week, thanks to the over 6% rally on Friday amid a broad-based uptrend in US stock markets. Robinhood’s rise gained momentum after KeyBanc raised the stock’s price target by $20 to $155 from $135 while maintaining its “overweight” rating.

HOOD stock, which was added to the S&P 500 Index earlier this year, has gained nearly fourfold this year. Among others, Robinhood’s focus on prediction markets is making investors bullish on the stock. Last Monday, Compass Point raised HOOD’s price target to $161 from $105 as it expects continued revenue growth from equity transactions, cryptocurrency trading business, and prediction markets.

Notably, Robinhood is open to acquisitions to bolster its prediction business. Last month, JB Mackenzie, Vice President and General Manager of Futures and International at Robinhood, said, “We as a firm are going to be looking to see if there is an acquisition that’s available.” He added, “I’m always looking to see if there’s something of interest, if there is, we’ll pursue it and see if it’s the right fit.”

Piper Sandler believes that annualized revenues of Robinhood’s event contract business surpassed $200 million in September. In its note, the brokerage said, “We estimate that Robinhood users account for about 25%-35% of Kalshi volumes on any given day.”

Las Vegas Sands (NYSE: LVS) +3%

Las Vegas Sands gained 3% last week and continued its momentum from the preceding week when it had soared over 18% following stellar Q3 2025 earnings. Several brokerages, including Goldman Sachs, Stifel, Macquarie, Barclays, and JPMorgan Chase, raised the stock’s target price following the earnings report.

Last week, Morgan Stanley also raised LVS’s target price from $59 to $63 even as the brokerage maintained its “equal weight” rating on the stock.

Sea Limited (NYSE: SE) +1%

Sea Limited also managed to close in the green, rising 1% last week. Sea, a tech conglomerate and parent of gaming studio Garena, has gained around 47% this year. However, it has lost over 20% from its all-time high, which it hit in mid-September, due to valuation concerns. Last week’s rise, meanwhile, seems like a technical rebound after the weakness in the previous few weeks.

Largest Gaming Stock Losers

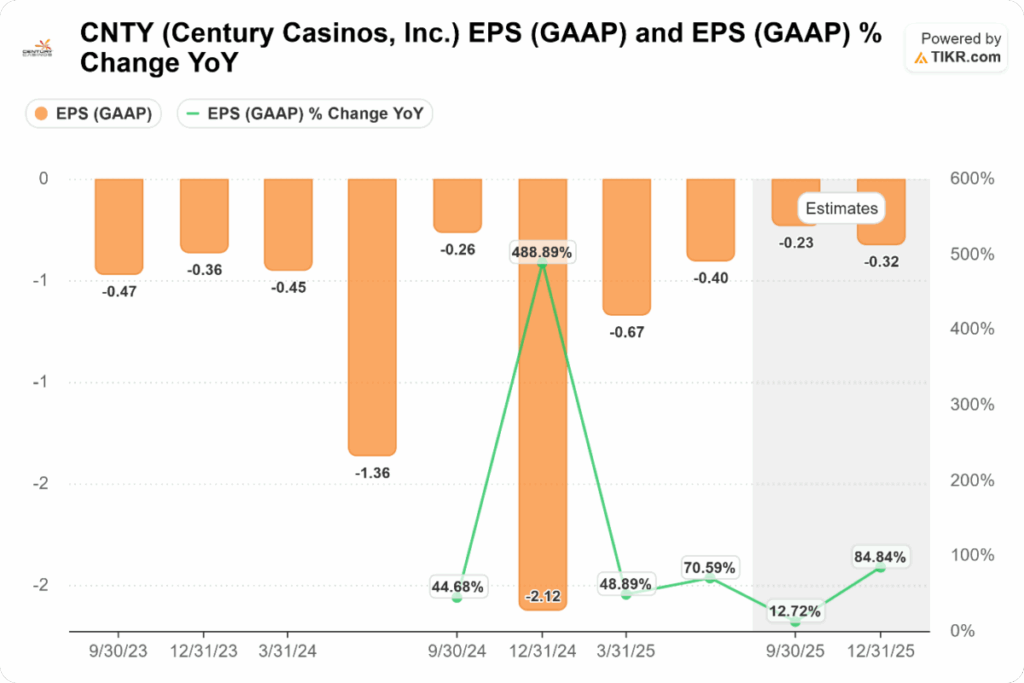

Century Casinos (NYSE: CNTY) -13.9%

With a loss of nearly 14%, Century Casinos was the biggest loser in our coverage of gaming stocks last week. CNTY has been quite volatile this year, and while it has risen from the 52-week low of $1.30 it hit amid the April sell-off, it is still down nearly 41% for the year. CNTY is a loss-making microcap company with a market capitalization of less than $70 million, characterized by low trading volume and a beta of over 2x, which makes it susceptible to significant price swings and is therefore a high-risk investment.

While there wasn’t any company-specific news last week, the decline appears to be in anticipation of the Q3 report, which is scheduled for this week. Analysts expect CNTY’s revenues to rise 2% in the quarter, while predicting a per-share loss of 20 cents.

Skillz (NYSE: SKLZ) -12.1%

Skillz shares lost over 12% last week and continued its volatile streak. The stock has lost over 26% from its 2025 highs but is still up 32% for the year.

Skillz was part of the 2021 meme stock mania and had participated in the meme stock frenzy earlier this year.

While Skillz faces significant headwinds, its Q2 earnings, released on August 7, show some improvement in financial performance. The company’s paying active users grew 20% to 146,000. That marks a welcome break as the user numbers have been falling over the previous few quarters. It, however, still posted a net loss of $8.9 million in the quarter.

Rush Street Interactive (NYSE: RSI): -11.7%

Rush Street Interactive was the other major loser last week, shedding 11.7%, which narrowed its year-to-date gains to 23.6%. Notably, last week’s decline came despite the company reporting a strong set of numbers for the third quarter, where its revenues rose 20% year-over-year to $277.9 million, which were ahead of estimates. Its net income rose $14.8 million in the quarter, significantly higher than the $3.2 million that it generated in the corresponding quarter last year.

RSI also raised its guidance and projected full-year revenues of $1.11 billion, with EBITDA of $150 million.

The management was quite upbeat on the company’s outlook during the earnings call, and CEO Richard Schwartz noted, “What makes these results particularly compelling is the continued acceleration of our growth in North American online casino markets, where we see the highest player value and retention. We’ve seen accelerating year-over-year growth in our North American online casino player base every single month since March, indicating a strong underlying momentum that extends well beyond any seasonal factors.”

Major Gaming Industry Developments

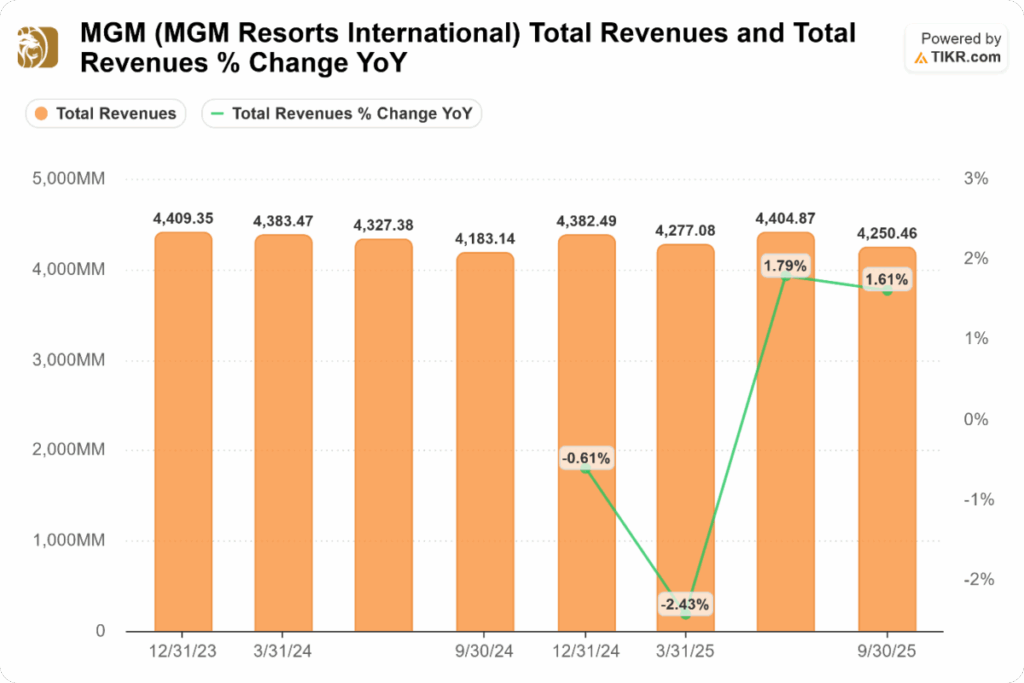

Last week, MGM Resorts reported a mixed set of numbers for the third quarter, with Macau delivering a record performance but Las Vegas revenues declining. Notably, the Macau market has continued its momentum in Q4 as well, and according to data released by the Gaming Inspection and Coordination Bureau, Macau’s Gross Gaming Revenues rose 15.9% year-over-year to $3.08 billion in October and came in ahead of estimates.

MGM posted a net loss of $285 million, primarily due to a $256 million impairment resulting from its withdrawal from the New York casino licensing process, as well as approximately $93 million in other non-cash write-offs related to Empire City.

Caesars Entertainment reported a revenue of $2.87 billion, which was slightly lower than the corresponding period last year. The company’s EPS came in at 27 cents, which was below Street estimates, and the stock fell following the earnings release.

Elsewhere, prediction markets got a shot in the arm as President Donald Trump’s Truth Social announced a partnership with Crypto.com to offer prediction markets to users.

“We are thrilled to become the world’s first publicly traded social media platform to offer our users access to prediction markets,” said Devin Nunes, CEO of Trump Media & Technology Group.

On a similar note, Trump nominated Michael Selig as the next Chair of the Commodity Futures Trading Commission, signaling a sharper focus on digital-asset regulation and the unresolved clash over prediction markets.