Gaming stocks in general had a tepid week, and the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, lost 3.45% which was just under twice that of the broad-based S&P 500 Index.

BETZ underperformed the S&P 500 in all four weeks in October and has had a tepid start to November. The ETF, which was once outperforming the broader markets, is now up in single digits year-to-date.

Golden Entertainment and Playtika Holdings were among the major gainers last week. Meanwhile, Corsair Gaming and Penn Entertainment were among the major losers.

Largest Gaming Stock Gainers

Golden Entertainment (NYSE: GDEN) +44.7%

With gains of 44.7%, Golden Entertainment was by far the best-performing stock in our coverage of gaming companies. Last week, the company announced it entered into a definitive agreement to sell its operating assets to CEO Blake L. Sartini and affiliates, and separately, sell seven of its casino real estate assets to VICI Properties (NYSE: VICI) in a sale-leaseback transaction for $1.16 billion.

GDEN stockholders are set to receive a total consideration valued at $30 per share at the time of signing, which represented a 41% premium to the stock’s closing price the day before the announcement. The consideration is a combination of a fixed exchange ratio of VICI common stock plus a cash distribution.

The acquisition announcement overshadowed the company’s simultaneous release of its Q3 2025 earnings, which had missed analyst revenue and EPS estimates. The positive news of the acquisition and the premium paid per share were the dominant factors for the stock’s price movement last week.

Playtika Holdings (NYSE: PLTK) +16.35%

Playtika Holdings shares gained over 16% last week after the markets gave a thumbs up to its Q3 earnings. Playtika reported revenues of $674.6 million, representing an 8.7% year-over-year increase and surpassing the consensus analyst estimate of $667.5 million. The company’s adjusted EBITDA rose 10.3% to $217.5 million, which was also ahead of Street estimates.

During the quarter, Playtika’s direct-to-consumer (DTC) revenue reached an all-time high of $209.3 million, growing 20% year-over-year. This strategic shift to direct channels is viewed favorably as it typically leads to higher margins and better control over the user experience.

Meanwhile, despite last week’s rise, PLTK stock is down 38% for the year amid declining revenue of its mature social casino games, particularly Slotomania, which is one of the company’s largest revenue generators.

Betr Entertainment (ASX: BBT) +12%

Betr Entertainment was among the other major gainers last week. The company released its Quarterly Activities Report and Appendix 4C for fiscal Q1 2026 last week, which showed turnover rising 27% year-over-year to Australian dollars (AUD) 363 million. The company’s net win margin expanded to 10.5% which helped push net wins to AUD 38 million – 36% higher than the corresponding quarter last year.

In the release, Betr disclosed that it holds a 27.72% stake in PointsBet Holdings and is moving forward with a selective buy-back to acquire all outstanding PointsBet shares – a transaction it intends to finance with a combination of equity and debt.

Biggest Gaming Losers

Corsair Gaming (NYSE: CRSR) -19.63%

Corsair Gaming lost almost a fifth of its market capitalization last week and was the biggest loser in our coverage of gaming stocks. The fall came after the company missed both top-line and bottom-line estimates for the September quarter and also lowered its annual guidance.

Corsair reported net revenue of $345.8 million, which, while up 14% year-over-year, was below the analyst consensus estimate of $353 million. The company reported adjusted earnings per share (EPS) of $0.06, which fell short of the consensus analyst forecast of $0.09. To make things worse, the company lowered its 2025 revenue guidance to between $1.425 billion and $1.475 billion.

Penn Entertainment (NYSE: PENN) -11.66%

Penn Entertainment was among the other major losers, losing 11.7% last week. The company reported revenues of $1.72 billion, which were slightly below the $1.73 billion that analysts had expected. Penn’s adjusted per-share loss came in at 22 cents, which was over twice what analysts were modeling.

Meanwhile, the key highlight of Penn’s earnings call was the announcement to terminate its betting deal with ESPN. The venture, named ESPN Bet, struggled to gain a meaningful foothold in the highly competitive US sports betting market, which is dominated by FanDuel and DraftKings. PENN’s CEO stated they were “unable to establish ESPN Bet as a scale player.

Notably, as part of that deal, Penn was supposed to pay $150 million annually to ESPN, which was a drag on its cash, especially as that business failed to take off. Penn was also under pressure from its investor AG Vora, which won two seats on the company’s board earlier this year and, among others, had been quite vocal against Penn’s partnership with ESPN.

After terminating that deal, Penn will rebrand its US online sports betting platform to theScore Bet starting next month. This allows PENN to leverage its own in-house technology and media asset (theScore app), which is popular in Canada. It will also double down on its iCasino business.

ESPN, meanwhile, partnered with DraftKings, and beginning next month, the company will become the exclusive Official Sportsbook and Odds Provider of ESPN.

Robinhood (NYSE: HOOD) -11.19%

Robinhood, one of the top two S&P 500 Index gainers this year, lost over 11% last week despite posting stellar Q3 earnings. The company doubled its year-over-year revenue to $1.27 billion and reported EPS of $0.61, both of which significantly exceeded analyst expectations.

Last week’s tech sell-off also added fuel to Robinhood’s crash as investors exited high-flying names like Robinhood, Palantir, and Nvidia.

Meanwhile, one of the key highlights of Robinhood’s Q3 call was the focus on the prediction business. CEO Vlad Tenev stated that prediction markets represent Robinhood’s fastest-growing business ever, reaching the milestone of generating $100 million or more in annualized revenue in under a year. Robinhood’s prediction volumes are growing at an astronomical pace and have doubled every quarter since the launch last year.

Tenev shared an ambitious, long-term vision for prediction markets, believing they could become “one of the largest asset classes” because they enable pricing risk in “pretty much anything.” He expressed excitement about being an early player in this “new asset class.”

Other Major Gaming Industry Development and News

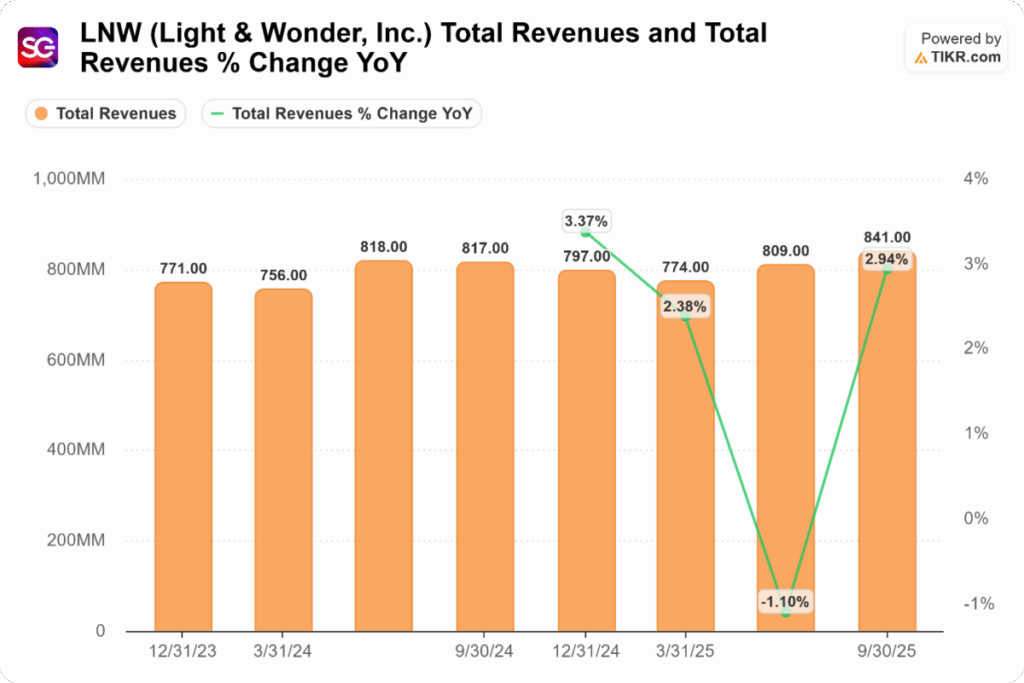

Last week, New York State announced that consumers in the state wagered $2.64 billion on online sports betting in October, setting a new record. On the earnings side, Light & Wonder Q3 reported strong Q3 2025 results, with significant growth in net income, driven by its diversified product portfolio, including social mobile games and iGaming solutions. The stock ended the week with double-digit gains following the positive reaction to the earnings.

On the regulatory front, NetBet Enterprises Limited was ordered to pay a fine of £650,000 for regulatory failures, underscoring the UK’s ongoing crackdown on compliance, particularly in areas such as responsible gambling and anti-money laundering.

In India, there is some light at the end of the tunnel for online gaming. During a recent hearing last week, the country’s Supreme Court indicated that regular competitions and tournaments based purely on skill may be “completely excluded” from the Promotion and Regulation of Online Gaming Act, which bans all real-money games.