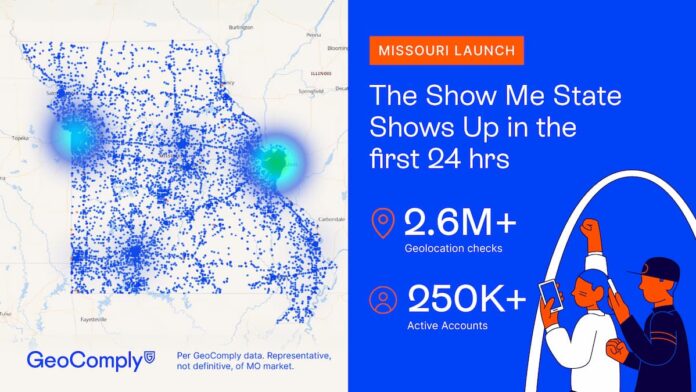

Legal Missouri sports betting went live on Monday, and a GeoComply analysis revealed some impressive numbers on opening day.

- GeoComply’s Missouri online sportsbook customers recorded more than 2,600,000 geolocation checks statewide in the first 24 hours

- Over 250,000 sports betting accounts were active on December 1

- Nearly 188,000 pre-registered accounts were created in the two weeks leading up to launch

“Missouri has shown for years that it’s one of the most eager states in the country for legal sports betting,” said Kip Levin, GeoComply CEO. “What we’ve seen in the first 24 hours is remarkable.

“Tens of thousands of Missourians immediately joined safe, regulated platforms the moment they became legal. It’s a powerful reminder of how quickly consumers embrace a well-regulated market when the option finally exists.”

Kansas & Illinois Markets, Tax Revenue Will Be Affected

Data from a previous GeoComply study revealed that more than 3,700 Missourians traveled to Kansas and over 2,800 traveled to Illinois to bet on sports from September 5 to October 21, marking the first six weeks of the NFL season.

Spencer Murry is among those thousands who have routinely headed over the border to Kansas to bet on the Chiefs.

“I’ll go on Sunday mornings, so probably once a week, maybe twice if there’s something fun,” Murry said. “Or if I’m over there — running errands in Overland Park or visiting family in Prairie Village — I’ll put it in.”

He added, “It was time for it to happen. I think, no matter what your opinion is on it, people are going to other states — people are going to do it regardless.”

Derek Durst, a Missourian who voted to legalize sports betting, noted that he “knows plenty of people who have crossed state lines” to bet in Illinois and Kansas.

“It’s like not the worst thing to keep the money in house for taxes, but it wasn’t really based on that,” he said. “I just kind of wanted it legal here, because it’s inconvenient to drive to Illinois.”

Early estimates suggest that Missouri will reap around $28 million in annual tax revenue from sports betting. Adam Hoffer, the director of excise tax policy at the Tax Foundation, believes that Missouri’s legal market will undoubtedly have an impact on neighboring states, including the loss of tax revenue.

Illinois recently imposed a per-bet tax that could drive some residents to Missouri, given its proximity to the Show-Me State.

“(Illinois) bettors can, if they’re near a border with Missouri … dodge that tax by betting across the border,” Hoffer said. “So I do think (Missouri) will see some net influx from people living in neighboring states. I don’t think it’s going to be enormous, but I do think there will certainly be some bettors looking to avoid the higher taxes in neighboring states.”