The S&P 500 Index closed in the green last week, and volatility edged down after spiking in the preceding couple of weeks. There wasn’t much action in gaming stocks even as the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ) slightly outperformed the S&P 500, continuing the winning streak to three consecutive weeks.

Genius Sports and Playtika were among the major gainers last week. Meanwhile, Penn Entertainment and Golden Entertainment were among the major losers.

Biggest Gainers

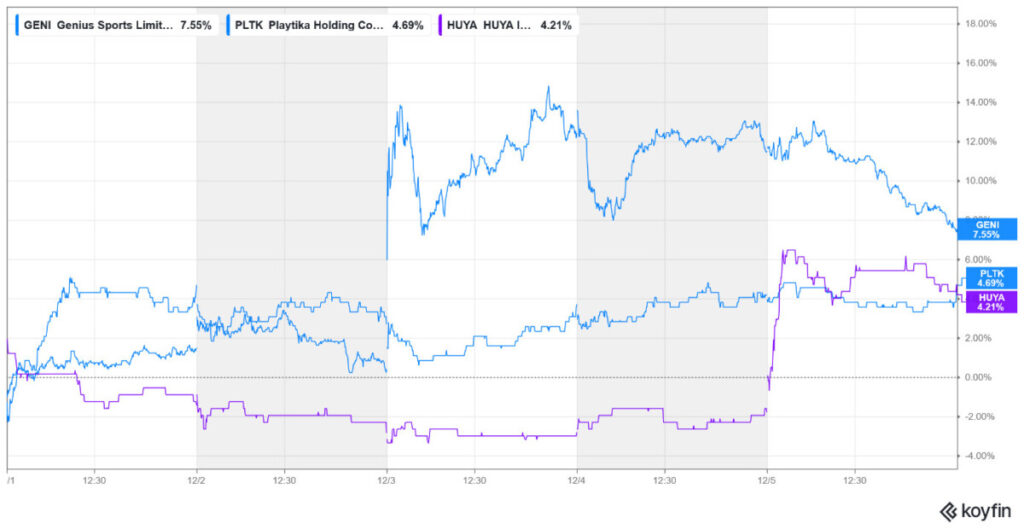

Genius Sports (NYSE: GENI) +7.55%

With gains of over 7.5%, Genius Sports was the best-performing gaming stock in our coverage. On December 3, Genius Sports held its Investor Day, where it presented an ambitious financial outlook for 2028. The company expects to generate an adjusted EBITDA of $365 million in 2028 on revenues of $1.2 billion. It also forecast free cash flows of $220 million, representing a healthy 60% conversion margin.

The guidance exceeded consensus expectations and helped reassure investors about the company’s growth trajectory, path to profitability, and strong cash flow generation.

Wall Street analysts also took note of the upbeat guidance, with Guggenheim and Citizens raising their target prices to $17, while Goldman Sachs increased its target to $16.

Last week’s rise helped GENI to extend its year-to-date gains to 25.2% which is roughly twice that of BETZ.

Playtika Holdings (NYSE: PLTK) +4.69%

Playtika Holdings stock rose nearly 4.7% last week and was among the major gainers. It was an unusual week for the company, though. On Monday, Playtika issued a press release announcing a high-profile NFL-themed collaboration for its World Series of Poker mobile game.

However, the very next day, the company issued a “DISREGARD RELEASE,” stating that the previous announcement had been made in error or contained inaccuracies.

Meanwhile, Playtika’s recent financial performance has been impressive, reporting revenues of $674.6 million, which were up 8.7% year-over-year and surpassed the consensus estimate of $667.5 million. The company’s adjusted EBITDA rose 10.3% to $217.5 million, which was also ahead of Street estimates.

During the quarter, Playtika’s direct-to-consumer (DTC) revenue reached an all-time high of $209.3 million, growing 20% year-over-year. This strategic shift to direct channels is viewed favorably as it typically leads to higher margins and better control over the user experience.

However, despite rebounding from its 2025 lows, the stock is down over 38% for the year amid concerns about the declining revenue of its mature social casino games, particularly Slotomania, which is one of the company’s largest revenue generators.

Huya Inc. (NYSE: HUYA) +4.21%

Huya also made it to the list of last week’s top gainers with gains of over 4%. On Thursday, the company announced that it had been named an Outstanding Esports Platform in the 2025 Forbes China Esports 30 Selection, which helped buoy sentiment.

“Huya received this award for its demonstrated strengths in these areas, supported by its vibrant esports content ecosystem, strong community engagement, cutting-edge technologies, and high-quality, immersive viewing experiences,” said the company in its release.

The announcement helped Huya stock move higher, and after last week’s rise, it has bridged its year-to-date losses to just about 3%.

Biggest Losers

Penn Entertainment (NYSE: PENN) -6.87%

Penn Entertainment continued its dismal run and fell almost 7% last week, making it the biggest loser in our coverage of gaming stocks. The stock has now lost 40% of its value from its 2025 highs and continues to underperform its gaming peers.

Last week, Penn officially ended its partnership with ESPN, which it had announced while releasing the Q3 2025 earnings in November. Penn is rebranding its US online sportsbook to theScore Bet, leveraging its strong Canadian platform. However, the US market is a virtual duopoly dominated by DraftKings and FanDuel, and investors are skeptical of any new brand’s ability to compete effectively without the massive marketing power of ESPN.

Gambling.com (NYSE: GAMB) -6.53%

Gambling.com was among the major losers last week, falling by over 6.5%. Notably, it was among the major gainers in the preceding week, when it rose 14% without any major market-moving news. Last week’s decline appears to be a profit-taking exercise following the stellar gains of the previous week.

Notably, GAMB is facing some structural challenges due to Google search algorithm changes, and the stock had tumbled last month after mixed Q3 earnings. The company reported revenue of $38.98 million, which fell short of the analyst consensus estimate of $41.04 million. The company also lowered its 2025 guidance for the second time this year. During the earnings call, GAMB noted that revenue was negatively impacted by less favorable search rankings that persisted through the third quarter.

Century Casinos (NYSE: CNTY) – 3.95%

Century Casinos yet again made it to the list of top losers, falling almost 4%, which extended its year-to-date losses to a whopping 55%. The company’s recent financial performance has been dismal, and it missed on most key metrics in Q3. For instance, its revenues came in at $153.7 million, which was significantly below the $163.4 million that analysts had modeled. Its net loss rose 30% year-over-year to $10.5 million, which was also higher than the analysts’ expectations.

Following the earnings release, Stifel lowered its target price from $4 to $3 while maintaining its buy rating.

CNTY is a loss-making microcap company with a market capitalization below $50 million, characterized by low trading volume and a beta of over 2x, which makes it susceptible to significant price swings and is therefore a high-risk investment.

Other Major Gaming Industry Developments

Last week, the UK Gambling Commission (UKGC) announced an £825,000 fine for Done Brothers (Cash Betting) Limited, trading as Betfred, for social responsibility and anti-money laundering (AML) failures. The regulator has imposed such fines on several companies in recent weeks.

Elsewhere, Slovakia implemented an increase in gambling taxation, particularly for mixed-license holders (land-based and online casinos/betting). This move is part of a trend across European markets to increase the state’s share of gambling proceeds.

Looking stateside, prediction market platform Kalshi filed a lawsuit against Connecticut authorities after the state issued the company a cease-and-desist letter, becoming the ninth state to do so.

The US prediction market continued to witness heightened activity, and Fanatics Markets went live in 24 states last week. Elsewhere, Polymarket is reportedly recruiting traders for an in-house market-making team that would essentially operate like a sportsbook, taking positions against users.