Gemini, the cryptocurrency exchange founded by Tyler and Cameron Winklevoss, has launched its prediction markets platform, Gemini Predictions, across all 50 U.S. states. The move marks the latest entrant in the rapidly evolving prediction market sector, while notably excluding sports-related contracts at launch.

The rollout follows federal approval from the U.S. Commodity Futures Trading Commission (CFTC), which granted Gemini’s derivatives affiliate, Gemini Titan, a Designated Contract Market (DCM) license.

What is Gemini Predictions?

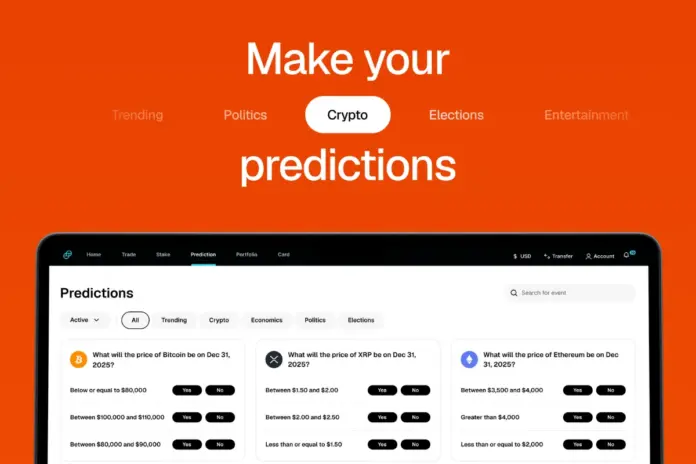

According to the company’s announcement, Gemini Predictions offers simple yes/no event contracts. It allows users to speculate on outcomes such as whether Bitcoin will close the year above specific price thresholds or whether notable regulatory penalties will be imposed.

Users in the U.S. can trade these contracts with U.S. dollars through Gemini’s web and mobile platforms. At launch, the platform is offering zero trading fees for a limited time.

Gemini described the product as part of its broader vision to become a “one-stop financial super app.” It integrates crypto trading, staking, tokenized stocks, and now prediction markets within a single ecosystem.

Broader Prediction Market Landscape

The prediction market sector has primarily been dominated by Kalshi, which has built the largest share of regulated U.S. event-contract volume to date.

However, Gemini’s entry comes amid a surge of interest and participation in prediction markets from both cryptocurrency platforms and traditional brokerages, as well as sports entertainment firms.

Gemini’s competitors, Crypto.com and Robinhood, have already entered the space. Meanwhile, Coinbase announced plans to enter the market earlier this year, with an expected launch soon.

Sports entertainment companies have also pivoted to prediction markets. Fanatics recently launched Fanatics Markets, while DraftKings and FanDuel have indicated that they will roll out their platforms this month.

Daily fantasy sports operators PrizePicks and Underdog have also brought regulated prediction market contracts to their platforms through partnerships with Kalshi and Crypto.com, respectively.

Much of the increased interest stems from the fact that prediction markets fall under the CFTC’s oversight, rather than state gambling regulators. That allows operators to bypass traditional state-level gaming licensing frameworks.

Market research suggests prediction markets could see explosive growth as the sector matures. According to a recent Citizens report, prediction markets could surpass $10 billion in annual revenue. That would be driven by increased participation across financial, political, sports, and cultural betting.

To support growth and regulatory clarity, industry leaders, including Kalshi, Crypto.com, Robinhood, Coinbase, and Underdog, teamed up earlier this month to form the Coalition for Prediction Markets. The alliance aims at promoting safe, transparent, and federally supervised access to prediction market services.

Regulatory, Legal, and Market Dynamics

The rapid evolution of prediction markets has not been without friction. Kalshi in particular has clocked billions in trading volume, with sports event contracts increasingly becoming the majority of that volume.

With that, several state gaming regulators and Native American Tribe gaming groups have questioned whether sports event contracts are effectively illegal sports wagers.

Kalshi, Robinhood, and Crypto.com are involved in multiple lawsuits over the question of who regulates these contracts: the states or CFTC.

Operators believe they are exempt from following states’ gambling laws. Meanwhile, regulators have argued that prediction markets offering sports outcomes function as unlicensed sportsbooks, regardless of their federal commodities registration.

Political & Regulatory Backdrop

Gemini’s launch comes approximately a month after reports surfaced that the Winklevoss twins were preparing to enter the prediction market space.

The twins were also previously in the headlines following the withdrawal of Brian Quintenz‘s nomination as chairman of the CFTC. Quintenz said the Winklevoss twins urged President Donald Trump to pause the nomination for reasons not tied to prediction market policy. Instead, it stemmed from a personal and professional fallout.

Trump later withdrew the nomination. He replaced Quintenz with Michael Selig, a candidate described as favoring “freedom, competition, and innovation” in commodities markets.