On January 23, Gemini Titan filed a product self-certification with the Commodity Futures Trading Commission (CFTC) to list a new series of sports event contracts known as “time-interval prop bets.” Sports betting and gaming attorney Daniel Wallach was the first to report the news, posting the filing on X on Monday. His post came the same day Gemini’s filing said it intended to make the contracts available on its platform.

The filing introduces a new framework, the company calls “SPORTSTOTAL1,” which allows participants to take a “yes” or “no” position on whether a specific stat, such as runs in the first five innings of a baseball game, will hit a certain number.

In the filing, Gemini lists the contract this way: “Will the {points} recorded in {time period} of {event} be {above/below/exactly/at least/between} {count} points?” A “time-interval prop bet” is a proposition wager that focuses on statistical outcomes within a certain part of a game, such as a quarter, a half, or even a specific minute, rather than the final result.

The structure of the “SPORTSTOTAL1” contracts makes them cash-settled event contracts with a notional size of $1.00 and trade within a price range of $0.01 to $0.99. According to the certification, the contract’s official values will be based on a hierarchy of source agencies, with the league governing the event at the top, followed by major broadcasters such as ESPN and Fox Sports.

Gemini Pivots From Crypto to Federal Prediction Markets

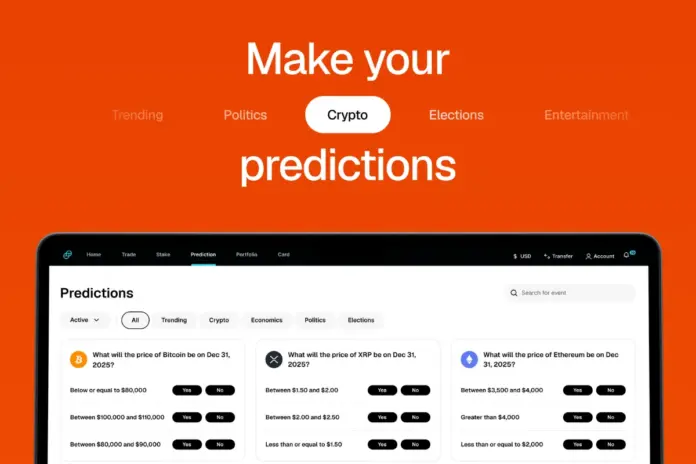

Before its move into prediction markets, Gemini was a well-established cryptocurrency exchange. The company’s January 23 filing with the CFTC follows its receipt of a Designated Contract Market (DCM) license from the CFTC on December 10, 2025, for Gemini Predictions, which it launched across all 50 U.S. states. The approval concluded a five-year licensing process that began when the exchange submitted its initial application on March 10, 2020.

Since Gemini operates as a DCM, its sports event contracts are subject to federal oversight rather than state-by-state gaming regulations that govern traditional sportsbooks. While its public filing uses the term event contract, these instruments are classified as swaps under the broad definitions of the Dodd-Frank Act.

Under the Commodity Exchange Act (CEA), the CFTC has exclusive jurisdiction over registered exchanges. This status is viewed by many as a gambling loophole, but as prediction markets have increasingly faced legal challenges from states, they’ve argued that because they are DCMs, they are exempt from state licensing requirements.

This positioning allows Gemini to offer its sports event contracts nationwide, putting it in direct competition with other CFTC-regulated prediction markets, including Kalshi and Polymarket’s US arm.