Gaming stocks had yet another dismal week, and the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, fell 2.8% last week. The ETF has now underperformed the S&P 500 Index for seven consecutive weeks and is now down over 11% for the year, while the broad-based index is up over 1%.

As has been the case for the last couple of weeks, the bar for top weekly gainers was quite low, while we had our fair share of losers. Huya and Playtech Plc were among the major gainers last week, while The Star Entertainment Group and Skillz Inc saw double-digit declines.

Major Gainers

Huya (NYSE: HUYA) +26.9%

Huya was by far the biggest gainer in our coverage of gaming stocks last week, rising nearly 27% and extending its YTD gains to an impressive 47%. In absolute terms, the stock rose above $4 – a price level it has failed to decisively break over since mid-2024.

Notably, Huya stock rallied earlier this year after the company reported that the mobile version of the popular social deduction game Goose Goose Duck (which it co-published with Kingsoft Shiyou) reached No. 1 on the Apple App Store’s free games chart in mainland China.

There wasn’t any major trigger for last week’s rally, and it came amid the renewed buying interest in Chinese stocks. While several analysts see U.S. tech share valuations as overstretched, Chinese shares still trade at a significant discount to their U.S. peers.

However, the Chinese tech sector, particularly gaming, is always at risk of adverse government policies. Specifically, Huya stock fell from a high of $14.65 in Q1 2021 to only $0.66 in October 2022 after the Chinese government cracked down on the tech sector.

Playtech Plc (LSE: PTEC) +9.23%

Playtech saw nearly double-digit gains last week. Notably, U.K. gaming stocks saw selling pressure in recent weeks after the gaming tax hike in the country’s Autumn budget. However, Playtech management reassured investors that they remain “comfortable” meeting full-year 2026 market expectations. The company’s geographic diversity, particularly growth in the U.S. and Latin America, is effectively cushioning the impact of U.K. tax hikes.

There wasn’t any major market-moving news last week, and the rebound comes after a brutal sell-off in recent weeks.

Meanwhile, apart from the U.K. tax hike, Playtech also faces a significant headwind from Evolution’s lawsuit.

Evolution alleged that Playtech’s subsidiary, Playtech Software Limited, had commissioned and paid for a 2021 report from Black Cube that contained “highly inflammatory and knowingly false claims” about Evolution’s business practices, particularly regarding its operations in prohibited and sanctioned markets.

Rush Street Interactive (NYSE: RSI) +2.93%

Rush Street Interactive gained 2.9% last week and made it to the week’s top gainers. The stock saw a double-digit decline the previous week and rebounded technically last week. Analyst sentiment towards RSI has been mixed, and last week Jefferies maintained its “Buy” rating on the stock and assigned a target price of $29, which is over 68% above the current price. However, earlier in January, Susquehanna had lowered its target price by $1 to $22.

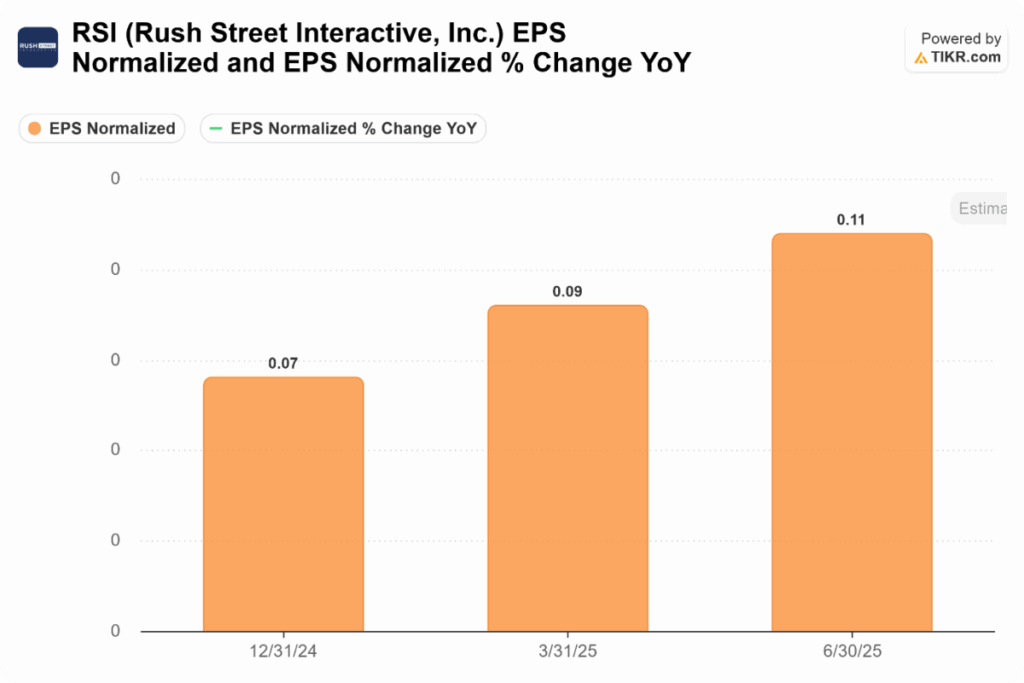

RSI is set to release its Q4 2025 earnings later this month, and analyst estimates call for a 20.2% year-over-year rise in revenues. The company’s adjusted earnings per share is expected to rise 52% to 11 cents over the period. Last week’s rise is also likely in anticipation of a strong quarterly update from Rush Street Interactive.

Biggest Losers

The Star Entertainment Group (ASX: SGR) -25%

The Star Entertainment Group was the biggest loser in our coverage of gaming stocks, shedding a quarter of its market capitalization last week. Last week’s decline was largely attributed to the market’s reaction to its quarterly earnings release.

While it generated a group-adjusted EBITDA of $6 million, The Star Sydney remained a major drag, reporting negative EBITDA of $8 million for the quarter. This is largely due to strict New South Wales (NSW) regulations, including mandatory carded play and cash limits, which have significantly suppressed gaming revenue. Even the adjusted Group EBITDA, after several adjustments the company would disclose later, was still below the company’s half-year earnings. While the return to EBITDA profitability would otherwise have been a positive move, the lack of adequate disclosures on the adjustments dampened sentiments.

Moreover, the company is in a race against time in the high-stakes negotiations with lenders to refinance its debt before a February 14 deadline for covenant testing. Management explicitly warned there is “no certainty” these talks will succeed, keeping the threat of insolvency on the table.

Notably, in its earnings, Star Entertainment said that its “ability to continue as a going concern remains dependent on the outcome of numerous material uncertainties” – some of which happen to be outside its control.

Skillz Inc (NYSE: SKLZ) – 12.74%

Skillz fell nearly 13% last week, continuing its dismal run. The recent launch of Google’s “Project Genie,” a generative AI model capable of creating playable video game worlds from simple text prompts, is a key headwind for companies like Skillz.

This news triggered a sharp sell-off across the sector, hitting companies like Unity Software, Roblox, and Skillz, as investors feared the technology could disrupt traditional game development and platform monetization.

AI advancements could significantly lower the barrier to entry in gaming, so much so that established competitive platforms like Skillz might face a sea of new competitors or render their current business models outdated.

Las Vegas Sands (NYSE: LVS) -12.04%

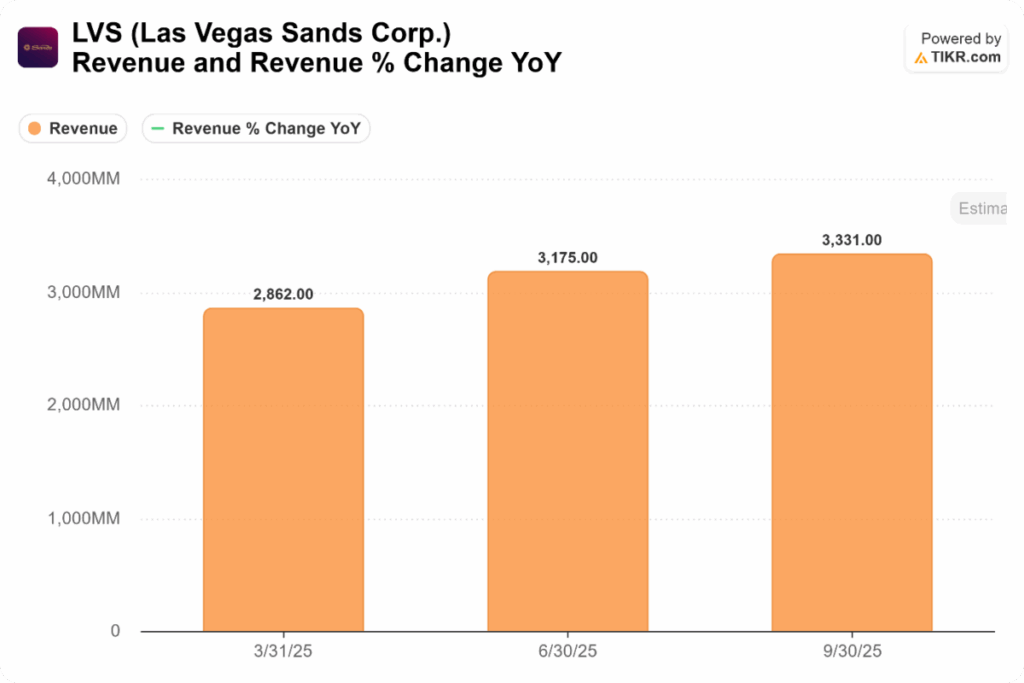

Last Vegas Sands was another major loser last week, falling over 12% and extending its year-to-date decline to 18%. Last week’s losses could be attributable to the market’s reaction to its Q4 2025 earnings, which led to a 14% crash on Thursday – its worst single-day decline since 2020.

The company’s Q4 earnings report showed a tale of two cities. While Singapore (Marina Bay Sands) posted a record-breaking quarter with $806 million in EBITDA, it wasn’t enough to offset concerns about Macau, the company’s largest market. Investors are worried that Macau’s recovery has hit a ceiling or will remain a low-margin environment.

Other Major Gaming Industry Developments

Evoke reported its December quarter earnings last week. The company’s revenues fell 3% year over year but were 7% higher sequentially, making it the strongest quarter of the year. While iGaming revenues rose 9% YoY in the quarter, betting revenues slumped 22% largely due to the tougher comps from the previous year’s high margins.

Looking at prediction markets, last week, lawmakers in Hawaii introduced legislation that would make them illegal under the state’s gambling laws.

Last week, the Commodity Futures Trading Commission (CFTC) dropped its proposed ban on political & sports event contracts and said it would develop new rules for prediction markets. The Coalition for Prediction Markets unsurprisingly welcomed the decision, and its spokesperson said, “By withdrawing uncertain guidance around sports-event contracts and committing to undertake comprehensive rulemaking, the Commission takes a key step to foster market clarity, responsible innovation, and trust in American markets.”

In yet another milestone for prediction markets, Coinbase officially rolled out Kalshi-powered markets to users in all 50 U.S. states last week. Users can now trade event contracts on politics, economics, and sports directly within the app using USD or USDC.

Meanwhile, we are now in the midst of the Q4 earnings season, and earnings reports from major gaming companies will likely set the direction for gaming stocks. After a dismal start to the year, investors are now looking forward to positive commentary during upcoming earnings calls, which could help reverse the slide in gaming stocks.