Novig announced on Wednesday that it has successfully closed a $75 million Series B funding round. The venture-backed start-up, which has positioned itself as a “trader-first” prediction market, has its sights set on federal regulatory approval.

The funding round was led by Pantera Capital, with participation from Multicoin Capital, Makers Fund, and Edge Equity, as well as existing investors Forerunner, Perceptive Ventures, and NFX. Novig’s total capital raised now exceeds $105 million.

Novig is seeking to distinguish itself from competitors by offering commission-free trades and by being a platform designed specifically for sports bettors. Its peer-to-peer, no-commission model uses an order-book system to generate odds, with users trading directly with each other instead of going up against the “house.”

From Sweepstakes to Federal Regulation

Novig’s Series B announcement comes at the same time as its formal application to the Commodity Futures Trading Commission (CFTC) for a Designated Contract Market (DCM) license. The company originally launched as a sports betting operator in Colorado before later changing to a sweepstakes model to reach a larger audience.

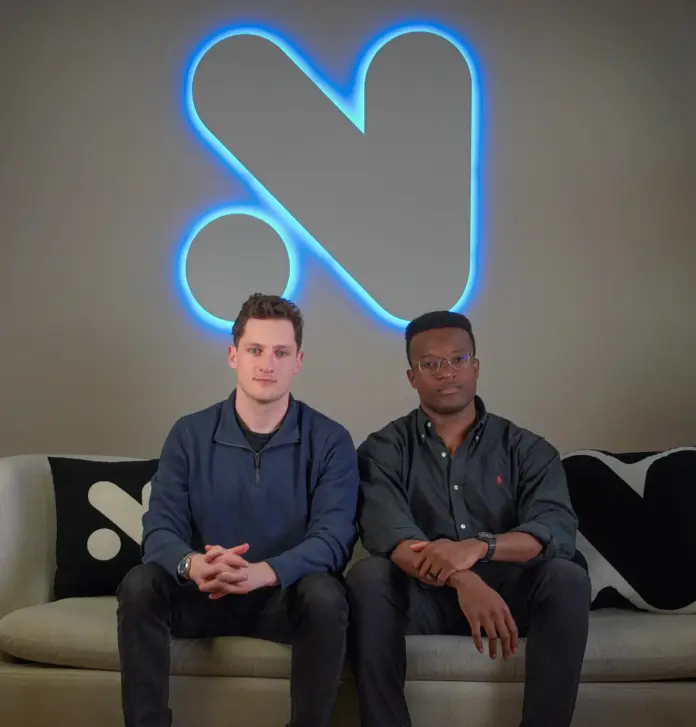

“We started the company because we felt sports betting was broken,” Co-Founder and CEO Jacob Fortinsky told Fortune. “Our basic bet as a company is that the median sports fan is far more likely to use an app whose brand and whose product is really built with sports in mind.”

In an article on X, Fortinsky further explained his vision, noting that while traditional sportsbooks rely on hidden fees and punitive limits, Novig treats users like traders on a level playing field. “Novig users are up to 10x more likely to win in the long-run than on traditional sportsbooks,” Fortinsky wrote.

Prediction Markets Face Growing Pushback

As Novig seeks to enter the prediction market space as a CFTC-regulated exchange, the industry is facing challenges from regulators across the United States, who view these platforms as nothing more than attempts to circumvent state gambling laws.

However, in the past week, the industry has found a powerful ally in CFTC Chairman Michael Selig, who has stated in various interviews and posts on X that the agency will take an active role in defending what it considers to be its “exclusive” jurisdiction over commodity derivatives, including the event contracts companies like Kalshi and Polymarket offer.

Selig’s most decisive step to date was the CFTC filing a friend-of-the-court brief in the Ninth Circuit Court of Appeals on February 17 in support of Crypto.com in its legal battle against the Nevada Gaming Control Board.

In the press release announcing the filing, the CFTC asserted its exclusive jurisdiction over event-based contracts and characterized state-led enforcement actions as an unlawful “power grab” that threatens the stability of the commodity derivatives market.

A coalition of more than 20 Democratic senators critical of Selig’s advocacy for prediction markets sent the chairman a letter on February 13, asking him to remain neutral and to maintain prohibitions on event contracts related to gaming and sports, describing his recent actions as a “stark reversal” of his testimony during his confirmation hearing.

Novig doesn’t appear deterred by the current political climate and is instead emphasizing its “trader-first” philosophy. As Paul Veradittakit, Managing Partner at Pantera Capital, noted in the press release: “When 23% of users are profitable compared to 2% on traditional platforms, it’s clear this is a foundational change to the industry.”