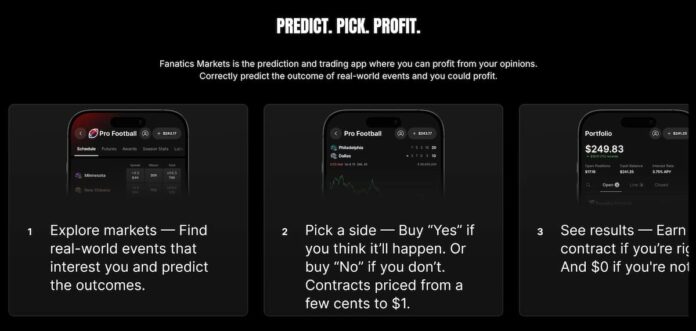

Fanatics has launched its prediction market platform, Fanatics Markets, which will go live in 10 states on December 3, with 14 additional states launching by December 5. With the launch, the company is stepping into one of the fastest-growing (and least regulated) segments of US wagering.

The rollout is powered by Fanatics’ new infrastructure, which includes the company’s July acquisition of Paragon Global Markets, LLC, a National Futures Association member and federally registered introducing broker.

Fanatics also partnered with Crypto.com to supply the pricing and market engine behind Fanatics Markets. Notably, Fanatics enters the segment before rivals FanDuel and DraftKings, both of which have confirmed a planned entry.

The move also comes just weeks after CEO Michael Rubin signaled that Fanatics would expand into prediction markets. He framed the segment as a growth opportunity that falls between casual gaming and regulated sports betting, particularly as younger players gravitate toward low-barrier, financial-style markets.

Where It’s Available

In total, 24 states will have access by Friday, December 5.

- Wednesday, December 3: Alaska, Delaware, Hawaii, Idaho, Maine, New Hampshire, North Dakota, Rhode Island, South Dakota, and Utah

- Thursday, December 4: Alabama, Minnesota, Mississippi, Nebraska, New Mexico, Oklahoma, Oregon, South Carolina, and Wisconsin

- Friday, December 5: California, Florida, Georgia, Texas, and Washington

Notably, the launch includes some of the largest states in the country, such as California, Florida, and Texas, all of which have limited or no online sports wagering.

Also, Fanatics Markets is not launching in states where litigation over prediction markets is ongoing. Examples include Massachusetts, Nevada, Maryland, New Jersey, and New York.

What Types of Contracts are Available & What’s Coming

At launch, Fanatics Markets will offer event contracts spanning multiple verticals:

- Sports — wagers on outcomes of games or specific events

- Finance/Economics — contracts tied to economic indicators or macroeconomic outcomes

- Politics — political events and election outcomes

Fanatics also says it will expand the scope of contracts in “Phase Two,” planned for early 2026. That expansion will add markets tied to cryptocurrency, stocks/IPOs, tech and AI developments, pop culture (including music and movies), climate, and broader cultural events.

Fanatics Beats FanDuel & DraftKings to Market

Fanatics becomes the first major U.S. sportsbook operator to launch a prediction market platform. Competitors, however, are close behind.

In August, FanDuel announced a deal with CME Group to launch a prediction market platform. In November, the operator announced it expects to launch later this month.

Another industry giant, DraftKings, is also likely to enter the segment by the end of the year. During the Q3 earnings call, CEO Jason Robins confirmed that the company is launching DraftKings Predictions following the acquisition of Railbird, a platform certified by the Commodity Futures Trading Commission (CFTC).

Still, Fanatics’ launch gives it a slight advantage. It means that the two sports betting industry leaders will now be reacting rather than leading.

Why Everyone Wants In: Little Regulation, Big Demand

The rush into prediction markets is fueled by a regulatory environment that is far more permissive than sports betting, online casinos, or even daily fantasy sports.

Operators are aggressively exploring the segment because:

- While under federal oversight, prediction markets remain largely unregulated.

- Platforms can operate even in states where sports betting is banned.

- The CFTC has largely maintained a hands-off approach and has signaled that courts will likely decide the debate on state vs. federal oversight.

- Consumer demand for event-trading products has surged.

Recent months have seen a wave of companies — sportsbooks, DFS operators, and even sweepstakes casinos — test the boundaries:

- FanDuel and DraftKings have indicated a strong pivot into prediction markets and have surrendered their Nevada sports-betting licenses.

- Multiple operators are entering the sector despite the ongoing legal battle over CFTC Rule 40.11, Senate scrutiny, and conflicting court decisions.

- DFS operators PrizePicks and Underdog have also expanded into the segment through partnerships with Kalshi and Crypto.com

- Sweepstakes casino platform MyPrize has also partnered with Crypto.com to combine “regulated prediction markets with social gaming experiences.”

The result is a gold-rush environment: enormous growth potential with minimal regulatory friction — at least for now.

Future Outlook

Fanatics now sets the pace in an emerging contest among the sports betting industry’s most prominent players.

With FanDuel and DraftKings preparing their own entries — and a growing number of smaller platforms already operating — prediction markets are becoming a central pillar in the evolution of US gambling.

With the CFTC’s current stance and a federal administration that appears open to event-contract markets, the segment’s long-term trajectory will likely depend on the courts.

But because those cases may take years to resolve, for now, Fanatics has the lead in a race that could reshape the boundaries between betting, gaming, and financial markets.