A speech by President Donald Trump was hijacked by a Kalshi market trader, who boasted about getting the President to mention certain words for financial gain in a mention market.

Mention markets have become increasingly available on a range of speeches and public forums, with users able to trade predictions on what words will be said.

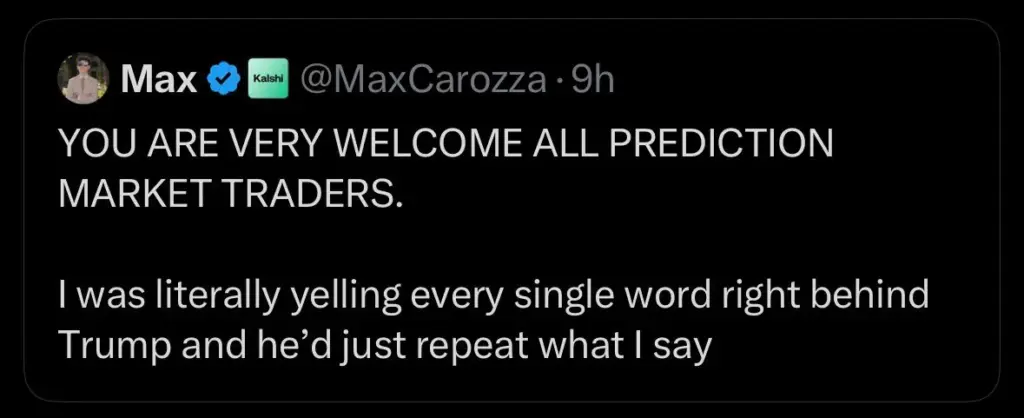

Kalshi had a market on “What will Trump say during his remarks in Pennsylvania?” and during the speech, a self-identified market trader at Kalshi shouted out certain words from the front row, which Trump then said in the speech.

In the market, there were a total of 32 terms that users could bet on Trump mentioning, of which he mentioned 27. Following the speech, the Kalshi user wrote in a since-deleted post on X, “You are very welcome all prediction market traders. I was literally yelling every single word right behind Trump and he’d just repeat what I say.”

The incident has sparked debate about whether these markets should be available at all, as well as the rules on who should be allowed to trade on them.

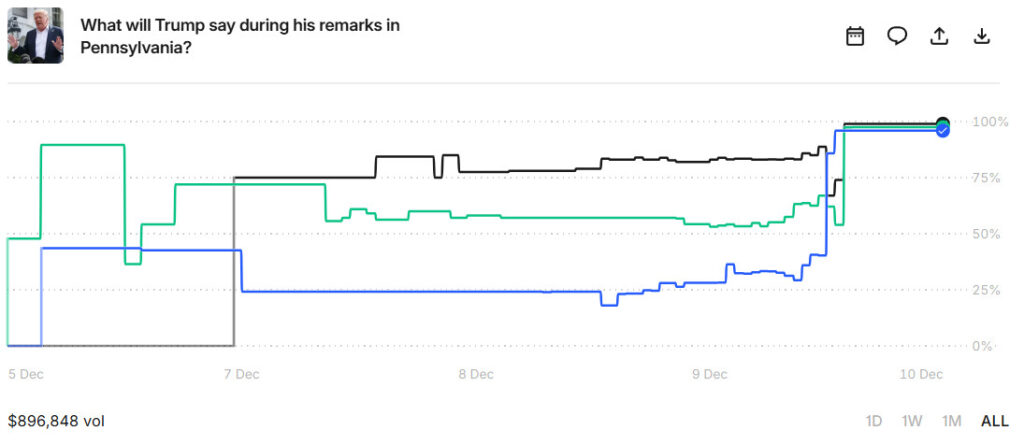

Nearly $1M Traded on Market

A total of $896,858 was traded on the market. While the X user may have been congratulated by those who had backed Trump to say certain phrases, prediction markets operate by requiring another user to take the other side of the trade.

This means that for every winner, there was also a loser. Everyone who backed “No” in the markets would not have welcomed the intervention.

Coinbase CEO Brian Armstrong previously did something similar. He listed off words in a mention market on what he would say during the company’s Q3 earnings call. At the end of the call, while viewing the market, he stated, “I just want to add here the words Bitcoin, Ethereum, blockchain, staking, and Web3 — to make sure we get those in before the end of the call.”

The stunt caused considerably less damage, with only $83,000 traded on Polymarket and Kalshi’s markets on that occasion. Still, anyone who had risked money on predicting that Armstrong would not say Web3 would have been understandably angered. Web3 traded at an 11% chance, meaning those who backed it would have taken 10 times their money from those on the other side of the trade.

Polymarket: Google Searches & War Market Manipulation

There have been several other incidents of apparent market manipulation on prediction markets. One user heavily backing terms to appear in Google’s rankings of the most searched phrases of the year has been accused of working for the company.

A market on the war in Ukraine was also seemingly manipulated. A map used to determine whether Russia occupied a specific territory was credited to the country, just in time for a Polymarket to settle, before the change was reversed shortly after.

In the wake of this incident, there have been calls for more guardrails to be put in place. The Trump incident is further evidence of the ease with which these markets may be manipulated.

The Commodity Futures Trading Commission (CFTC) sets out rules stating that “contracts must not be readily susceptible to manipulation.” It also has rules that prohibit markets on gaming and war, which are not being followed.

Market Manipulation Set to Continue

It remains to be seen if the CFTC will clamp down on the rise of these incidents, which are likely to increase as platforms become mainstream. Polymarket CEO Shayne Coplan stated that he welcomes insider trading on markets where they know, as it gives the market more authority.

Coplan said that anyone trading on these kinds of markets should be aware that someone with better information may emerge. He admitted that the company is committed to protecting the integrity of certain markets, such as sports, but the line between what is accepted and what violates the rules is unclear.

Much as the line between what is betting and what is trading. Prediction markets appear to be here to stay for the foreseeable future, so anyone trading on them should, as Coplan states, be aware that they are highly volatile and susceptible to manipulation.