It was a volatile year for gaming stocks amid all the noise over economic slowdown and geopolitical tensions. There were several developments on the legal and regulatory front, many of which weren’t music to the ears of gaming companies.

Among other things, India imposed a blanket ban on real-money games, while the UK increased its gambling tax. Looking stateside, President Donald Trump’s flagship One Big Beautiful Bill Act (OBBBA) reduced the deduction for gambling losses from 100% to 90%, which could result in gamblers paying taxes even if they don’t make a profit.

However, prediction markets were a real bright spot for the industry despite all the regulatory uncertainty. Here, we’ll focus on how select gaming stocks performed in 2025 and their outlook moving forward.

Gambling.com Lost Nearly Two-Thirds of Its Market Capitalization

Gambling.com had a terrible year, losing nearly two-thirds of its market capitalization, making it the worst performer in our coverage of gaming stocks. In January, GAMB completed the acquisition of Odds Holdings (parent company of OpticOdds and OddsJam), a sports analytics platform. The deal was valued at up to $160 million, of which $80 million was paid initially in cash and stock, and was the largest in the company’s history.

Gambling.com has been pivoting from a pure-play marketing affiliate to a broader sports data and media ecosystem company, which has started to reflect in its earnings. Revenue from sports data services quadrupled year-over-year in Q3 2025 and accounts for around a quarter of its total revenues. The management is upbeat on the prospects of the sports data services business, which it believes is a multi-billion-dollar total addressable market.

Notably, prediction markets like Kalshi and Polymarket use OpticOdds data, and it acts as the virtual “operating system” for their sports and event-based trading. Gambling.com expects the sports data business to become “core” in the future as it benefits from the high growth in prediction markets.

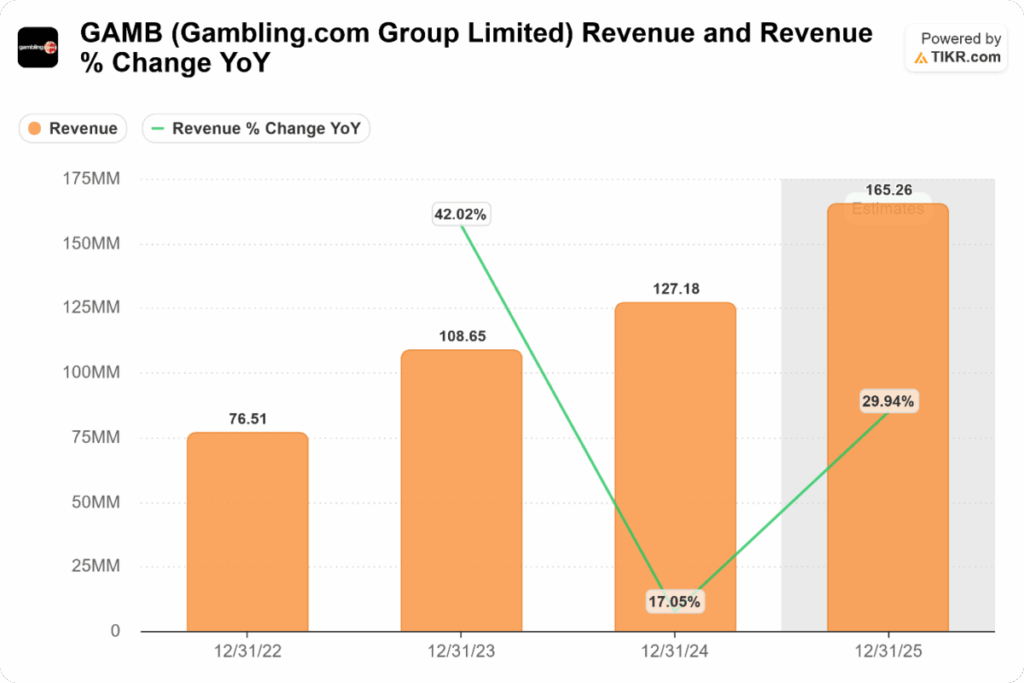

However, like many digital publishers, GAMB faced volatility due to Google search algorithm updates and the rise of AI-generated search results, which pressured the company’s organic traffic rankings. These changes prompted GAMB to lower its guidance twice this year, and its most recent guidance calls for revenues of $165 million and adjusted EBITDA of $58 million.

Analysts Expect Massive Upside in GAMB Stock in 2026

Looking forward, analysts expect Gambling.com to report revenues of $46.06 million in Q4 2025, which represents a year-over-year rise of 30.4% and is in line with the company’s guidance. The adjusted EBITDA is expected to rise 4.1% to $15.1 million, which would push the full-year number to nearly $58 million.

While GAMB had a disappointing year to say the least, analysts see substantial upside over the next year amid the company’s pivot towards the prediction markets business. While GAMB has received a consensus rating of “Hold” from analysts, most of whom have gradually lowered their target prices this year, the stock’s mean target price of $12.29 is over 135% higher than its current levels.

Better Collective Shares Almost Flat This Year

Better Collective had a volatile year, and the stock fell to its 2025 low of SEK 95.5 in April amid the sell-off following President Trump’s tariff war. The stock quickly rebounded and hit a high of SEK 148.22 in July. However, it could not hold onto those levels and is down over 23% from its highs, pushing the stock into bear market territory.

BETCO is currently up just about 2% for the year and is set to underperform most of its gaming peers. While the shares were out of favor with the market this year, the company announced a €20 million share buyback program in August, following a previous €10 million buyback program announced in May. Earlier this month, the company said that it had reached the 5% threshold for treasury shares and would now convene an extraordinary general meeting in January to decide on the cancellation of all repurchased shares.

Better Collective faced a regulatory change this year as Brazil transitioned to a fully regulated market, which impacted the company’s profitability. However, while the transition is a short-term headwind, it will help build a more sustainable business in the country.

Overall, 2025 was an eventful year for Better Collective. In May, it embarked on a “transformative journey.” As part of that transformation, the company elevated co-founder and COO Christian Kirk Rasmussen as Co-CEO alongside Jesper Søgaard. This split allows Søgaard to focus on external strategy and M&A, while Rasmussen oversees daily innovation, product development, and operational execution.

Better Collective Changes Its Reporting Structure

The company also dismantled its geographic management structure in favor of three global business verticals: Publishing, Paid Media, and Esports. Notably, the company grew rapidly inorganically, acquiring nearly three dozen companies over the previous seven years. The new structure helps it streamline the business and cut costs, including through mass layoffs.

In September, Better Collective launched Playbook, its AI-powered betting assistant. The launch was timed ahead of the NFL season with BETCO planning additional key markets in the future. It also partnered with X (formerly Twitter) to integrate Playbook directly into the microblogging platform, which would provide fans with access to personalized and AI-generated bet slips on the platform.

Better Collective Maintained Its 2025 Guidance

While Better Collective saw a revenue decline in Q3 due to lower sports margin wins, it maintained its 2025 guidance and still expects to post revenues between €320 million and €350 million, with an adjusted EBITDA between €100 million and €120 million. The company has completed the €50 million cost-cutting program, which would help it boost its profits structurally.

While BETCO shares have declined this year, consensus estimates predict a 50% rally over the next year.

Catena Media Looks Set to Close in the Red

Catena Media stock is down over 7% for the year and looks set to close 2025 in the red unless there’s a year-end rally. The year started well for Catena, and it hit its 2025 high of SEK 495 towards the end of January. It bottomed at SEK 372 on April 9 amid the reciprocal tariffs unleashed by President Trump, but has since rebounded.

Catena focused on a major “turnaround” strategy in 2025, following a difficult 2024 during which it lost nearly half of its market capitalization. 2025 was characterized by cost-cutting, revenue diversification, and a significant shift toward the North American market.

Catena Delivered on Turnaround Strategy

The company’s 2025 strategy centered on three key areas: people, product, and profit. As part of the strategy, the company achieved a 39% year-over-year reduction in personnel costs in Q3. In product, the company pivoted to performance marketing verticals, paid media, CRM, and sub-affiliates, which continue to offset its heavy reliance on SEO. The company also saw improvements in profitability, with its adjusted EBITDA margin nearly doubling to 25% in Q3.

The turnaround strategy helped revive Catena’s growth, and the company’s revenues and EBITDA from continuing operations showed year-over-year growth in Q3 2025. Notably, North America accounted for 96% of the sales, a record high for the Malta-based company. The yearly growth cannot be overemphasized as the company achieved the feat after 14 consecutive quarters of negative growth.

In Q3, the company launched its sub-affiliation platform, MRKTPLAYS.com, to connect affiliates and operators, replacing the manual processes. During the quarter, it also cleared Google’s Core Web Vitals assessment for all of its top-tier products. It was a vital development as Google uses Core Web Vitals as a ranking factor.

Looking forward, the company intends to focus on prediction markets and stated that, while it has lower CPAs compared to the sportsbook and casino verticals in general, it is a play on higher volumes.

Analysts are optimistic about the company’s Q4 performance and expect sales growth to expand from the 9% reported in Q3. During their Q3 earnings call, management said that it expects Q4 sales to rise 15% on a currency-neutral basis.

Catena Faces Headwinds from AI Search, Bans on Sweepstakes Casinos

That said, the company faces several headwinds that also impact its industry peers. These include the growing traction of AI search, many of which are zero-click, thereby leading to revenue losses for online publishers.

There is also the challenge from the regulatory environment surrounding social sweepstakes casinos, which had become a critical but increasingly volatile revenue driver for the company. While sweepstakes served as a “bridge” to future regulated online gaming, they also presented some of the year’s most significant legal headwinds.

California has banned social sweepstakes casinos, effective next year, and Catena CEO Manuel Stan has warned that the company is bracing for the full impact of this ban to be reflected in its Q1 2026 earnings. There is also concern that other states may follow California’s lead.