There seems to be no end to the woes of gaming stocks, and they continued their frustrating underperformance last week. Specifically, the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, fell 1.9% while the broad-based S&P 500 Index rose nearly 1.6% and hit a new record high on Friday.

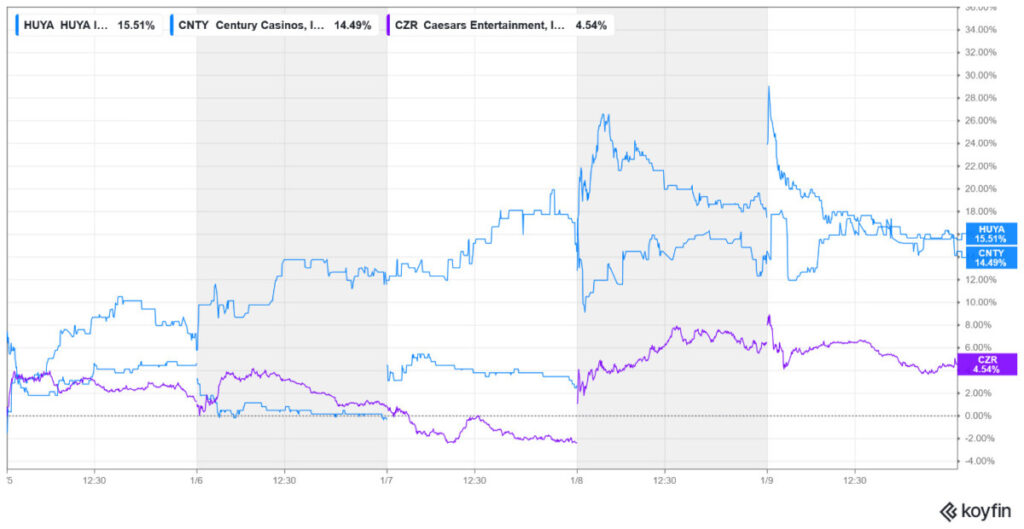

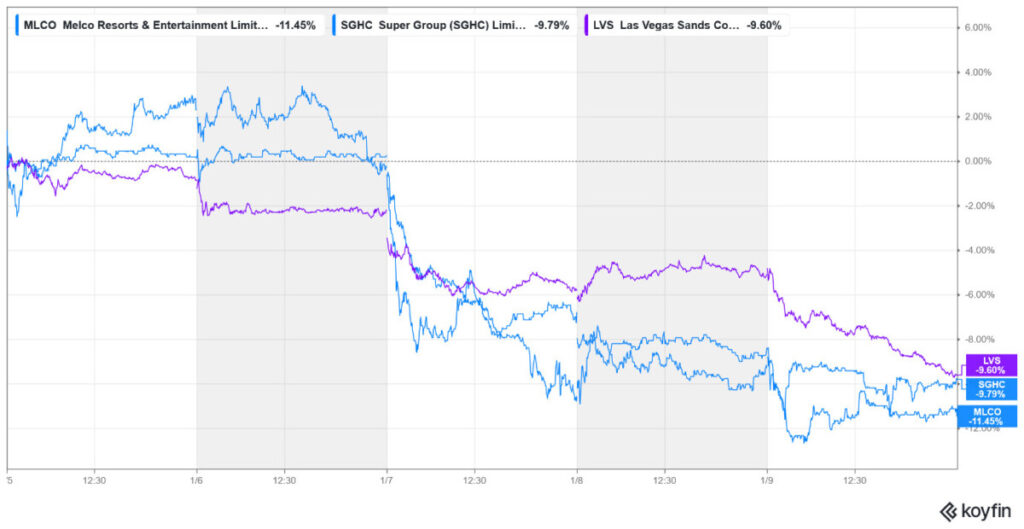

Huya Inc. and Century Casinos were among the major gainers last week. Meanwhile, Melco Resorts and Super Group underperformed in what was overall a dismal week for gaming stocks.

Top Gainers

Huya Inc. (NYSE: HUYA) +15.51%

Huya was the biggest gainer in our coverage of gaming stocks, rising 15.5% last week and extending its year-to-date gains to 21.5%. Last week, Huya reported that the mobile version of the popular social deduction game Goose Goose Duck (which it co-published with Kingsoft Shiyou) reached No. 1 on the Apple App Store’s free games chart in mainland China, which helped trigger the rally.

The game recorded over 5 million new registered users within its first 24 hours of open beta (launched Jan. 7).

Century Casinos (NYSE: CNTY) +14.49%

Century Casinos also saw double-digit gains last week, bucking the broader sell-off in gaming stocks. There was no major announcement from the company last week, and it continued its momentum from the preceding week, when it saw a buying spree following the announcement of a $1.5 million share buyback plan. The stock, however, still closed in the red in that week due to selling pressure before the announcement.

Meanwhile, Century Casinos’ recent financial performance has been dismal, and it missed on most key metrics in Q3. For instance, its revenues came in at $153.7 million, which was significantly below the $163.4 million that analysts had modeled. Its net loss rose 30% year-over-year to $10.5 million, which was also higher than analysts’ expectations.

CNTY is a microcap company with limited trading volumes and is quite volatile, making it a risky proposition, at least for risk-averse investors.

Caesars Entertainment (NYSE: CZR) +4.54%

With gains of 4.5%, Caesars Entertainment was among the other major gainers last week. While the stock fell nearly 30% last week and underperformed gaming peers, analysts now see it as a good stock to buy, and last week’s gains were led by positive commentary from brokerages.

Last week, Susquehanna upgraded Caesars from “Neutral” to “Positive” and raised its price target from $25 to $31. Analysts cited several “attractive risk/reward” factors, including an expected sequential improvement in Las Vegas operations due to a strong convention and group business mix in early 2026.

It also believes that upcoming tax refunds and easing inflationary pressures in the spring will boost discretionary spending.

Last week only, Stifel named Caesars one of the “Top Ideas” in its 2026 Gaming & Leisure Outlook. Stifel increased CZR’s price target to $39, suggesting over 60% upside from current levels. The firm highlighted that the stock was deeply undervalued after a rough 2025 and is poised to benefit from growth in the iGaming market. Also, Stifel sees the rising IRS slot reporting limit (to $2,000) as a positive for CZR, as it is expected to reduce friction for gamblers and lower administrative costs for operators.

Along with Caesars, Stifel also named Flutter Entertainment and Penn Entertainment as “top picks” for 2026. Like Caesars, both these stocks underperformed last year, and the brokerage sees value in them at these levels.

Top Losers

Melco Resorts & Entertainment (NYSE: MLCO) –11.45%

With a drawdown of nearly 11.5% last week, Melco Resorts was the biggest loser in our coverage of gaming stocks. The primary driver was a broader sell-off in Macau-linked gaming stocks. Despite a record 40 million visitors to Macau in 2025, investor sentiment turned cautious as the market digested more conservative 2026 Gross Gaming Revenue (GGR) forecasts. The Macau government recently projected 2026 GGR at approximately $29.4 billion, a figure that reflects caution due to global economic uncertainties and external risks.

Earlier this year, JPMorgan also forecasted a “cooling” of growth for Macau casino revenue throughout 2026. The firm’s analysts noted that while the mass market has recovered well, the VIP gaming segment continues to lag significantly.

Since Melco has historically relied more heavily on the premium and VIP segments than some of its peers, JPMorgan’s report led to a sell-off in the stock.

Also, there are concerns over rising labor costs at a time when growth is slowing down, and last week, Melco joined other major operators (like MGM China and Galaxy) in announcing a one-month discretionary bonus for non-management employees. While this supports staff retention, it signals a period of higher operating expenses for the quarter.

Super Group (NYSE: SGHC) –9.79%

Super Group stock fell by nearly 10% last week and made it to the list of the week’s top losers. There was no major news related to the company last week, and the losses appear to be a profit-taking exercise following the stellar gains last year.

SGHC was incidentally among the major gainers last year, backed by its stellar financial performance. Notably, after its stellar Q3 2025 earnings, SGHC raised its full-year revenue guidance to a range of $2.17 billion to $2.27 billion, up from the previous guidance of $2.125 billion to $2.20 billion. Similarly, it raised the annual EBITDA guidance to $555 million and $565 million.

While the stock saw selling pressure last week, Benchmark maintained its buy rating and $17 target price on SGHC. The overall analyst sentiment is bullish towards the stock, with a mean target price of $16.30, which is almost 55% higher than the current price.

Las Legas Sands (NYSE: LVS) –9.60%

Las Vegas Sands was among the other major losers last week, shedding 9.6% of its market capitalization. The fall was driven by concerns over the Macau market, where both growth and margins are expected to be under pressure this year.

Other Gaming Industry Developments

In what was yet another shot in the arm for prediction markets, last week, Google said that it will allow authorized prediction markets in the US to advertise through Google Ads starting January 21, 2026.

Separately, the Alcohol and Gaming Commission of Ontario (AGCO) issued a CA$350,000 penalty to FanDuel for advertising violations, which the operator is currently contesting.

Meanwhile, despite the regulatory uncertainty, prediction markets continue to see traction, and last week, Dow Jones announced an exclusive partnership with Polymarket. As part of the deal, Polymarket’s prediction data will be integrated across Dow Jones consumer platforms like The Wall Street Journal, Barron’s, MarketWatch, and Investor’s Business Daily.