Gaming stocks that underperformed markets last year had another disappointing week. The Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, fell 5.2% last week, which was much worse than the 0.42% decline in the S&P 500 Index.

It was the sixth consecutive week that BETZ underperformed the S&P 500 Index, and it is already down nearly 9% for the year, while the broad-based index is up over 1% over the period.

There weren’t many gaming stocks that closed in the green last week, but Codere Online managed to buck the trend and saw low single-digit gains. Meanwhile, DraftKings and Rush Street Interactive were among the major losers.

Biggest Gainers

Codere Online (NYSE: CDRO) +3.23%

Codere Online gained over 3.2% last week and was the biggest gainer in our coverage of gaming stocks. There wasn’t any major company-specific news last week, though, and the rise looks like a technical rebound. The stock, meanwhile, has low trading volume, making it prone to volatile price moves.

Gaming & Leisure Properties (NYSE: GLPI) +0.87%

Gaming & Leisure Properties gained nearly 1% last week as the broader Real Estate Investment Trust (REIT) sector experienced a tailwind. Investors appeared to be rotating back into high-yield, stable-income stocks as they sought defensive plays ahead of the Q4 earnings season. GLPI has a dividend yield of almost 6.9%, and many investors seek solace in high-dividend names during periods of market volatility, as we currently have.

Biggest Losers

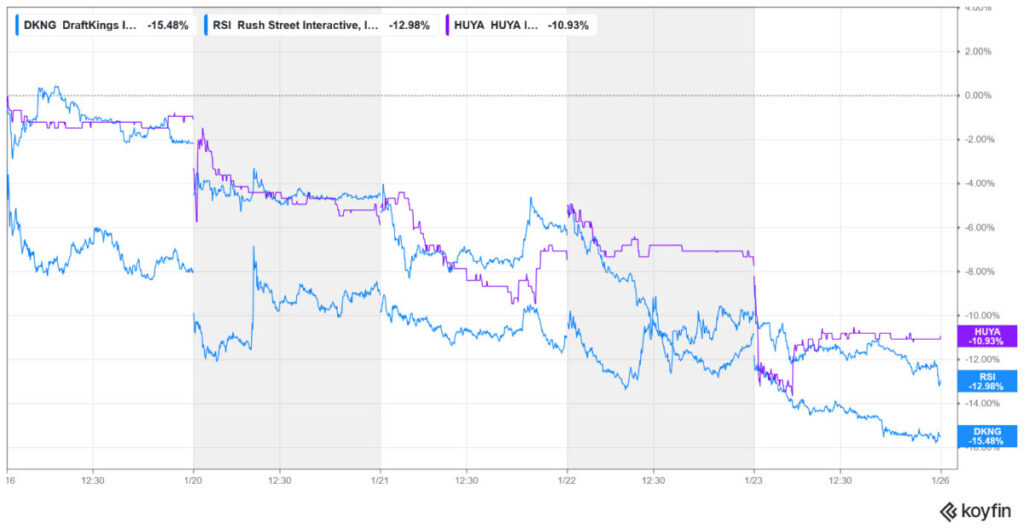

DraftKings (NYSE: DKNG) –15.48%

With a drawdown of over 15% last week, DraftKings was the biggest loser in our coverage of gaming stocks. The company, which has ventured into prediction markets amid growing competition from the likes of Kalshi and Polymarket, has suffered new challenges

Data from the New York State Gaming Commission showed that gross gaming revenue for the week ending January 11 plummeted by approximately 40% compared to the same period last year. The steep decline came amid the NFL playoff season and served as yet another reminder of how legacy sportsbooks are losing market share to prediction markets.

While the pivot to prediction markets could help DraftKings gain ground, the company would need to compete with established players. Commenting on FanDuel and DraftKings entering into prediction markets, Needham analyst Bernie McTernan said, “It’s still early days for the products, and Kalshi has a lot more functionality than them at this time, so I would be surprised if they were gaining a lot of traction.”

Meanwhile, in what could add to DraftKings’ woes, the NCAA earlier this year called for a federal halt to certain bets on college sports.

Rush Street Interactive (NYSE: RSI) –12.98%

Rush Street Interactive, which has otherwise been strong in recent months, fell nearly 13% last week in what was likely a technical sell-off. Reports of the company’s CEO selling shares did not help matters.

Notably, Colombia – a key market for RSI – introduced a new “emergency” tax on gaming revenue, which went into effect on January 1, 2026, and would hit Rush Street Interactive. Amid new headwinds for RSI, Susquehanna lowered the stock’s target price by $1 to $22.

Huya (NYSE: HUYA) –10.93%

Huya, which was among the major gainers in the preceding two weeks, lost nearly 11% last week.

Despite beating some analyst estimates in previous reports, investors remain cautious about Huya’s long-term profitability. While revenue growth has shown signs of recovery (up nearly 10% year over year in the most recent quarter), the company has continued to struggle with losses.

Notably, Huya stock rallied earlier this year after the company reported that the mobile version of the popular social deduction game Goose Goose Duck (which it co-published with Kingsoft Shiyou) reached No. 1 on the Apple App Store’s free games chart in mainland China.

The broader Chinese tech sector has been on a massive rally in recent weeks, driven by a buying spree in tech stocks. Trading volumes also rose to record levels amid a surge in margin financing, which too reached historical highs. Chinese regulators, meanwhile, signaled caution over speculative trading and tightened margin financing rules, prompting a sell-off in some high-flying Chinese companies like Huya.

Key Gaming Industry Developments Last Week

ICE Barcelona 2026 (Jan 19–21) was the most significant event last week, and the world’s largest gambling exhibition saw over 65,000 visitors and more than 600 exhibitors. A key highlight was the launch of “Academia America Latina,” a dedicated forum for the booming Latin American market.

Notably, many global regulators, including those from the UK, convened at the ICE to discuss a unified front against illegal gambling. A major theme was how high taxation in Europe is inadvertently pushing players toward unregulated markets. Incidentally, at its Autumn budget last year, the UK hiked gambling taxes, which has led to a sell-off in companies that focus on that market.

Meanwhile, in yet another sign of Wall Street majors warming up to prediction markets, Charles Schwab CEO Rick Wurster said that the brokerage firm is “absolutely open” to offering prediction markets on its platform, as long as they’re related to investing and not gambling.

Previously, during Goldman Sachs’ Q4 earnings call last week, CEO David Solomon called prediction markets “super interesting” and confirmed that he had personally met with leaders of two major prediction market firms.