Things have been going from bad to worse for gaming stocks, and the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ) fell over 5% last week, which was well ahead of the 1.4% decline in the S&P 500 Index. The ETF, which invests in a basket of gaming companies, has underperformed the broader markets for nine consecutive weeks and is now down nearly 18% for the year.

Corsair Gaming and Playtech Plc were among the major gainers last week, while DraftKings and Melco Resorts were among the major losers.

Major Gainers

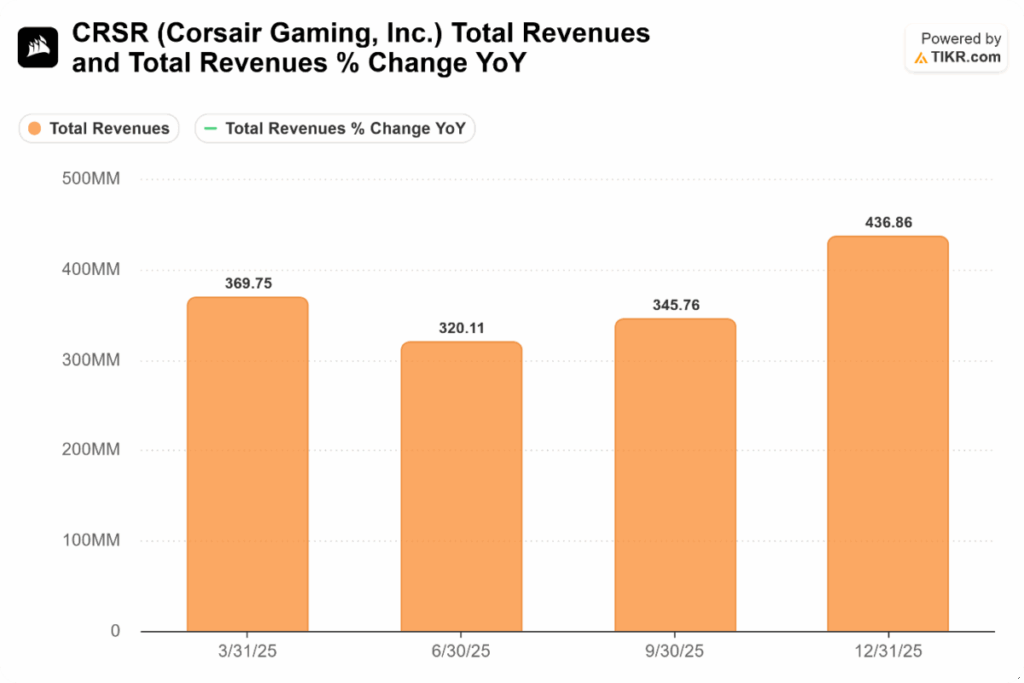

Corsair Gaming (NYSE: CRSR) +31.3%

Corsair Gaming was by far the biggest gainer in our coverage of gaming stocks, soaring over 31% last week and helping it turn positive for the year. It was a turbulent week, though, for the stock, and during the week it fell to record lows, briefly falling below the $5 price level, which is the dividing line for characterizing stocks as penny stocks.

However, while markets were apprehensive about the company’s financial performance, it delivered a strong set of numbers for Q4 2025, beating on both the top and bottom lines. Its full-year revenues rose 12% to $1.47 billion, while GAAP gross profit increased to a record $425.9 million. The adjusted EBITDA came in at $100.6 million, which was ahead of the company’s guidance.

Corsair also announced a $50 million buyback, the first in its brief history as a publicly traded company. Additionally, it reduced debt by $52 million last year amid the deleveraging push. These are big numbers for Corsair Gaming, whose market cap is just about $725 million despite last week’s rally.

Meanwhile, the company’s earnings report wasn’t flawless, and its 2026 revenue guidance of $1.4 billion was well below Street estimates and implied a year-over-year decline. While CRSR’s Q4 earnings received a thumbs-up from the market, sending its stock north by over 48% on Friday, the analyst community wasn’t as impressed.

Analysts at Craig Hallum, Baird, and Barclays lowered CRSR’s target price following the report. B. Riley, however, raised its target price from $6 to $7 while maintaining its “neutral” rating.

Playtech Plc. (LSE: PTEC) +11.85%

Playtech Plc continued its good run and rose nearly 12% last week, extending its year-to-date gains to 17.2%. There wasn’t any major company-specific news, though, and last week’s rally is a continuation of the uptrend that we have seen in recent weeks.

Notably, on February 5, 2026, Playtech released an upbeat FY25 trading update. The company announced that it expects adjusted EBITDA for the year to be at least €195 million, which was well ahead of the analyst consensus of roughly €177 million.

Playtech is upbeat about its performance in the US and Mexico and is confident of meeting its medium-term targets of adjusted EBITDA of €250-300 million and free cash flows of €70-100 million.

It, however, warned that “For 2026, the Company remains mindful of ongoing sector headwinds, including the scheduled increase to gambling taxes in certain markets, including the UK.”

Betr Entertainment (ASX: BBT) +5.88%

Betr Entertainment was among the other major gainers last week. The stock has looked strong this year and is already up 35%. Last month, the company reported a 24.5% increase in turnover for the December quarter, which was supported by a growing base of over 163,000 active customers.

Additionally, the board announced an on-market buyback of up to 10% of its ordinary shares. Management stated the shares were trading “below their intrinsic value,” which signaled strong internal confidence to the market.

Biggest Losers

DraftKings (NYSE: DKNG) – 18.26%

DraftKings continued its dismal run, losing over 18% last week and extending its YTD decline to almost 37%. Last week’s drawdown was in response to the company’s Q4 2025 earnings. It reported a 43% rise in revenue, while adjusted EBITDA soared almost fivefold to $343 million – both metrics hitting record highs.

However, the company’s 2026 guidance spooked investors. DraftKings projected 2026 revenue between $6.5 billion and $6.9 billion, which fell well short of the $7.3 billion analysts had expected. The adjusted EBITDA guidance of $700 million to $900 million also fell short of the $1 billion analysts had expected.

The company’s CEO, Jason Robins, pitched prediction markets as a key growth driver and said, “We plan to deploy growth capital to build the best customer experience in Predictions, and acquire millions of customers. We have the playbook to execute and win.”

However, markets are concerned about declining revenues in the traditional sportsbook business and the nascent prediction business’s inability to fill the void.

All eyes would now be on the Investor Day on March 2, where the company intends to provide more details on its “efficient and powerful business model.” For now, though, markets are not buying the optimism, and BMO, Canaccord, BTIG, and Benchmark lowered the stock’s target price following the Q4 earnings release.

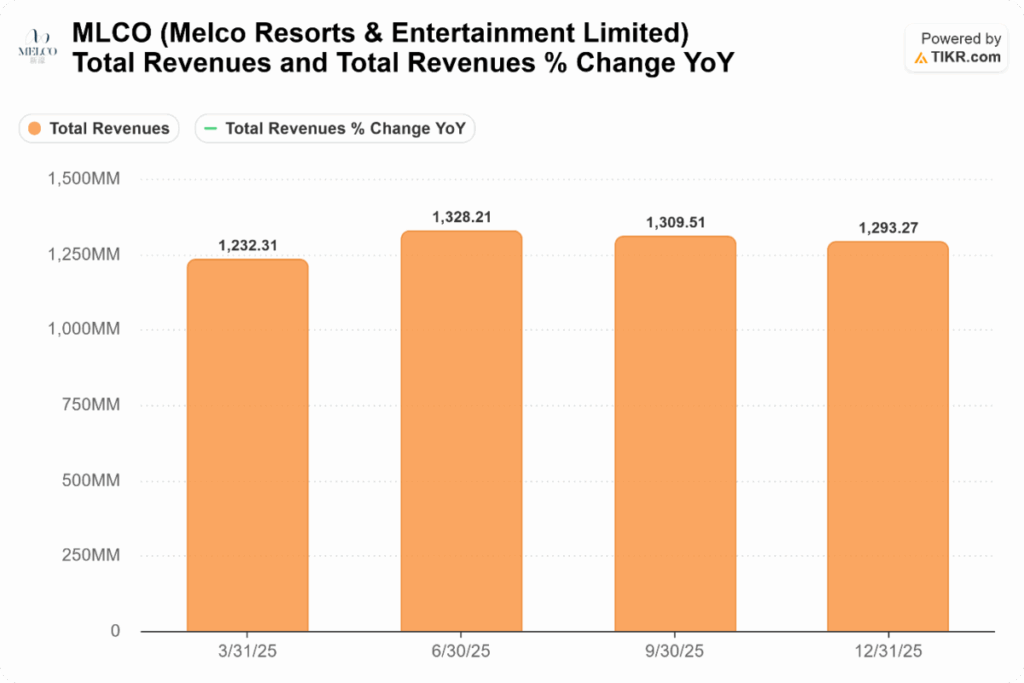

Melco Resorts (NYSE: MLCO) –12.91%

Melco Resorts was among the major losers last week, shedding nearly 13% and extending its YTD decline to 27%. Last week’s decline could be attributed to mixed Q4 earnings: while the company’s revenues came in slightly ahead of estimates, it reported EPS of 5 cents, which was half of what analysts expected.

The performance of City of Dreams Manila, whose Gross Gaming Revenue (GGR) dropped 26%, was a significant drag on earnings. The adjusted EBITDA for the Manila property fell 42% YoY as it continues to navigate tepid demand and higher competition in that market. Melco also dropped plans to sell the property. During the earnings call, it said, “Although we considered various alternatives, we did not feel that any of those options would allow the value and potential of the property to be fully realized.”

Light & Wonder (ASX: LNW) – 12.53%

Light & Wonder, which had otherwise had a strong start to the year, fell 12.5% last week and is now negative for the year. The recent losses look like a profit-taking exercise following sharp gains in January, when the stock soared after the announcement that it would settle all global legal disputes with Aristocrat Leisure.

The dispute centered on allegations that Light & Wonder used Aristocrat’s trade secrets and copyrighted work to develop its popular Dragon Train and Jewel of the Dragon game.

It is a costly settlement for LNW, though, as the company agreed to pay US$127.5 million (approx. AU$190 million) to Aristocrat to settle the case.

Major Gaming Industry Developments

Last week, SEGG Media (formerly Lottery.com) announced a $61 million deal to acquire a majority stake in Veloce Media Group, aiming to merge sports, gaming, and digital media.

In another major development, a new bill in Illinois proposes to end the controversial per-bet fee that the state enacted last year.

Elsewhere, FanDuel announced that beginning on March 2, 2026, it will no longer accept credit cards as a deposit method for U.S. customers to fund their betting accounts. The move is in response to the arbitrary fees charged by credit card companies, which often treat them as cash advances.

We are still in the Q4 earnings season, and several key earnings were released last week. Wynn Resorts reported its Q4 earnings, and while its revenue rose marginally, its net profit dropped and missed analysts’ estimates, leading to a sell-off in the stock. Looking forward, Caesars Entertainment and Rush Street Interactive are among the companies reporting this week.

Earnings should be a key driver of gaming stocks’ price action over the next two weeks as investors gauge the impact of slowing consumer spending and competition from prediction markets on their profits. Being a high-beta sector, gaming stocks might remain volatile amid turbulence in broader markets and a sell-off in tech stocks.