The gambler’s fallacy is a type of cognitive bias related to the perception of probability. We’ll explain this misconception by illustrating some common examples before discussing the risks involved. Heed our expert advice and avoid succumbing to the gambler’s fallacy.

Key Beats

- Gambler’s Fallacy is the assumption that random events are influenced by previous outcomes.

- Do not think you will “surely win” on a particular hand or betting round after a streak of losses on the same hand. That’s Gambler’s Fallacy at play, and it can lead to financial ruin.

- You can avoid Gambler’s Fallacy by understanding independent vs dependent outcomes and sticking to logical bankroll management.

What Is Gambler’s Fallacy?

Simply put, the Gambler’s Fallacy is an illusion. It is the belief that previous outcomes influence random events, where bettors assume that an occurrence will become less common over time because it is becoming more common in the present.

To better understand Gambler’s Fallacy, consider a scenario where someone logs into their casino account to play blackjack. In the first round, they lose heavily to the dealer. They play another round and lose again.

Hoping for a third-time lucky scenario, they bet again and lost to the dealer for a third straight time. They may want to give up and save their remaining funds, but the gambler’s fallacy sets in. They think, “the dealer won the last three rounds, I’m winning this one for sure, so let me bet big and cash out big at the same time. My winnings will surely cover the entire cost I have lost today.”

After betting big, they lose heavily, and their funds are depleted. It’s essential to remember that the gambler’s fallacy in this scenario does not see each blackjack round as a random occurrence.

Gambler’s Fallacy History

The Gambler’s Fallacy began with an impossible event that occurred on August 18, 1913, at the famous Monte Carlo Casino. During a game of roulette, the wheel astonishingly landed on black 29 consecutive times. This outcome was so improbable that it has since become legendary in gambling history.

As the streak continued, players grew increasingly convinced that the next spin simply had to be red. By the tenth spin, most gamblers were betting huge sums on red, believing the odds demanded a correction. Instead, black kept appearing, spin after spin, wiping out fortunes and perfectly illustrating the danger of the gambler’s fallacy.

Gambler’s Fallacy Examples

We’ve discussed the most famous example of the gambler’s fallacy, but that was a once-in-a-lifetime occurrence. Here are some more gambler’s fallacy examples in real life.

Tossing a coin

Coin flips are the simplest example, as there are just two outcomes. If the coin is fair, the probability of tossing a head or a tail is 50%. But is that always true? What happens when you’ve already flipped heads ten times? We must see some tails eventually, as the chances are 50-50. Surely we’re more likely to see that on the next flip?

No. That’s the gambler’s fallacy in a nutshell. With an infinite number of flips, there’ll be a distribution of precisely 50%. But an individual coin toss is not an infinite number – it’s one isolated flip. The probability is unaffected by history.

Hot slots

If you’ve spent time around slot players, you’ll be familiar with the idea of machines getting ready to pay. There may have been some truth in that, historically, due to old-fashioned coin collection mechanisms. However, modern real money slots are computer games. They’re glorified calculators, programmed to pay a fixed percentage over time.

It doesn’t matter if the slot paid nothing in the last 20 spins. The date of the previous jackpot is irrelevant. You’re just as likely to win on this spin as any other. Theoretically, you can even win the jackpot on two consecutive spins. It’s improbable, of course – but it’s possible.

Winning streaks

Sports bettors are just as vulnerable to the gambler’s fallacy. Betting on basketball or baseball games is different from betting on roulette. The odds are not fixed due to the variables involved. A star player could be injured. The weather might come into play. Teams travel across the country, which can cause fatigue.

Becoming a successful sports bettor requires an analytical mind. Yet, many people believe in streaks. Just because you’ve won your last five bets in a row, it doesn’t mean you’ll win again next time. Nor does it mean you’re due to make the wrong pick.

Independent vs. Dependent Outcomes in Betting

Understanding gambler’s fallacy requires bettors to differentiate between independent and dependent outcomes correctly.

Independent Outcomes

These are unconnected events, like the examples of gambler’s fallacy we just discussed – coin tosses and roulette spins, for instance. When you flip a coin, the result has no bearing on the outcome of future flips. They are independent of each other.

Dependent Outcomes

On the other hand, a dependent outcome is directly influenced by a different event. For example, when playing blackjack at an online casino, the probability of drawing another specific card changes when a card is removed from the shoe without replacement. The outcome of the second event depends entirely on the result of the previous event.

Knowing that dependent outcomes exist, it’s easy to see how our brains can be tricked into thinking all probability events are connected.

The Risks of Gambler’s Fallacy

Succumbing to the gambler’s fallacy poses two main risks, the first of which is chasing your losses.

Irrational Decision Making

If you’ve convinced yourself a random outcome is due, it’s not hard to imagine upping the stakes.

Let’s say you’re playing roulette and have placed four prior $10 bets on black. They all lost, so you’re sure a black number is coming. A winning $50 bet here would return $100, covering the prior $40 loss and leaving you $10 up overall. It feels like a sure thing.

In reality, the probability is unaffected by past results. If this poorly considered wager loses, you must place an even bigger bet to cover your debt. These exponential increases will quickly lead to ruin. You should always gamble responsibly, and with funds you can afford to lose.

The Trap of Betting Systems

Another big trap is the belief in betting systems. You subscribe to these if you succumb to the gambler’s fallacy. With a deep understanding of sports and statistics, it’s possible to beat the bookmakers. But those bets involve dependent outcomes.

It’s not possible to devise a winning system for independent outcomes, such as the toss of a coin. Most casino betting systems involve some variation of Martingale, where you progressively increase your stake after each result. This is just chasing your losses with extra steps and should be avoided at all costs.

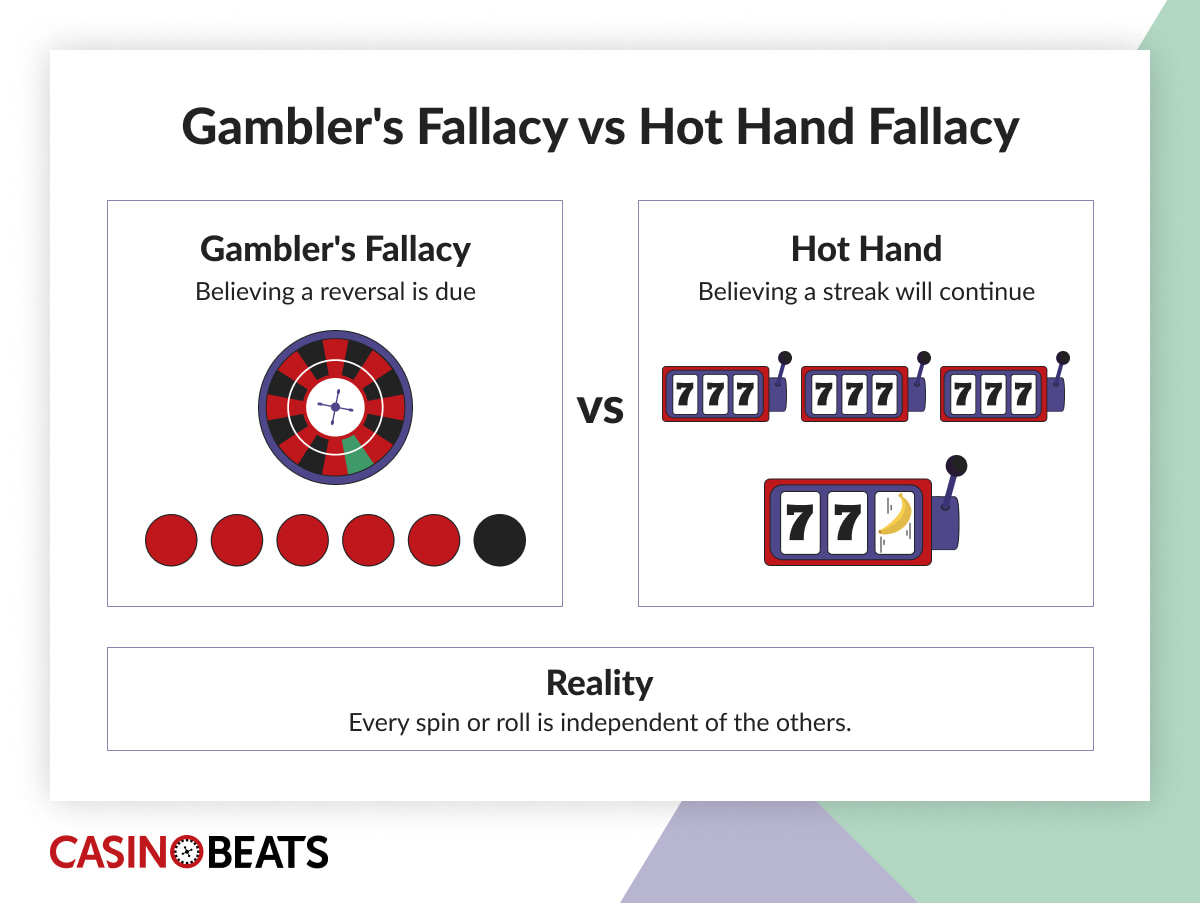

Gambler’s Fallacy vs. Hot Hand Fallacy

Gambler’s fallacy and hot hand fallacy are two intertwined terms that are opposite sides of a coin. The two fallacies involve flawed thinking about probability, with bettors assuming patterns in random events. But, despite a similarity, both terms are quite different. So, what’s the difference:

- The Hot Hand fallacy refers to a bettor thinking he is more likely to have continued winnings in future bets because of a string of successes.

- On the other hand, Gambler’s Fallacy is the belief that a losing streak is due for a win.

The table below provides a quick comparison between gambler’s fallacy and hot hand fallacy, showing how both biased thoughts affect betting behavior.

| Aspect | Gambler’s Fallacy | Hot Hand Fallacy |

|---|---|---|

| Bettor’s Thoughts | A winning or losing streak will end soon | A winning streak will continue |

| Example | Expecting red after three or more sequences of black in roulette | Expecting 7 or 11 craps throw to continue after two successive ones |

| Behavioral Outcome | Chasing losses | Overconfidence in continued wins, resulting in bigger bets. |

In essence, the gambler’s fallacy expects a reversal, while the hot hand fallacy expects a continuation. Both fallacies ignore the reality that each event, in games of chance, is independent.

Staying in Control: How to Avoid Gambler’s Fallacy

The gambler’s fallacy can quietly drain your bankroll and confidence. At worst, it could lead to financial ruin. The good news is you can train your mind to spot the trap and avoid it before it strikes. Below are a few smart and practical habits to help you stay logical, protect your funds, and make sure you’re in control of every bet.

- Ignore streaks and clusters: As tempting as it is to look for patterns, don’t. If you’re playing roulette, and the last three results were 10, 11, and 12, that’s a fun little coincidence. By all means, share a joke with your tablemates – gambling is supposed to be fun, after all. But don’t try to use it as some sort of justification for your next bets. It doesn’t mean the next number will be 13, as every spin is an independent outcome.

- Stick to a predetermined betting system: All gamblers should understand bankroll management before playing. A crucial part of this is determining the right bet size. Whether you opt for a fixed betting strategy with a consistent stake, or some kind of progressive system, make sure you stick to it. Increasing the wager because you “feel” like something is “due” to happen is a recipe for disaster.

- Take each result as it comes: Never make predictions about random events. Watch the action unfold and move to the next bet. Sure, it’s possible to count cards in blackjack, which definitely would shape your decisions. But there’s no logic in trying to time a win when playing games of chance like roulette. Every outcome is totally unrelated to whatever went before. The table doesn’t owe you anything.

Conclusion

The mistaken belief that random events are somehow connected – commonly referred to as the gambler’s fallacy – is surprisingly common. However, if you’re to enjoy any success when gambling, you must understand that it’s not true. Each roll of the dice, turn of a card, and spin of the wheel is entirely independent. Whatever you do, don’t fall into the trap.

FAQs

Also known as the Monte Carlo fallacy, this is the false belief that independent events are somehow linked. For example, if a roulette wheel produces nine red numbers in a row, the next one must be black, as this result is due.

The most famous example dates back to 1913, when a Monte Carlo roulette wheel produced an incredible run of 26 consecutive black numbers. Players lost millions by betting on red, mistakenly expecting the sequence to end.

Gambler’s fallacy is real. It’s a form of cognitive bias that leads to incorrect beliefs around probability. Take the toss of a coin, for instance. If you think the outcome is affected in any way by prior results, you’re mistaken.

Psychologists Amos Tversky and Daniel Kahneman link the gambler’s fallacy to believing in the “law of small numbers.” This false notion asserts that random processes will self-correct in the short term. In other words, streaks will end quickly.

First, read about the true nature of variance or randomness. Once you understand this concept, it’s much easier to consider specific events and probabilities individually. In addition, it’s essential to keep a clear head when gambling and avoid emotional thinking.