Gaming stocks, which underperformed the broader market in October and extended their dismal run into the first half of November, outperformed the market in the second half of the month. The Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which underperformed the S&P 500 Index for six consecutive weeks, has now outperformed it for the last two weeks, extending its year-to-date gains to over 10%.

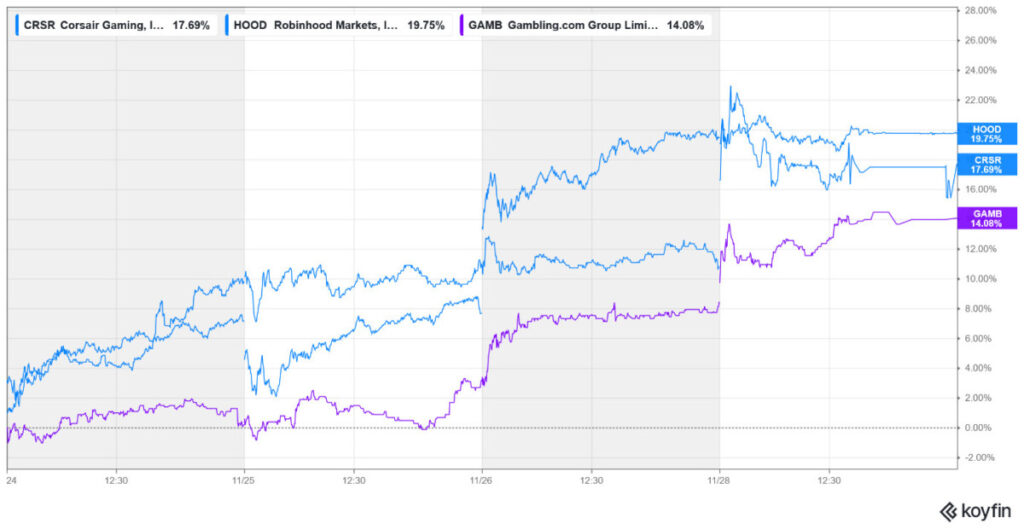

In the otherwise holiday-shortened week, Robinhood and Corsair were among the biggest gainers. Meanwhile, Super Group and Betr Entertainment made it to the list of biggest losers.

Biggest Gainers

Robinhood (NYSE: HOOD) +19.75%

Robinhood, which saw a double-digit dip in the preceding week, was last week’s top gainer with a gain of almost 20%. While the rally in tech stocks helped propel HOOD stock higher, it saw double-digit gains on Wednesday after announcing plans to enter into a joint venture with market maker Susquehanna International Group (SIG).

This venture will acquire a 90% stake in MIAXdx, which operates LedgerX, a regulated clearinghouse for cryptocurrency derivatives, previously part of the collapsed FTX.

These licenses will allow Robinhood to operate its own futures and derivatives exchange, significantly expanding and internalizing its rapidly growing prediction markets business. Notably, during the Q3 earnings call, Robinhood CEO Vlad Tenev stated that prediction markets represent Robinhood’s fastest-growing business ever, reaching the milestone of generating $100 million or more in annualized revenue in under a year. Robinhood’s prediction volumes are growing at an astronomical pace and have doubled every quarter since the launch last year.

However, the business continues to face legal and regulatory issues, and last week the company announced that it would suspend its Nevada sports-event contract business, effective December 1, 2025, for the duration of any ongoing appeal proceedings.

Corsair Gaming (NYSE: CRSR) +17.69%

Corsair Gaming, too, saw over 17% in gains last week. The gains came amid a broad-based market rally and a rebound following the decline in the preceding week when CRSR tumbled after missing Q3 earnings estimates.

CRSR CEO Thi La disclosed that she bought 50,000 shares of the company last week. Insider buying is invariably a positive sign, especially at a time when the stock has been trading weakly, as it helps restore investor confidence.

Meanwhile, Corsair Gaming announced a leadership transition last month, appointing Gordon Mattingly as CFO, effective December 2, 2025. He will succeed Michael G. Potter, who will remain an employee until the end of the year in an advisory capacity to the CEO and thereafter as a consultant through March 31, 2026, to ensure a smooth transition.

Playtech Plc (LSE: PTC) +17.67%

Playtech shares rose a cool 17.6% last week primarily because the company reassured investors that it expects to meet its full-year expectations for 2026, despite the UK government’s recent announcement of a significant rise in online gaming tax as part of the new budget.

While the company said that the tax hike would lead to a hit of “high teens millions of euros” (before mitigation) in 2026, it added, “However, given the group’s geographic diversity across regulated markets and strong performance and prospects outside of the UK, Playtech remains comfortable that it can meet market expectations for the full year 2026.”

Gambling.com (NYSE: GAMB) +14.08%

With gains of over 14%, Gambling.com made it to last week’s top gainers. There wasn’t any major company-specific news last week, and the rise looks like a technical rebound amid the broader market rally.

The stock had tumbled earlier in the month after mixed Q3 earnings. The company reported Q3 2025 revenue of $38.98 million, which fell short of the analyst consensus estimate of $41.04 million. The topline miss was more than overshadowed by the EPS beat. During the earnings call, GAMB noted that revenue was negatively impacted by less favorable search rankings that persisted through the third quarter.

Major Gaming Stock Losers

Super Group (NYSE: SGHC) -6.56%

There weren’t many losers in the gaming space last week, but Super Group shares fell over 6.5% after the gambling tax hike in the UK. The new UK duties include raising the remote gaming duty on online casinos to a higher-than-expected 40% from 21% and increasing the general betting duty on online sports bets to 25% from 15%.

Notably, Super Group, the parent company of Betway sportsbook, which announced an exit from the US market last year, has thrived in Europe, and the UK tax hike is a headwind for the company, which has otherwise reported stellar earnings this year, helping its stock rally over 73%.

Following the strong Q3 performance, SGHC raised its full-year revenue guidance to a range of $2.17 billion to $2.27 billion, up from the previous guidance of $2.125 billion to $2.20 billion. Similarly, it raised the annual EBITDA guidance to $555 million and $565 million.

Betr Entertainment (ASX: BBT) -4.55%

Betr Entertainment also made it to the list of major losers last week with a fall of over 4% which extended its year-to-date losses to 30%. There was no major news related to the company, and the fall appears to be related to profit-taking. In fact, if anything, the company presented a positive outlook at the AGM held last week, noting they entered FY26 in their strongest position, with strong turnover growth and a focus on market consolidation in Australia.

Notably, in the week ending November 7, Betr released its Quarterly Activities Report and Appendix 4C for fiscal Q1 2026 last week, which showed turnover rising 27% year-over-year to Australian dollars (AUD) $363 million. The company’s net win margin expanded to 10.5% which helped push net wins to AUD $38 million – 36% higher than the corresponding quarter last year.

The tax changes in the UK also seemed to have played a part. While Betr is an Australia-focused company, bad news in one major regulated market invariably has a domino effect across the entire sector as investors fear similar regulatory risks could emerge in other jurisdictions.

Other Major Gaming Industry Developments

On the legal and regulatory front, Spain’s gambling regulator issued fines amounting to over €33 million ($38 million) to gambling companies. This includes heavy penalties for unlicensed operators as well as fines to high-profile brands, including Betfair, 888, and Codere.

Looking stateside, Kalshi was hit with a nationwide class-action lawsuit alleging it is duping users into believing it is not a sportsbook. Penn Entertainment, however, received a boost in its legal fight with activist investor HG Vora after an independent Special Litigation Committee (SLC) investigation concluded that the board acted “in good faith” when it reduced the company’s director slate earlier this year.

Elsewhere, South Africa proposed a 20% tax on online gambling. Critics, however, argue that the proposals, if accepted, would only fuel illegal gambling activity.

Meanwhile, the gaming industry continued to witness increased M&A activity last week, with EveryMatrix acquiring user experience specialist Goma Gaming, signaling a continued focus on improving the end-user experience in online gaming.