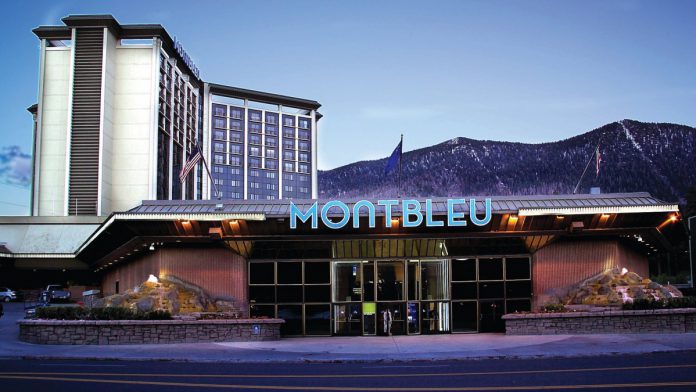

Bally’s Corporation has announced the completion of its previously announced acquisition of the Stateline, Nevada, based MontBleu Resort Casino & Spa from Caesars Entertainment.

The purchase was first detailed in April 2020 in a $155m joint deal that would also see the operator gain Louisiana’ Eldorado Shreveport Resort and Casino, which subsequently gained completion in December of last year.

“I want to thank the team members of MontBleu for all of their hard work and dedication throughout the years with the Caesars organisation, particularly during the COVID-19 pandemic,” said Tom Reeg, CEO of Caesars Entertainment. “We wish all of them continued success under Bally’s ownership.”

MontBleu, which is situated minutes from Lake Tahoe, features approximately 418 slots and 17 tables, 438 hotel rooms, as well as in the region of 14,000 square feet of convention, meeting & exhibition space.

George Papanier, president and chief executive officer of Bally’s Corporation, added: “MontBleu is a premier entertainment asset that is commensurate with the iconic Bally’s brand, and advances our ongoing portfolio diversification strategy.

“With the close of this transaction, we look forward to integrating the property into the Bally’s family, and utilising it as an attractive destination for our loyal Bally’s customers to drive visitation to Lake Tahoe.”

Bally’s, whose M&A spree since rebranding from its former Twin River Worldwide Holdings moniker is showing no signs of slowing down, maintains that it is striving to become “the first truly vertically integrated sports betting and igaming company in the US with a B2B2C business model”.

Last month, Gamesys Group backed a proposed $2bn business combination with Bally’s that would see the US casino operator absorb the company in a deal worth 1,850 pence per share.

This deal, which would see Bally’s acquire the entire issued and to be issued ordinary share capital of Gamesys under the terms of the deal, followed the completion of its Monkey Knife Fight purchase.