Digital Gaming Corporation, Everi and White Hat Studios are best placed to challenge the status quo of the US’ online casino ecosystem, said Rick Eckert, Managing director of Slot Performance and Analytics at Eilers & Krejcik Gaming, following publication of a latest monthly round-up.

As Evolution, International Game Technology and Light & Wonder cemented their dominance in the latest igaming rundown, Eckert is also predicting that Aristocrat’s real money gaming division will eat into the share of the latter.

“Evolution’s most dominant hold on the US market continues to be live dealer games with little to no competition in the US market to date while IGT has a strong position with table games and a dominant hold with poker products,” he explained.

“The major challenge to these suppliers comes mostly from operators releasing internally developed content to compete, which has begun with table games and video poker.

“Light & Wonder’s status quo challenge will come mostly in the form of top tier slot content that land based customers in the US are used to seeing.

“Insert the Anaxi (Aristocrat) team here, who just this month have made the reporting minimums to be included in our Online Game Performance Report.

“While Anaxi will certainly eat into LNW’s share we expect them to also impact IGT and Evolution as well but to a lesser degree based on their lack of table game presence in the US market and mediocre video poker performance.

“DGC, Everi, and White Hat Studios have already impacted the big three suppliers and performance suggests this will continue as they all expand as well.”

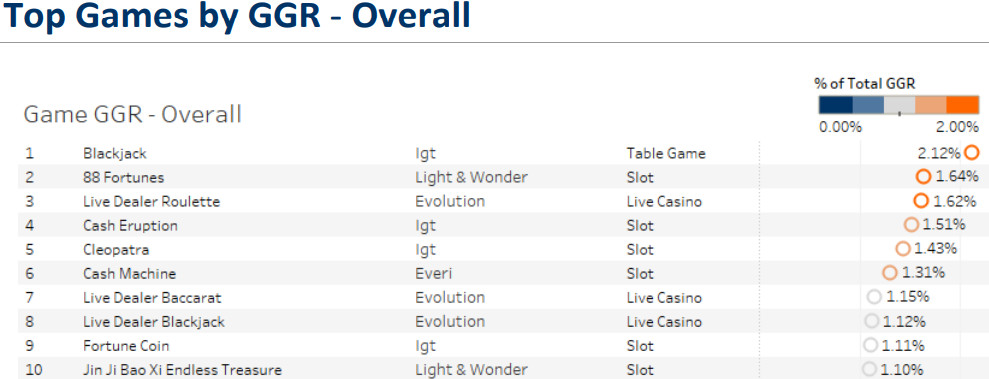

In the latest reports, it is very much a case of familiarity when assessing May’s performance on a GGR basis, with IGT’s Blackjack (2.12 per cent), L&W’s 88 Fortunes (1.64 per cent) and Evolution’s Live Dealer Roulette (1.62 per cent) retaining their top three status’.

Of the top 25 titles that are dominating the GGR charts, online slots maintain the lion’s share with 19 games. Live casino, all courtesy of Evolution, have four entrants, while table games comprise the remaining pair.

On an overall basis, Evolution leads the way overall with a total GGR of 22.1 per cent (15.7 per cent on a slots basis), which is down from the previous month’s 16.7 per cent.

IGT was next in line with an overall percentage of 17.4 (April: 16.7 per cent), of which 16.3 per cent was slots, while L&W rounded off the top three once more with 16.2 per cent (April: 17.2 per cent) and a slots score of 19 per cent.

On a new games basis, DGC boasts a bumper performance after counting six titles in the top 25, which includes four of the top five.

Squelin Riches and Amazon Kingdom scooped gold and silver, with White Hat Studios’ Almighty Buffalo Megaways Jackpot splitting the studios’ Fishing Floats of Cash and Bison Moon in rounding out the quintet.

Regarding DGC’s performance, Eckert continued: “DGC has done a great job promoting their game features with Link & Win branding on many products.

“Link & Win titles from DGC also utilise an easy graphic user interface allowing players to immediately increase their bets with a ‘win booster’ button which leads to higher average bets and increased house win.

“The DGC team are also quick to reskin some of their most successful games to match seasonality including an NBA Gold Link & Win game released just in time for the NBA playoffs.”

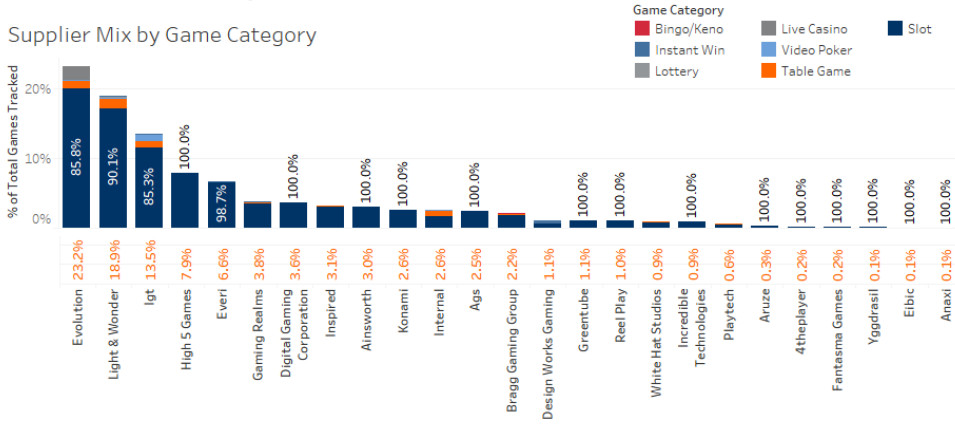

On the ‘supplier mix by game category’ classification, it is Evolution that maintains its place at the summit, despite detailing a drop month-on-month.. Through May the group occupied 22.3 per cent (April: 26 per cent) of the space, of which 85.8 per cent (April: 85.7 per cent) are online slots.

L&W slipped down a place with 16.3 per cent (February: 17.5 per cent), of which 90.1 per cent (April: 89.8 per cent) were slots. IGT’s portfolio through the month was made up of 85.3 per cent slots to claim 17.6 per cent (February: 17.9 per cent) of the total ecosystem.

Slots remained the dominant segment when looking at the total games tracked with a total percentage of 90.9, ahead of table games’ 4.3 per cent.

Live casino was next in line with two per cent, ahead of video poker’s 1.3 per cent, the 1.2 per cent gained by instant win and 0.2 per cent shared by lottery and bingo/keno.

Mobile maintains its frontrunning status with the highest percentage of theo win generated at 65.7 per cent (April: 65.4 per cent) and leads across most segments, with desktop, via a theo win of 31.9 per cent (April: 32.6 per cent), soaring ahead in video poker and virtual sports. Tablet continues to bring up the rear despite a slight rise to 2.4 per cent.

This latest analysis examines data from Michigan, West Virginia, Pennsylvania, New Jersey and Connecticut across 30 online casino sites, tracking 44,365 games to represent 59 per cent of the market.

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].