South Korean casino stocks are on the rise following the government’s recent decision to waive visas for Chinese group tourists temporarily.

The waiver will remain in place from the end of September 2025 until the end of June 2026. Chinese tourists are a major customer base for South Korean casinos, most of which only allow entrance to overseas passport holders.

Other travel-related stocks also saw rises on the Korea Exchange (KEX) on August 11. The South Korean finance-focused newspaper Maeil Kyungjae reported that stock market experts “predict that the momentum will continue in the short term.”

South Korean Casino Stocks Surge After Announcement

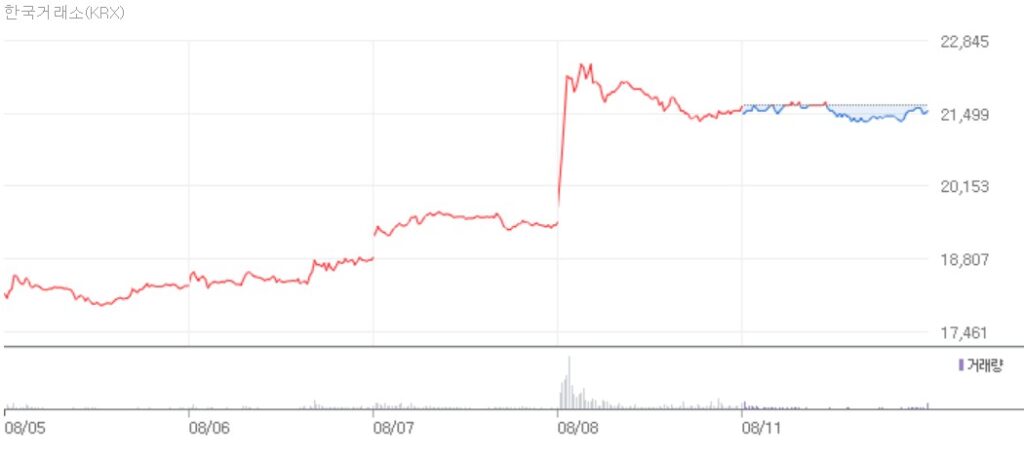

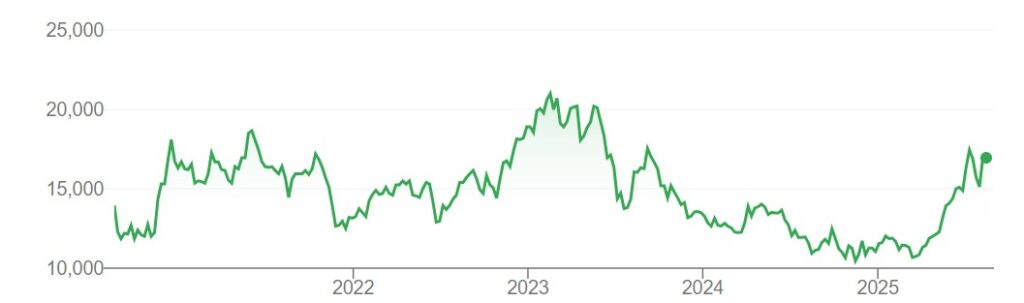

Operators such as Paradise saw their shares surge following the August 8 announcement, with prices rising 19% ahead of a peak of 22,600 KRW.

The recent peak has seen Paradise share prices rise to levels unseen since the mid-2010s. The hotel-casino operator’s all-time share high was reached in November 2017, peaking at 28,000 KRW.

The operator’s flagship resort is Paradise City, the nation’s largest foreign passport holder-only casino, located near Incheon International Airport.

Casino visitor numbers experienced a sharp drop in footfall in the wake of former President Yoon Suk-yeol’s failed attempt to declare martial law in December last year.

But this spring saw a rapid rebound, with Paradise posting casino revenues of 80.9 billion won ($60.5 million) in March. This represented a 52% year-on-year increase from the same month last year.

There were also major gains on the KEX for Grand Korea Leisure (GKL), which has seen share prices hit a yearly high this month, climbing by almost 9%.

GLK’s second-quarter net profit rose by almost 50% to $12 million, the company revealed earlier this month.

Casino sales are also up by over 100% year-on-year, GLK revealed.

GLK operates the Seven Luck casino brand, which has branches in the affluent Gangnam District of Seoul and the port city of Busan.

Asia-wide Growth Forecasted

Maeil Kyungjae called the rise in share prices “significant, especially considering the KOSPI index’s 1.19% fall this month.”

Shares in South Korean hotel chains popular among Chinese tourists were also up, along with those of duty-free retailers.

Financial experts agreed that expectations of a large rise in Chinese group tourism rates were the key factor driving up related stock prices.

However, they also mentioned that a possible visit to Seoul from Chinese President Xi Jinping could be a contributing factor.

With Macao Special Administrative Region’s casino industry stocks also recovering fast, the South Korean securities industry says that the outlook for casino shares is currently positive.

Ji In-hae, a researcher at Shinhan Investment and Securities, told the media outlet: “A boom in inbound tourism, excitement about future regulatory reform, and the Macao casino shares recovery […] are all positive factors.”

Macao casino stocks are continuing to perform well on the markets in Hong Kong and the United States.

Last month, forecasters predicted further Macao casino-related growth in the near future.