Gaming stocks lost momentum last week, and the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, lost 1.9% as economic worries resurfaced after a tepid August jobs report that showed the US economy added only 22,000 jobs last month, which was less than a third of what economists were expecting.

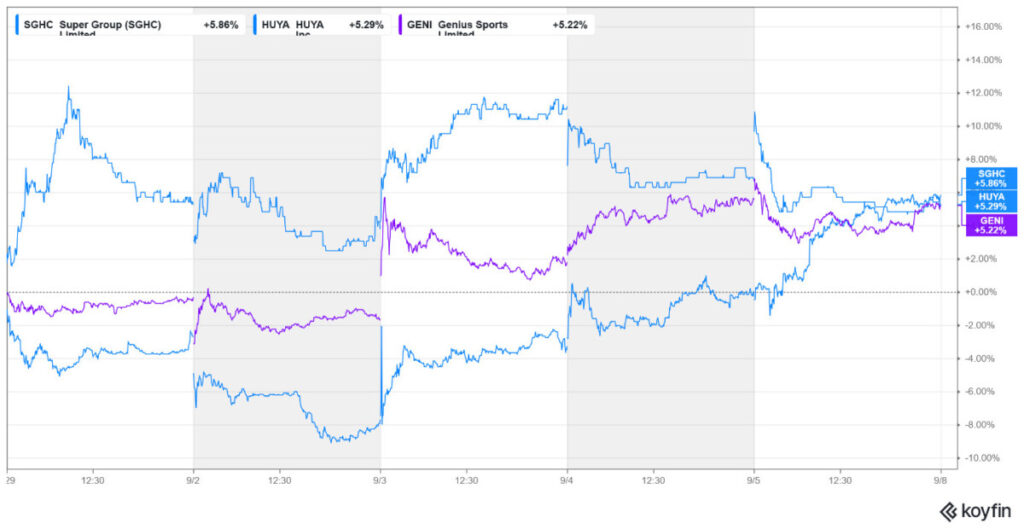

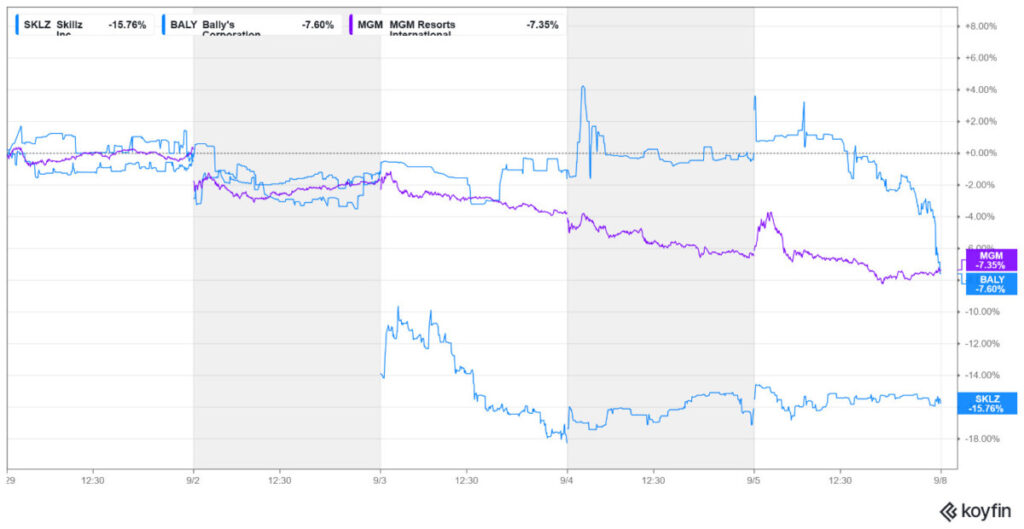

Super Group and Huya were among the major gainers last week. Meanwhile, Skillz and Bally’s Corporation underperformed.

Largest Gaming Stock Gainers

Super Group Ltd. (NYSE: SGHC): +5.9%

Super Group was the biggest gainer in our coverage of gaming stocks last week, rising 5.9%, thanks to the over 6% spike on Friday. The rise came amid supportive technical indicators and higher trading volumes, which were over twice the average volumes. After last week’s rise, SGHC has extended its year-to-date rally to 103%, handsomely beating most of its peers.

Super Group, the parent company of Betway sportsbook, which exited the US last year, has thrived in Europe and continued its strong performance since the beginning of the year. The company reported record revenues and adjusted EBITDA in Q2 2025, led by a 28% rise in its ex-US Online Casino revenue. Benchmark, Needham, and Canaccord Genuity raised SGHC’s target price following the report.

Huya Inc (NYSE: HUYA): +5.3%

With gains of 5.3%, Huya was among the major gainers for the second consecutive week. While there wasn’t any major market-moving news last week, the stock continued its uptrend from the previous week when it announced a new strategic partnership with Kingsoft Shiyou to co-publish the mobile version of the popular social deduction game “Goose Goose Duck” in mainland China.

Amid the recent rally, Huya stock has bridged its 2025 losses and is now up over 16% for the year.

That said, Huya is a penny stock with a market capitalization of less than $1 billion and is susceptible to significant price fluctuations. Investors should therefore be cautious about the stock.

Genius Sports (NYSE: GENI): +5.3%

Genius Sports was the other major gainer and added 5.3% to its market capitalization last week, extending its YTD gains to 56%. The company has announced several partnerships this year, which have helped buoy sentiments. These include

- A collaboration with PMG, which represents brands like Nike and TurboTax. Under the agreement, PMG will become a founding agency partner of Genius Sports’ premier fan activation platform, FANHub.

- It has secured exclusive betting data rights for a select group of competitions in European football leagues.

- Genius has also renewed its long-term partnership with the NFL

As for last week’s gains, they look likely in anticipation of its upcoming investor day in December, which the company announced during the week.

Largest Gaming Stock Losers

Skillz (NYSE: SKLZ): −15.8%

With a drawdown of 15.8%, Skillz was the biggest loser among our coverage of gaming stocks. The popular meme stock, which is much more volatile than other gaming companies, held the dubious distinction in the preceding week as well.

Last week’s decline was attributable to the termination of the partnership with developer Tether Studios LLC. Skillz termed the termination notice as “invalid and in breach of Tether’s obligations” and filed a lawsuit against the company.

In its filing, Skillz said that it “is also disputing Tether’s allegations with respect to the grounds for termination of the Tether Agreements for cause.” It added, “The Company intends to defend its position, but can provide no assurances regarding the outcome of the claim and the impact it may have on the Company’s business.”

Bally’s Corporation (NYSE: BALY): −7.6%

Bally’s Corporation was among the other major losers last week, falling 7.6%, which extended its YTD losses to almost 50%. The bulk of last week’s losses came on Friday amid the broad-based sell-off after the weak August jobs report.

The company has been battling several issues and posted a loss in Q2, even as its revenues surpassed estimates.

Bally’s received a jolt earlier this year after the NYC Council rejected land use change for its planned Bronx casino, which all but ended its bid for a gaming license. The company had acquired the lease for that property from President Donald Trump’s Trump Organization and was planning a grand casino there at an investment of $4 billion. Currently, the Community Advisory Committee is reviewing the proposal.

MGM Resorts International (NYSE: MGM): −7.4%

MGM Resorts lost 7.4% amid continued concerns over the Las Vegas market. Being the biggest operator on the Strip, MGM is impacted by weak visitor numbers. To make things worse, there has been a price war, and some players are offering rooms for as low as $19.

MGM has doubled down on its digital business, whose revenues doubled in Q2 2025 even as it continues to lose money. The management is, however, optimistic of turning the corner on profitability in the digital business.

In the company’s Q2 release, MGM’s CEO Bill Hornbuckle said: “Looking beyond 2025, our BetMGM venture (the joint venture between Entain and MGM Resorts) continues towards its goal of $500 million in EBITDA, and our MGM Digital segment is on target to become profitable in the coming years.”

Meanwhile, MGM and BetMGM have stayed away from prediction markets. Speaking at the BofA Securities 2025 Gaming and Lodging Conference, Hornbuckle yet again spoke against prediction markets.

He, however, did not rule out entering the industry and said: “We’d be foolish not to. It’s out, it’s real. We have to contend with it and understand it, we’ve got to be ready for it if it becomes even realer. But officially, it is not something we endorse.”

Other Key Gaming Industry Developments

In other major gaming industry developments, Sweden said that its gambling revenue increased 1.9% in the second quarter. On a similar note, Macao casinos reached their highest revenue figures since January 2020 in August, posting gross gaming revenue (GGR) of $2.76 billion.

In the regulatory space, Caesars Sportsbook won a partial victory last week as a judge in Illinois ordered that a lawsuit against the platform’s free bets advertising move to arbitration.

In Canada, an Ontario Superior Court judge last week sided with the Alcohol and Gaming Commission of Ontario (AGCO) and ruled that the GotSkill? “skill game” terminals amount to gambling under the law.