Gaming stocks had a lackluster week, and Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, lost 2% last week, underperforming the S&P 500 Index for the second consecutive week as concerns over a weakening U.S. economy took a toll on consumer discretionary stocks.

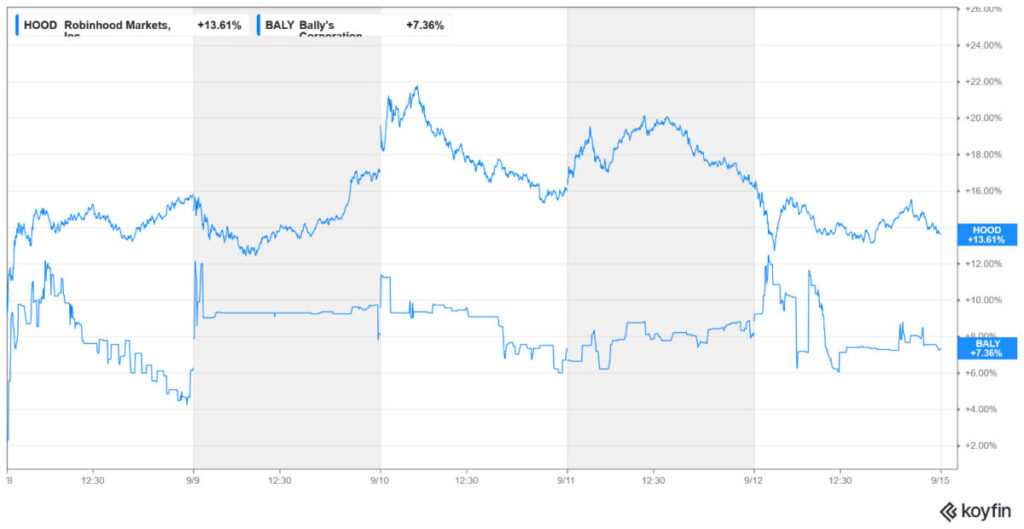

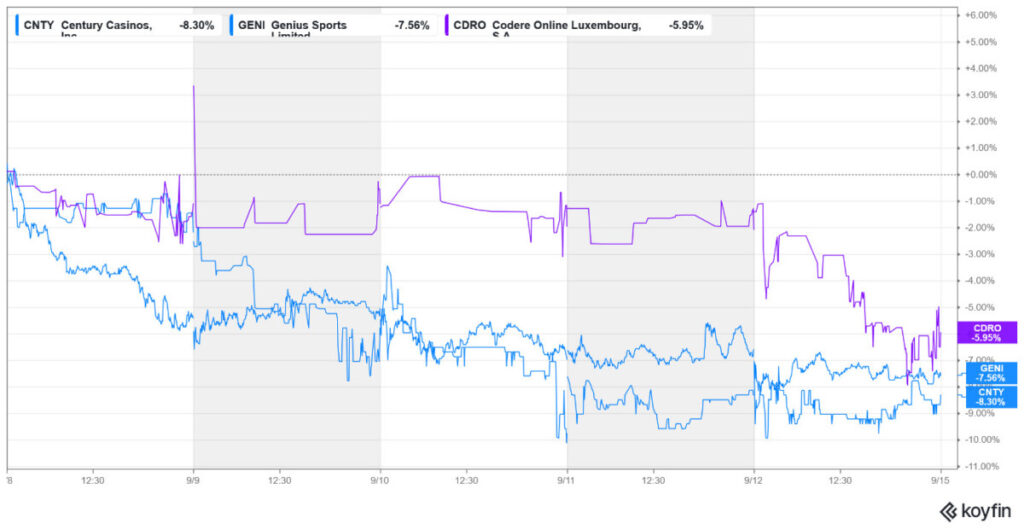

Robinhood and Bally’s Corporation were among the major gainers last week. Meanwhile, Century Casinos and Genius Sports underperformed.

Largest Gaming Stock Gainers

Robinhood Markets (NYSE: HOOD): +13.6%

Retail trading app Robinhood, which has been aggressively expanding into prediction markets, was the biggest gainer last week, rising 13.6%. The gains were attributable to its inclusion in the S&P 500 Index effective September 22. The world’s most popular index, which had overlooked Robinhood on several occasions this year, finally decided to add the stock. HOOD will replace Caesars Entertainment, which will be removed from the index.

It’s usual for stocks to rise after getting included in the index, as addition means that passive funds actively tracking the S&P 500 index would necessarily need to buy the shares in the same percentage as in the index.

Bally’s Corporation (NYSE: BALY): +7.4%

Bally’s Corporation was among the other major gainers last week, rising 7.4%. The stock’s rise came as a welcome break for investors, as it had fallen 7.6% in the preceding week and is still down over 46% for the year.

Bally’s received a jolt earlier this year after the NYC Council rejected land use change for its planned Bronx casino, which all but ended its bid for a gaming license. The company had acquired the lease for that property from President Donald Trump’s Trump Organization and was planning a grand casino there at an investment of $4 billion.

Last week, the Community Advisory Committee (CAC) held its second hearing over the proposal, which saw a heated debate. CAC had to pause the session, call the police to remove repeat hecklers, and even take a five-minute break while the crowd calmed down.

Meanwhile, last week’s rise in Bally’s was a technical rebound after the brutal YTD drawdown. CEO Robeson Reeves commented about the possibility of the company becoming a “great consolidator” in the UK iGaming market, where it is the second-largest player with a 14% market share. That helped lift sentiments as markets saw it as a sign of further M&A.

Zeal Network Se (DAX: TIMA.D.DX): +3.4%

Zeal Network was among the other major gainers and rose 3.4% last week, the bulk of which came on Friday. There wasn’t any major company-specific announcement last week, and despite these gains, the stock is down 9% for the year.

Notably, Zeal Network, the largest online lottery company in Germany, has been working on strategic partnerships to expand its reach.

In July, it partnered with Greentube, the digital gaming subsidiary of Novomatic, to integrate select Greentube online games into its portfolio for its German B2C brands, LOTTO24 and Tipp24.

The same month, its investment arm ZEAL Ventures announced a co-investment in Random State, a Swedish iLottery and iBingo specialist.

Largest Gaming Stock Losers

Century Casinos (NYSE: CNTY): −8.3%

Century Casinos was the biggest loser in our coverage of gaming stocks, falling 8.3% last week. While there wasn’t any major company-specific news last week, the sell-off in gaming stocks seems to have triggered the fall.

The stock has been quite volatile this year, and while it has risen from the 52-week low of $1.30 it hit amid the April sell-off, it is still down 21.6% for the year. It’s a microcap company with a market capitalization below $100 million with little trading volume, which makes it susceptible to wild price swings and is therefore a risky bet.

Genius Sports (NYSE: GENI): −7.6%

Genius Sports, which has otherwise had a stellar year with year-to-date gains of 44%, was among the notable losers last week, losing 7.6%. The company has announced several partnerships this year that have buoyed investors. These include:

- A collaboration with PMG, which represents brands like Nike and TurboTax. Under the agreement, PMG will become a founding agency partner of Genius Sports’ premier fan activation platform, FANHub.

- It has secured exclusive betting data rights for a select group of competitions in European football leagues.

- Genius has also renewed its long-term partnership with the NFL.

Genius Sports announced an expanded partnership with Hard Rock Bet last week, but it wasn’t enough to move the needle for the stock, and there was some profit-taking after the rally in the previous few weeks.

Codere Online (NYSE: CDRO): −6%

Codere Online lost 6% last week and made it to the list of worst-performing gaming stocks for the second consecutive week.

While the company has demonstrated strong growth, particularly in Latin American markets such as Mexico, it continues to face challenges. These include competitive pressures in Spain, regulatory issues in Colombia, and currency fluctuations.

Its recent financial performance has been reassuring, though, and it posted better-than-expected numbers for the June quarter. The management also maintained its annual revenue guidance of €220-230 million and adjusted EBITDA forecast of €10-15 million despite the headwinds, including adverse currency movements.

Other Major Gaming Industry Developments

US Senators Catherine Cortez Masto (D-Nev.) and Cindy Hyde-Smith (R-Miss.) introduced the bipartisan Withdrawing Arduous Gaming Excise Rates (WAGER) Act, to repeal the federal sports betting excise tax. The bill aims to help Tribal communities and states like Nevada to reinvest their gaming revenues into their local economies.

Elsewhere, across the Atlantic, the British Horseracing Authority (BHA) made good on its promise to strike, and all horse racing in the UK was canceled on September 10. The BHA has been protesting the proposed tax hike, which would increase the tax on horse racing and sports betting from 15% to 21%.