The US stock market experienced a turbulent week marked by intense volatility, a solid start to earnings season, and resurfacing concerns over the banking sector and global trade.

The S&P 500 Index gained around 1.7% and ended the week on a high note. The Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, gained around 1.5% as gaming stocks looked for momentum after the brutal crash in the preceding week.

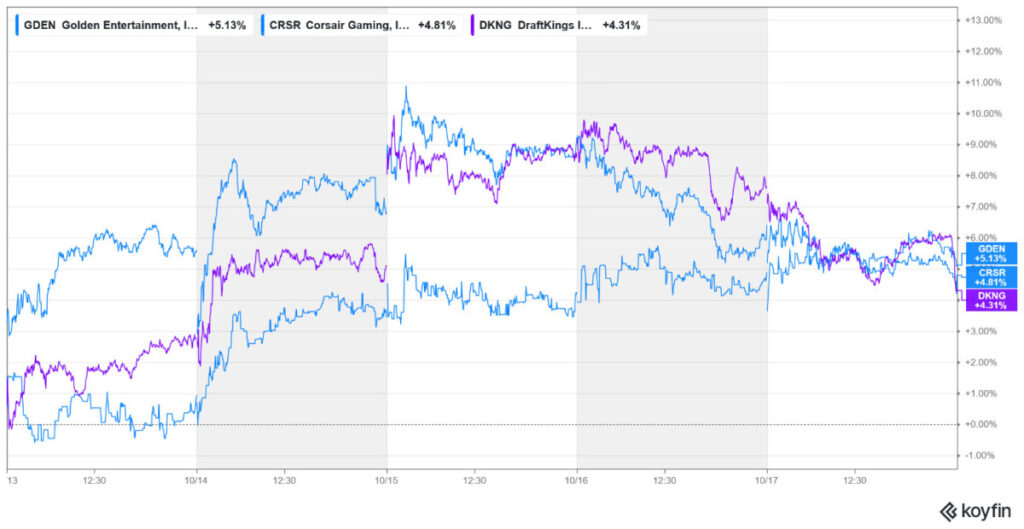

Golden Entertainment and Corsair Gaming were among the major gainers last week. Meanwhile, Sea Limited and Century Casinos underperformed.

Largest Gaming Stock Gainers

Golden Entertainment (NYSE: GDEN) +5.1%

On October 10, activist investor GAMCO Investors revealed that it holds over a 5% stake in Golden Entertainment. It is not uncommon for stocks to rise after an activist investor takes a stake, even as their collective record is mixed.

In the gaming space, activist investor AG Vora won two nominees on the company’s board in June. The stock’s price action has meanwhile been dismal this year, and it is down 18% year-to-date, failing to gain traction following AG Vora taking board seats.

Meanwhile, GDEN has lost over 28% this year as its financial performance has disappointed markets. While the stock has a healthy dividend yield of 4%, it is struggling for growth, and its revenues have been in a downtrend. In Q2 2025, while it reported better-than-expected earnings, its revenues trailed estimates.

Corsair Gaming (NYSE: CRSR) +4.81%

Corsair Gaming was among the major gainers last week, rising 4.8%. The stock’s rise looked linked to the strength in broader markets, and there wasn’t any company-specific announcement during the week. However, in the preceding week, Craig Hallum initiated coverage on the stock with a buy rating and $12 target price, which is higher than the consensus target price of $10.13.

CRSR had a strong start to the year but has since pared gains and lost 17% over the last three months, which has narrowed its year-to-date gains to 18.7%.

DraftKings (NYSE: DKNG) +4.31%

DraftKings made it to the list of top gainers last week with a rise of 4.3%. The gains are a welcome break for investors as the stock has looked weak over the last month amid concerns that prediction platforms like Kalshi are threatening the business of traditional sports betting operators like DraftKings and FanDuel.

However, many analysts contend that the sell-off went a bit too far, and on October 9, Berenberg analyst Jack Cummins upgraded the stock to a buy, saying, “We think the move is overdone.” However, the firm lowered the stock’s target price from $64 to $59 to reflect the threat from prediction platforms. While several other analysts have lowered DKNG’s target price this month, it still has a target price of $53, which is 55% higher than last week’s closing price.

Cathie Wood’s ARK Invest bought DraftKings shares worth over $8 million last week, which also lifted sentiments. Wood is among the early backers of Tesla, and her bullishness has payed off well for ARK investors.

Largest Gaming Stock Losers

Sea Limited (NYSE: SE) -11.48%

With losses of nearly 11.5%, Sea Limited was the biggest loser in our coverage of gaming stocks. The bulk of these losses came on Wednesday, which Philip Securities analyst Helena Wang attributed to its “stretched valuations” that are well ahead of its peers.

Sea, which is a tech conglomerate and is the parent of gaming studio Garena, has gained over 50% this year. However, it has lost almost 20% from its all-time high that it hit in mid-September. While Philip Securities maintained its cautious stand on the stock, Bank of America upgraded the stock from a neutral to buy, while raising its target price to $215. JP Morgan, which has an overweight rating on Sea Limited, also maintained its bullish bet and $230 target price after last week’s sell-off.

Century Casinos (NYSE: CNTY) -7.08%

Century Casinos stock lost over 7% last week. CNTY has been quite volatile this year, and while it has risen from the 52-week low of $1.30 it hit amid the April sell-off, it is still down over 31% for the year. CNTY is a loss-making microcap company with a market capitalization below $70 million, with little trading volume and a beta of over 2x, which makes it susceptible to wild price swings and is therefore a risky bet.

Robinhood (NYSE: HOOD) -6.51%

Robinhood stock, which is up nearly 250% for the year, took a breather last week and lost 6.5% in what looks like profit-taking after the stellar rally. Notably, while analysts have gradually raised HOOD’s target price this year, it trades ahead of the mean target price. There have been concerns over the stock’s valuations getting overheated, and many find the current P/E multiple of 57x a bit too high.

Meanwhile, after cryptocurrency, prediction markets have emerged as a key growth pillar for Robinhood, and the company is reportedly looking at an acquisition to further bolster that business. However, several state gambling regulators in the US have argued that prediction platforms should be subject to state gaming laws. Last week, the Nevada Gaming Control Board joined the chorus and said that betting companies “may be subject to discipline” if they offer sports event contracts.

Other Major Gaming Industry Developments

Last week, BetMGM raised its full-year 2025 guidance and expects to generate revenues of over $2.75 billion and around $200 million in EBITDA.

The flurry of M&As in the gaming industry continued last week as Lottery operator Allwyn International and Greek gaming company OPAP agreed to an all-stock merger. In the preceding week, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, announced an investment of up to $2 billion in prediction market platform Polymarket.

On the regulatory front, India’s Supreme Court agreed to hear a Public Interest Litigation (PIL) that seeks a nationwide ban on online gambling and betting platforms allegedly operating under the guise of Esports and social games.

Notably, Indian lawmakers cleared the “Promotion and Regulation of Online Gaming Act, 2025,” earlier this year, which has imposed a blanket ban on all “real money games,” regardless of whether they are based on skill or chance.

The Act evoked mixed reactions, and while some have hailed the move, saying it would help curb gaming addiction among the youth, others have criticized the provisions, expressing fear over job losses, revenue loss for the government, and likely expansion of the illegal market.