Google is integrating prediction-market data from Polymarket and Kalshi into Google Finance. The move, it says, will help users “make sense of the financial world, with Deep Search, prediction market data, and live earnings features.”

Google announced the update in a blog post on November 6. It stated that it will roll out the prediction market feature “over the coming weeks,” starting with Labs users.

The announcement comes shortly after Google moved to restrict gambling-related ads. It also tightened its approach to online gaming content across YouTube.

The approach marks a striking contrast in how the tech giant views two highly debated sectors in the US: prediction markets and sweepstakes casinos.

Prediction Markets Enter the Mainstream

Google confirmed that users will soon see data from two of the most prominent prediction-market platforms, Kalshi and Polymarket, integrated directly into Google Finance and Search.

“We’re also adding support for prediction markets data from Kalshi and Polymarket, so you can ask questions about future market events and harness the wisdom of the crowds,” Google wrote.

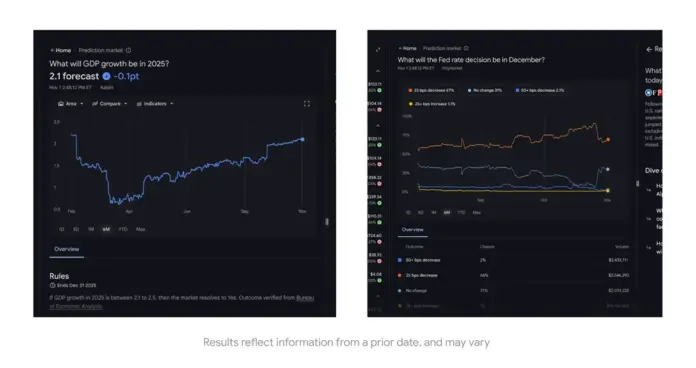

Through this feature, users can query topics such as GDP growth, interest-rate cuts, or election outcomes and view the current market-implied probabilities — figures derived from live trading on the two platforms.

Kalshi currently operates in the US under the regulation of the US Commodity Futures Trading Commission. Meanwhile, Polymarket operates on blockchain infrastructure and is preparing to relaunch in the US in the coming weeks. Notably, Google may be waiting for Polymarket’s official return before rolling out the new feature.

Google’s integration marks the latest mainstream backing of prediction markets, blurring the line between financial analysis and speculative forecasting. Many tech companies, with Gemini Exchange being a recent example, have pivoted towards this sector.

Recently, President Trump’s Truth Social announced plans to launch “Truth Predict” in partnership with Crypto.com. Meanwhile, a few weeks ago, Intercontinental Exchange, the parent company of the New York Stock Exchange, announced an investment of up to $2 billion in Polymarket.

Even traditional gaming operators, like DraftKings and FanDuel, are now preparing to enter the space.

Google Reclassifies Sweepstakes Casinos

The addition of prediction-market data comes as Google takes a more cautious approach elsewhere in the gaming space.

Just days before, it updated its advertising policy to redefine sweepstakes casinos as a form of online gambling rather than social gaming. The decision could have significant implications for the industry.

The revised policy, published October 28, states: “Examples of games that are not social casino games: Sweepstakes casinos.”

That single line effectively places sweepstakes operators — long marketed as “free-to-play” or “promotional” — in the same regulatory category as licensed gambling sites for advertising purposes.

In the update, Google also lists “online gambling games played with virtual currencies or items that have real-world value” as examples of gambling products. That could have implications nationwide.

By reclassifying the sector, Google now requires sweepstakes casino advertisers to meet its standards for gambling ad certification. Those include licensing verification, jurisdictional targeting, and responsible gaming compliance.

The update effectively closes a loophole that sweepstakes casinos used to advertise more freely on Google Search and Display networks.

This tightening comes amid growing state-level scrutiny of sweepstakes casinos, with several states moving to prohibit the platforms.

Google’s redefinition aligns its policies more closely with those of regulators and consumer-protection agencies.

The policy revision also arrives as a way for Google to distance itself from legal pressures surrounding the sector. Earlier this year, Google and Apple were named in a federal class-action lawsuit. The complaint accused them of facilitating illegal sweepstakes and casino operations through their app stores.

Plaintiffs allege the companies “promote, distribute, facilitate and materially participate in an interstate gambling enterprise.”

YouTube’s Stricter Approach to Gambling Content

Google’s subsidiary YouTube is following suit. In a recent community update, the platform said it is “strengthening its approach to online gambling and graphic violence in gaming.” It noted a new round of enforcement actions against channels that promote unlicensed gambling operators or display excessive violent imagery in gaming footage.

Starting November 17, YouTube will require content to meet Google’s ad certification requirements. It will prohibit sharing content that directs viewers to non-Google-certified sites and apps, including those related to gambling.

Balancing Innovation with Regulation

Google’s latest updates demonstrate its efforts to strike a delicate balance: To support new financial tools while maintaining strict control over gambling content.

Prediction markets, such as Kalshi and Polymarket, operate similarly to betting platforms. They allow users to stake real or digital currency on the outcomes of various events. While they’re meant to collect “crowd-sourced” forecasts that help traders and analysts understand public expectations, these markets often face legal challenges.

Some regulators and lawmakers argue that they amount to illegal betting. In some places, they’ve even been forced to shut down.

By adding this data to Google Finance, the company is helping to normalize prediction markets as part of the broader financial landscape.

At the same time, Google is acting carefully with other sectors. While it’s opening the door to new kinds of market data, it’s cracking down on gambling ads.

Together, these moves show Google’s attempt to define where financial innovation ends — and gambling begins.