South Korean casinos are poised to emerge as the unlikely winners of a deepening political spat between Japan and China.

Major casino operators’ share prices have buoyed as news of worsening Tokyo-Beijing relations hit the market, the South Korean newspaper Chosun Ilbo reported.

The newspaper noted that industry insiders and stock market experts think that “investor sentiment has been driven by expectations that domestic tourism stocks will benefit from the recent deterioration in China-Japan relations.”

The outlet added that Sino-Japanese relations have “cooled rapidly” after the new Japanese Prime Minister, Sanae Takaichi, said that “if China launches an armed attack against Taiwan, this could result in an existential crisis” for Japan.

The Chinese Ministry of Foreign Affairs immediately responded angrily to Takaichi’s comments. It issued a statement advising Chinese citizens to refrain from traveling to Japan.

It also urged Japanese leaders to “stop playing with fire” and “retract their words.”

South Korean Casinos Stand to Benefit from Geopolitical Unrest

Tourism between the three nations has been on the rise in the post-COVID period. But previous spats between Seoul, Beijing, and Tokyo have resulted in falling arrival numbers.

In 2017, the Chinese government imposed a group tourism ban on South Korea after Seoul agreed to allow the US military to deploy Terminal High Altitude Area Defense (THAAD) systems in the north of the country.

Beijing claimed the THAAD systems’ radar units could be used to spy on Mainland Chinese installations.

This led to a significant decline in South Korean tourism and casino revenues. The outbreak of the coronavirus in 2019 compounded this effect. It was not until 2023 that Chinese casino visitors began to return to South Korea in large numbers.

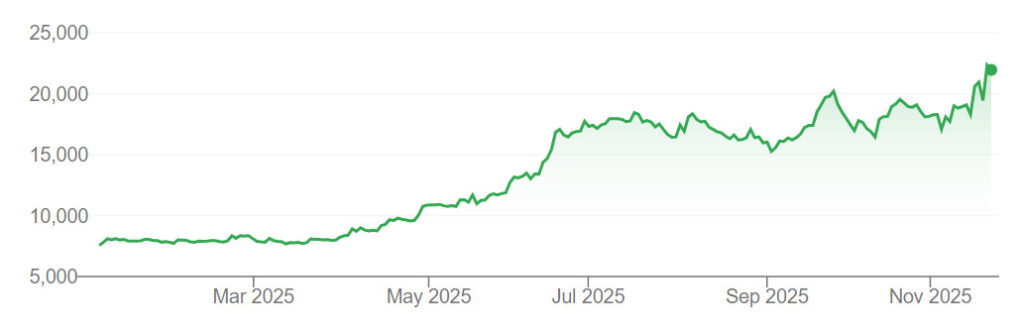

Lotte Tour Development and Paradise, both of which operate casinos that exclusively cater to foreign passport holders, saw their share prices rise by over 12% as news of the latest China-Japan dispute began to spread.

Share prices have continued to climb, with Lotte Tour Development’s stocks rising in value by over 17% in the past five days. The firm operates the Jeju Dream Tower casino in Jeju City, a popular destination for Chinese bettors.

Paradise shares are up by over 87% over the past year. The firm operates Paradise City, a foreign passport-holders-only casino near Incheon International Airport.

And Grand Korea Leisure, the Seven Luck casino operator, saw its own share prices rise by almost 9% this week.

Chinese Tourism Boycott to Hit Japan in the Pocket

On November 19, Reuters reported that China’s tourism boycott “could result in a loss of around 2.2 trillion yen ($14.23 billion) annually,” per Nomura Research Institute data.

“Tourism-related stocks in Japan have sunk since the warning was issued on [November 14],” the news agency added.

Rising political tensions are not the only reason Chinese tourists are increasingly visiting South Korean casinos. Seoul recently announced a temporary waiver on Chinese group visas, another development that sent share prices soaring earlier this year.

Recent financial reports from the three casinos indicate that VIP customers from both Japan and China are spending more during their visits.