The Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, rose nearly 3% last week, whereas the S&P 500 index closed in the red. BETZ has now outperformed the S&P 500 for four consecutive weeks, and its year-to-date returns are now in line with the broad-based index.

Codere Online and Accel Entertainment were among the major gainers last week. Meanwhile, Century Casinos and Robinhood were among the major gainers.

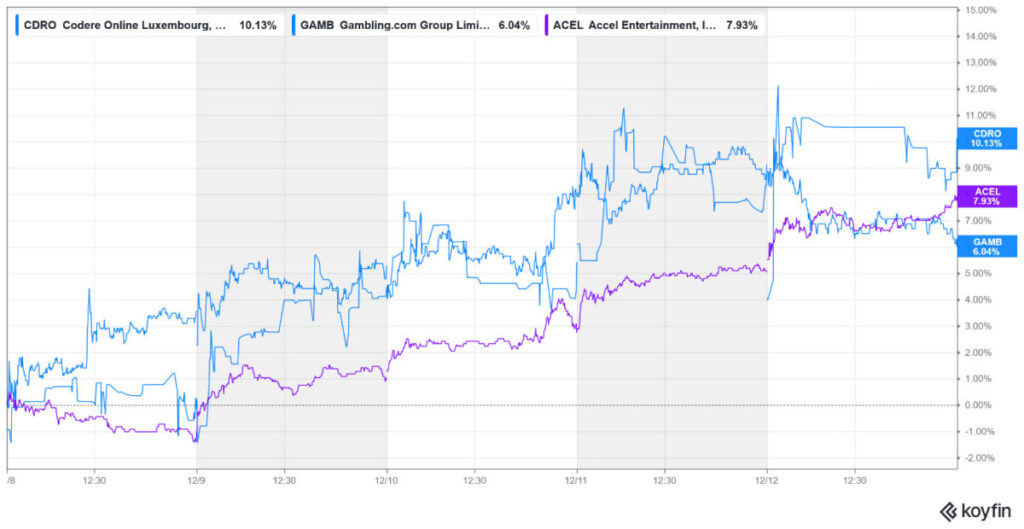

Major Gainers

Codere Online (NYSE: CDRO) + 10.13%

Codere Online rose over 10% last week and was the only gaming stock in our coverage universe to witness double-digit gains. There was no market-moving news from the company last week, and the stock continued its momentum from earlier this month, when it had impressed markets with its Q3 earnings and forward guidance.

While its net gaming revenues were flat in the quarter, adjusted EBITDA nearly doubled to €2.9 million in Q3 2025 compared to €1.5 million in the prior year. CDRO maintained its annual revenue and EBITDA guidance and noted an “encouraging recent trend” and a re-acceleration of net gaming revenues in the final quarter of the year.

The company experienced a 39% year-over-year increase in active customers in Mexico, its most significant market, positioning it for stronger future revenue despite short-term currency headwinds in Q3.

Moreover, Codere increased its share buyback authorization by 50% to $7.5 million, which also helped buoy sentiments.

Accel Entertainment (NYSE: ACEL) +7.3%

With gains of over 7%, Accel Entertainment was among the other major gainers last week. While that rise occurred amid a broader uptick in gaming stocks as investors shifted their focus from tech names to other sectors, there were some positive developments earlier this month that helped build momentum in ACEL shares.

On December 2, Accel announced the acquisition of Dynasty Games’ route operation assets. While the company did not disclose the financial details, it stressed that the transaction would be accretive to its 2026 earnings.

Following that announcement, Citi initiated coverage on ACEL with an “outperform” rating, while JMP Securities set a bullish $13 target price for the stock.

Gambling.com (NYSE: GAMB) +6%

With gains of 6%, Gambling.com was among the other major gainers last week. The stock, which is quite volatile compared to its peers, often whipsaws between the week’s top gainers and losers. For instance, it was among the major losers in the preceding week and a major gainer in the week before.

As for the last week, there wasn’t any company-specific news. However, GAMB, which is down over 60% for the year, is facing some structural challenges due to recent changes in the Google search algorithm. The company reported revenue of $38.98 million in Q3 2025, which fell short of the analyst consensus estimate of $41.04 million. The company also lowered its 2025 guidance for the second time this year. During the earnings call, GAMB noted that revenue was negatively impacted by less favorable search rankings that persisted through the third quarter.

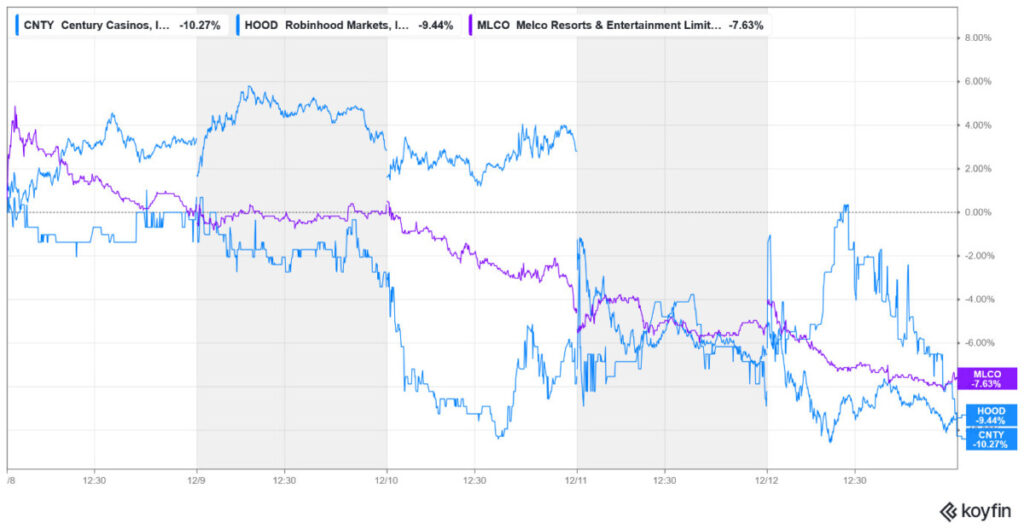

Biggest Losers

Century Casinos (NYSE: CNTY) -10.27%

Century Casinos fell over 10% last week and was the biggest loser in our coverage of gaming stocks. The stock has been sliding for quite some time now and is very close to its 52-week low of $1.30, which it hit amid the April stock market crash.

The company’s recent financial performance has been dismal, and it missed on most key metrics in Q3. For instance, its revenues came in at $153.7 million, which was significantly below the $163.4 million that analysts had modeled. Its net loss rose 30% year-over-year to $10.5 million, which was also higher than the analysts’ expectations.

Analysts have also taken note of CNTY’s woes and have been gradually lowering their ratings. Still, its mean target price of $3.67 implies a potential upside of nearly 180% from these levels.

That said, CNTY is a loss-making microcap company with a market capitalization below $50 million, characterized by low trading volume and a beta of over 2x, which makes it susceptible to significant price swings and is therefore a high-risk and speculative investment.

Robinhood (NYSE: HOOD) – 9.44%

With a loss of almost 9.5%, Robinhood was the other major loser last week. While the continued tech sell-off took a toll on HOOD shares, markets were also spooked by the November operating data that the company released on December 10.

The November metrics revealed a sharp month-over-month decline in all major trading categories following an unusually strong October. Specifically, the equities volume decreased by 37%, while options and crypto volumes decreased by 28% and 12%, respectively.

This sharp cooling of activity raised concerns among investors about the volatility and sustainability of the company’s transaction-based revenue, which is the platform’s traditional bread and butter. Moreover, the company reported a decrease in funded customers to 26.9 million, a drop of approximately 130,000 from October.

Meanwhile, Robinhood has been expanding its prediction market business, which, according to CEO Vlad Tenev, is Robinhood’s fastest-growing business ever, having reached the milestone of generating $100 million or more in annualized revenue in under a year. Robinhood’s prediction volumes are growing at an astronomical pace and have doubled every quarter since the launch last year.

As part of the expansion strategy, Robinhood last month announced plans to enter into a joint venture with market maker Susquehanna International Group (SIG).

This venture will acquire a 90% stake in MIAXdx, which operates LedgerX, a regulated clearinghouse for cryptocurrency derivatives, previously part of the collapsed FTX.

However, Robinhood’s prediction business has been plagued by regulatory uncertainties, and earlier this month, the Connecticut Department of Consumer Protection issued a cease-and-desist order against Robinhood for alleged unlicensed online gambling operations related to its prediction markets.

Melco Resorts and Entertainment (NYSE: MLCO) – 7.6%

With losses of nearly 8%, Melco Resorts and Entertainment made it to the list of last week’s top losers. However, there was no major negative company-specific news, and last week’s decline appears to be a profit-taking exercise, as MLCO stock is outperforming this year, thanks to the continued growth in the Macau gaming market.

Other Major Gaming Industry Developments

In what could complicate the picture for the prediction markets business, Washington and Louisiana also announced opposition to the platforms, joining a growing list of states that are battling against them. However, companies continue to pivot to the fast-growing and promising business, and Betr, the betting platform co-founded by Jake Paul, is also launching its own prediction market platform, Betr Predictions.

Meanwhile, amid the regulatory woes, last week, Kalshi, Crypto.com, Coinbase, Robinhood, and Underdog teamed up to form the Coalition for Prediction Markets (CPM), which they said is “dedicated to preserving safe, transparent, and federally supervised access to prediction markets.”

Separately, Kalshi announced that it’s expanding access to its CFTC-regulated prediction markets through a new integration with Phantom, a popular crypto wallet with more than 20 million users.

Elsewhere, the Indian Supreme Court of India pushed back hearings on the challenge to the country’s real-money gaming ban to January, keeping regulatory uncertainty alive for operators in that market.

In the UK, the recent hike in gambling tax has prompted William Hill owner Evoke plc (formerly 888 Holdings) to undertake a strategic review, which will include considering a potential sale of the entire group or some of its assets.