Concerns about increased royalty payments to US firms are denting market confidence in formerly buoyant Macao casino stocks, say securities experts.

The Japanese financial newspaper Kabushiki Shimbun reported that Macao casino stocks have endured a “weak” end to the year.

It attributed much of this to reports from major brokers like Morgan Stanley, which have adjusted their performance expectations for major Macao operators downward in recent weeks.

A Morgan Stanley research paper explained that MGM China is now set to pay higher royalty payments to the US operator MGM Resorts.

The Asia-based firm is currently paying its US parent company 1.75% of its monthly net revenue. But that figure will rise to 3.5% next year.

Morgan Stanley says that in 2206, these new fees will drive MGM China’s EBITDA (earnings before interest, tax, depreciation, and amortization) 7% lower than previously expected.

And that could lead to a 5% year-on-year drop in revenues, the broker claimed. The report has hit the market hard, Kabushiki Shimbun wrote, “worsening sentiment across the entire sector.”

Macao Casino Stocks: Royalty Fears Dashing Market Hopes

The royalty burden will also be felt at Wynn Macau, which is set to pay its own parent company, the Las Vegas-based Wynn Resorts, royalties worth 14% of its EBITDA.

Predictably, perhaps, MGM China itself has borne the brunt of the market drop, with its share prices falling almost 23% over the past five days.

But other Macao casino operators listed on the Hong Kong Exchange experienced knock-on effects.

Melco International Development saw 6% wiped off its share price, Wynn Macau experienced a 5% fall, Sands China saw a drop of over 4%, and Galaxy Entertainment’s share price fell by almost 2.5% over the same period.

Silver Lining for Some Macao Casino Operators

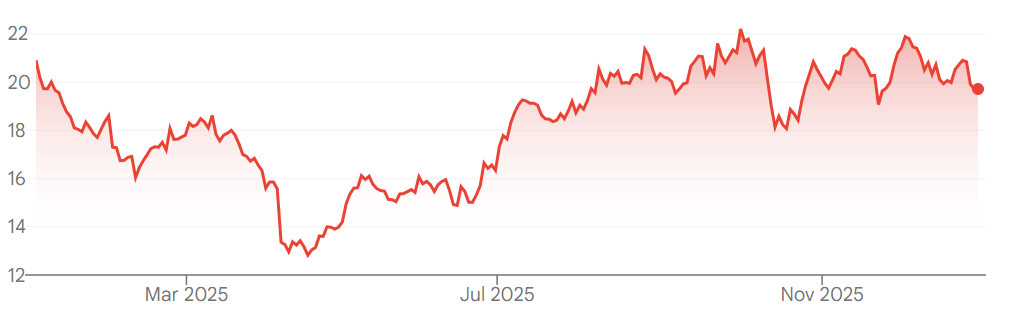

After months of sustained growth for Macao casino shares, December has brought bad news for both casinos and investors.

MGM’s late-year drop has been most severe, with prices plummeting by almost 24%. Melco has experienced a sharp fall of over 15% since the early days of the month, with others experiencing smaller, but still significant drops.

After experiencing stellar growth for much of the year, Macao casino shares began to fall in October after a tropical storm disrupted travel from Mainland Chinese cities during Golden Week, the country’s biggest holiday period.

However, the Morgan Stanley report brought a silver lining for some operators. Its authors noted that royalty leakages were “much less for Galaxy and Sands, making them more shareholder-friendly,” the media outlet Macau Business reported.